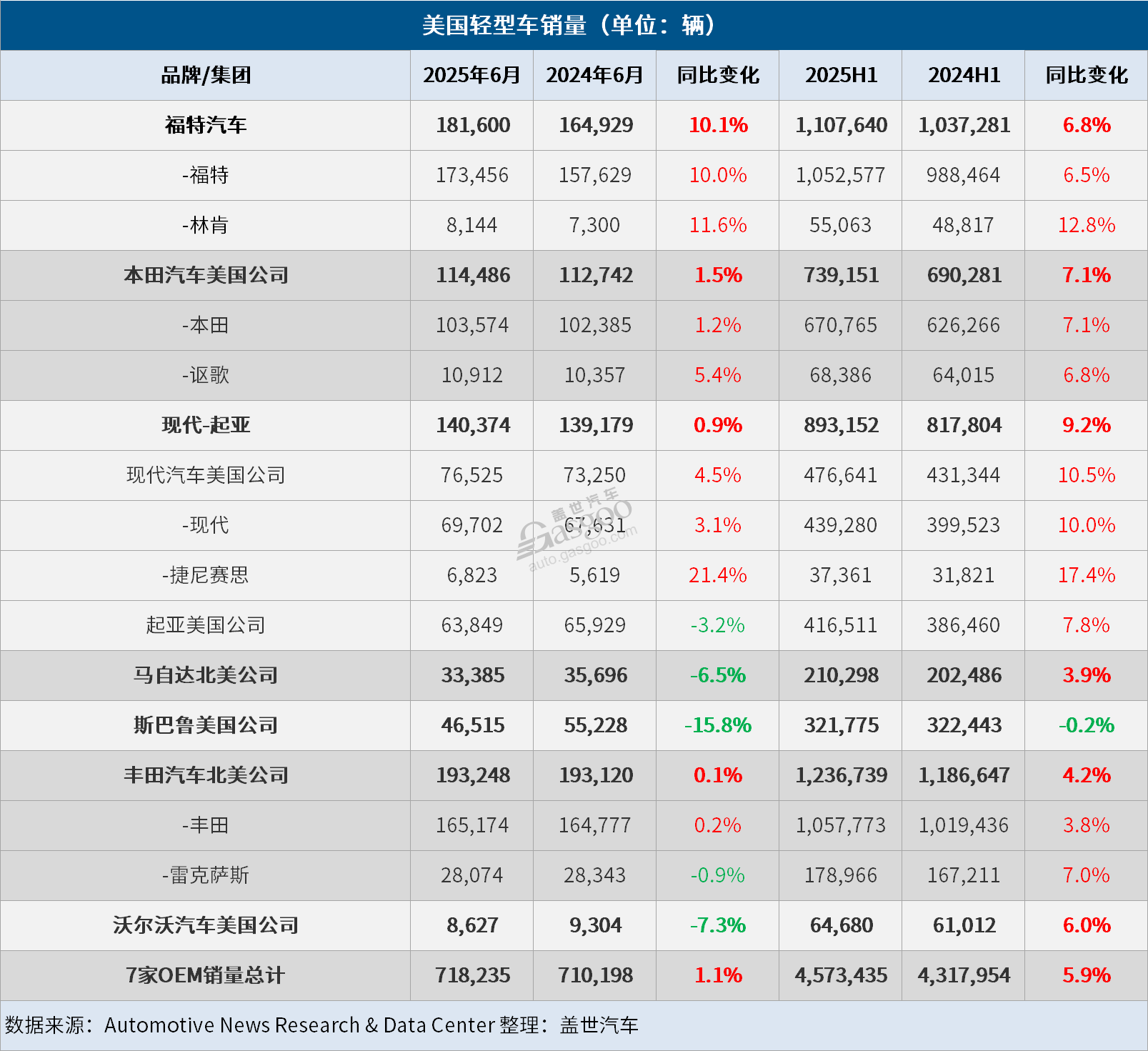

Latest data shows that in the first half of this year, sales of new passenger cars and light trucks in the United States increased by 3.2% year-on-year to 8,140,775 units; however, the second quarter saw a lower growth of 2.3% compared to the first quarter's 4.4%. The new import tariffs on vehicles effective from April 3 appear to have begun affecting certain brands reliant on imports, including Audi, Porsche, Lexus, Volkswagen, Mazda, and Mitsubishi. June saw a significant slowdown in the US light vehicle market, following a strong performance in spring where consumers rushed to purchase vehicles before the new tariffs took effect. A preliminary report from GlobalData released on July 2 indicates that sales of new passenger cars and light trucks in June in the US decreased by 4.3% year-on-year to 1.26 million units, marking the first negative growth in the US automotive market this year. According to Motor Intelligence, the seasonally adjusted annual sales rate (SAAR) for June was 15.68 million units, remaining at the high end of analysts' predictions (15 to 15.6 million). This further indicates that the US car market has been cooling since March and April, when the SAAR easily surpassed 17 million, with May's SAAR recorded at 15.72 million. In the first half of the year, while several major automakers in the US saw an increase in light vehicle sales, the sales performance in the second quarter and June varied, suggesting a potential slowdown in new car sales for the second half of the year. General Motors reported an 11.8% year-on-year increase in sales to 1,432,516 vehicles; its brands Buick, Cadillac, Chevrolet, and GMC saw respective year-on-year sales increases of 29.2%, 16.5%, 9.6%, and 11.2%. Benefiting from a 10% year-on-year increase in retail deliveries, GM's sales grew by 7.3% in the second quarter, with Buick's sales up by 19.3%, Cadillac's by 15.3%, GMC's by 6.3%, and Chevrolet's by 5.7%. Ford's sales increased by 6.8% to 1,107,640 vehicles; its brands Ford and Lincoln saw year-on-year increases of 6.5% and 12.8%, respectively. In June, due to employee pricing incentives and strong sales of trucks and electrified models, Ford's sales rose by 10.1% year-on-year. Toyota's sales in the US increased by 4.2% to 1,236,739 vehicles; its brands Toyota and Lexus saw increases of 3.8% and 7.0%, respectively. However, in June, due to supply constraints in the industry, Toyota's sales only increased by a slight 0.1% year-on-year. Honda's sales rose by 7.1% to 739,151 vehicles in the first half; its brands Honda and Acura saw respective increases of 7.1% and 6.8%. Stellantis reported an 11.0% decrease in sales to 605,987 vehicles in the first half. Despite employee pricing incentives attracting showroom traffic, Stellantis' overall sales dropped by 10.2% in the second quarter, marking the eighth consecutive quarter of decline. The report concludes that while several brands posted positive sales growth, others faced significant challenges, indicating a mixed performance across the automotive market in the US.

US Light Vehicle Sales See Mixed Performance in First Half of 2023

Images

Share this post on: