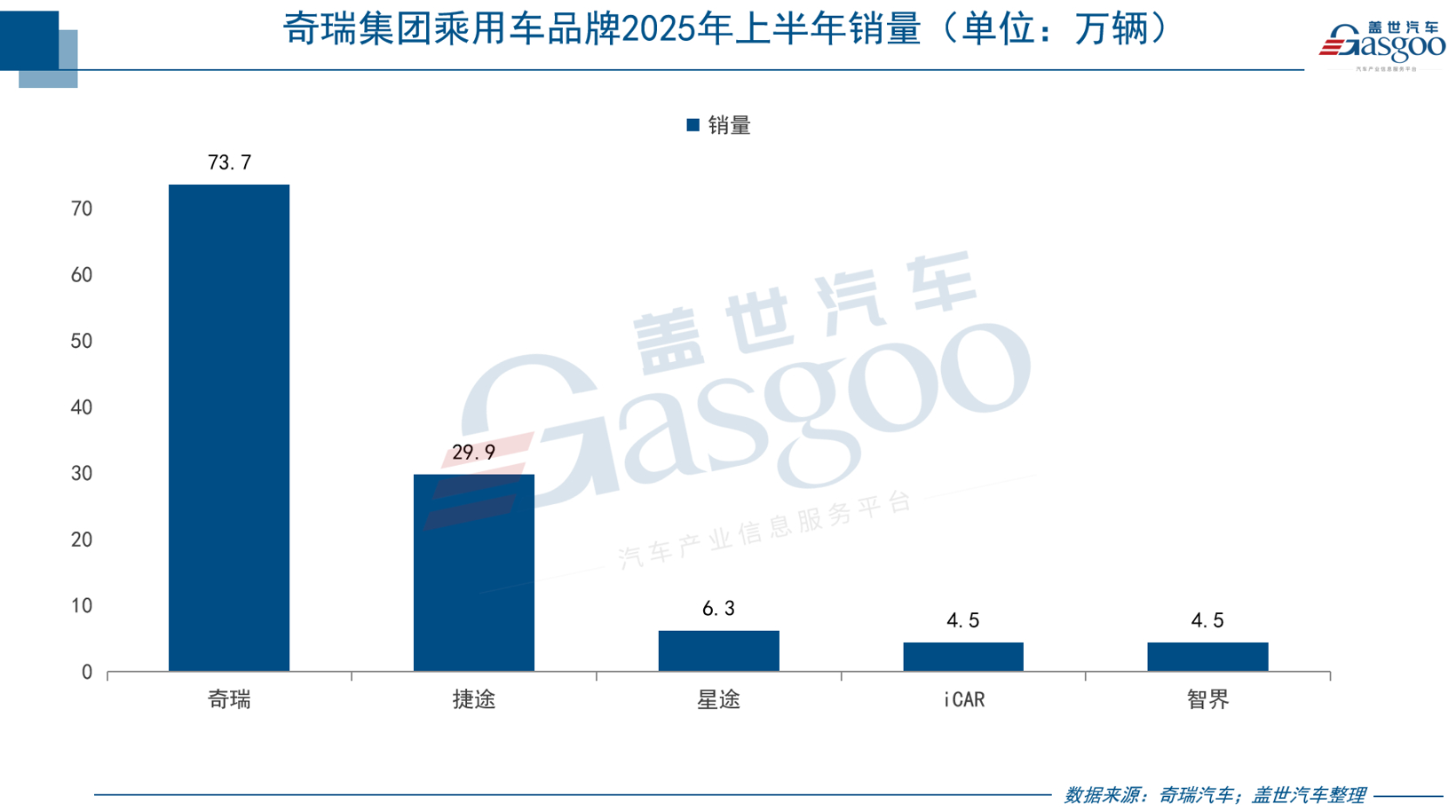

At a recent conference on the high-quality development of technology-oriented export enterprises in Anhui Province, Chery Holding Group Chairman Yin Tongyue announced that the company aims to achieve a sales target of 2 million vehicles in the second half of this year, with annual revenue exceeding 600 billion yuan, pushing for a spot in the top ten global automakers. He emphasized that all departments at Chery must 'value talent as life,' seeking to attract top global talent with a strict approach: 'Only top talents will be introduced, only bestselling models will be initiated, and only disruptive innovations will be considered.' This almost rigorous elitist strategy underscores Chery's commitment to achieving market prominence through technological density, racing against time during the restructuring of the global automotive landscape. The revenue of 600 billion yuan not only reflects a leap in scale but also tests the efficiency of technological transformation. In the first half of 2023, Chery Group's total sales reached 1.26 million vehicles, a 14.5% increase year-on-year, with revenue reaching 280.5 billion yuan, a significant rise of 38.3%. This growth momentum lays a solid foundation for achieving the targets of 2 million sales and 600 billion yuan in annual revenue in the second half of the year. Chery's performance in overseas markets has been impressive, with exports reaching 550,000 vehicles in the first half, accounting for nearly 44% of total sales. The transition to new energy vehicles is also accelerating, with sales of 360,000 new energy vehicles in the first half, nearly doubling year-on-year, and a penetration rate rising to 28.5%, up 8 percentage points from 2023. However, this penetration rate is still below the domestic industry average of 44.3%, indicating that Chery has room to catch up in the electrification sector. Currently, Chery's brand layout has formed a three-dimensional matrix of six passenger car brands covering a diverse range of market segments from mainstream to high-end, with the Fengyun brand officially elevated to a brand status in July this year. Through strategies of 'brand hierarchy, technology sharing, and domestic-international collaboration,' Chery has achieved resource integration and established competitive barriers. As the core pillar, the Chery brand has accumulated sales of 737,000 vehicles in the first half of the year, a year-on-year increase of 3.15%, accounting for 58.5% of the group's total sales. The single-month sales in June reached 138,000 vehicles, solidifying its leadership position in the mainstream market. The Jietu brand, focusing on travel and off-road sectors, saw sales of 299,000 vehicles in the first half, soaring by 33.9% and surpassing the 290,000 mark for the first time. The Xingtu brand, positioned as high-end, achieved sales of 63,000 vehicles, a year-on-year increase of 15.1%. The launch of new models in the Xingjiyuan series is gradually enhancing brand premium capabilities. The iCAR brand, as an independent new energy brand targeting the young and free-spirited consumer group, achieved sales of 45,000 vehicles in the first half with models like iCAR 03 and V23, marking a 60.5% increase, with monthly sales in June exceeding 10,000 vehicles, demonstrating its vitality in the electrification wave. The Zhijie brand, co-developed with Huawei, focuses on intelligent experiences, with sales of 45,000 vehicles for models S7 and R7 in the first half, soaring by 165.3% and becoming a mainstay in the high-end market. In terms of high-end transformation, Chery's newly launched models Yaoguang C-DM, Xingjiyuan ET, and ES have an average price exceeding 200,000 yuan. In the first five months of this year, these three models sold nearly 20,000 units, showing steady growth. The Zhijie brand is particularly significant, focusing on the market above 200,000 yuan, with sales in the first five months increasing by 1.9 times to 40,000 units, effectively addressing the previous high proportion of models priced below 200,000 yuan, injecting new momentum for brand premiumization. Behind Chery Group's sales of 1.26 million vehicles in the first half are the precise efforts of six brands in their respective market segments and the company's first-mover advantage in global expansion. Additionally, in the fields of new energy and high-end development, Chery is currently in a stage of intensification with significant room for improvement. This provides leverage and possibility for its 'top ten global' declaration, despite the challenges ahead. The competition for a top ten position poses certain challenges. In 2024, the rankings of the top ten automakers are clearly visible. From the sales perspective, Toyota, Volkswagen, Hyundai, Stellantis Group, General Motors, BYD, Ford, Honda, Nissan, and Geely Holding Group occupy the list in order, with Geely leading the bottom with annual sales exceeding 3.33 million vehicles. In contrast, Chery, despite achieving a record 2.6 million units, still lags behind by more than 700,000 units, highlighting the difficulty for Chery to break into the global top ten. In terms of revenue, in 2024, giants such as Volkswagen, Toyota, and General Motors lead the top ten, with BYD as a gatekeeper with annual revenue exceeding 777 billion yuan. Chery Group's annual revenue is 480 billion yuan, with a year-on-year growth of over 50%. If Chery achieves 600 billion yuan in revenue, it represents a year-on-year increase of 25% based on last year's figures, which is quite possible given Chery's previous year-on-year growth of 50%. The automotive industry is currently undergoing waves of electrification and intelligence, with declining demand for traditional fuel vehicles dragging down sales of some established international automakers. The rise of Chinese new energy forces is reshaping the global landscape, and Chery is also accelerating its transition to new energy and intelligence. This change may present opportunities for Chery. Currently, Chery has established a relatively complete and independently controllable technical reserve system across various technological paths, including fuel, pure electric, plug-in hybrid, and range-extended vehicles, all capable of large-scale production. Additionally, it has built five core technology systems: Mars architecture, Kunpeng power, Lion intelligence, Falcon intelligence, and Galaxy ecology. In the hybrid field, Chery's Kunpeng hybrid architecture exemplifies its technical advantages, encompassing three product series: high-efficiency CDM/CEM, high-performance CDM-S/CEM-S, and strong off-road CDM-O/CEM-O. By combining different engines, transmissions, and motors, it meets global user needs in various scenarios. In the pure electric field, Chery is accelerating the development of its independently developed pure electric dedicated platform, which includes a comprehensive self-research capability for motors and electric drive systems, and is speeding up solid-state battery research. In terms of intelligence, although Chery started relatively late and has gaps compared to leading new forces in the industry, it has adopted an open cooperation strategy to catch up quickly. Chery has established deep cooperative relationships with leading technology companies such as Huawei and Momenta while adhering to independent research and development. Chery's latest generation of Lion AI cockpit systems, supported by the Lion.AI smart cockpit model, aims to realize a more advanced 'cockpit-driving fusion' functional experience, enhancing user convenience and intelligence. In the field of intelligent driving assistance, Chery mainly adopts a collaborative research and development model. Its 'Falcon Plan' developed in partnership with Momenta is a key focus. This plan is based on Momenta's 'end-to-end flywheel large model' technology, which enables the system to evolve continuously, potentially reaching levels that surpass human drivers through reinforcement learning in the future. Currently, the 'Falcon Plan' covers core scenarios such as high-speed NOA, urban NOA, valet parking, and parking space-to-parking space, and the gap in functionality compared to mainstream new force brands is narrowing. Chery plans to equip all brands and models with the 'Falcon' intelligent driving system by 2025, successfully lowering the entry threshold to models priced at 60,000 yuan. This combination strategy of 'hybrid technology' and 'intelligence' is expected to drive continuous growth in Chery's sales.

Chery Aims for 2 Million Sales and 600 Billion Revenue in 2023

Images

Share this post on: