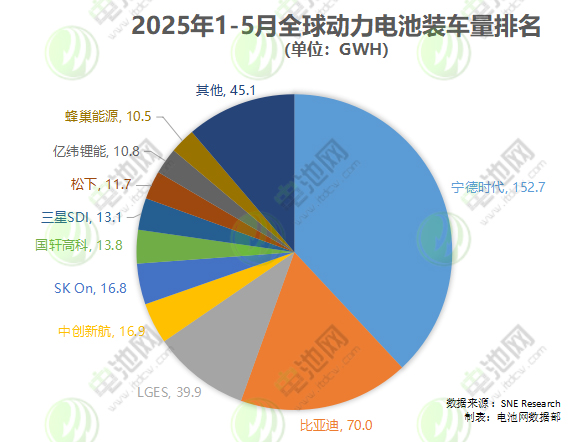

From January to May 2025, global power battery installations reached 401.3GWh, marking a year-on-year growth of 38.5%. Recent data released by South Korean research institution SNE Research reveals that the top three companies in the global power battery installation rankings remain unchanged compared to the same period in 2024, with CATL, BYD, and LG Energy Solution leading the pack. Samsung SDI dropped from 4th to 7th position, while SK On maintained its 5th place. China Innovation Aviation moved up from 6th to 4th, Panasonic dropped from 7th to 8th, and Guoxuan High-Tech climbed from 8th to 6th. EVE Energy ranked 9th, and Honeycomb Energy entered the list at 10th place. In terms of market share, CATL, BYD, Guoxuan High-Tech, EVE Energy, and Honeycomb Energy saw increases, with BYD showing the most significant growth of 2%. Conversely, LGES, China Innovation Aviation, SK On, Samsung SDI, and Panasonic experienced declines, with LGES seeing the largest drop of 2.1%. Year-on-year, only Samsung SDI and Panasonic recorded a decrease in installation volume among the top ten companies, while Honeycomb Energy doubled its installations to 110.1%. Among Chinese companies, the total installation volume of the top six, including CATL, BYD, China Innovation Aviation, Guoxuan High-Tech, EVE Energy, and Honeycomb Energy, reached 274.7GWh, further increasing their market share to 68.4%. Specifically, CATL led with 152.7GWh, up 40.6%, holding a market share of 38.1%, an increase of 0.60%. BYD followed with 70.0GWh, a 57.1% increase, capturing a market share of 17.4%, up by 2.00%. China Innovation Aviation ranked 4th with 16.9GWh, a 22.7% increase, but saw a slight decrease in market share to 4.2%. Guoxuan High-Tech ranked 6th with 13.8GWh, showing a growth of 78.9% and a market share of 3.4%, up 0.70%. EVE Energy ranked 9th with 10.8GWh, a 67.7% increase, and a market share of 2.7%, up 0.50%. Honeycomb Energy ranked 10th with 10.5GWh, achieving a remarkable 110.1% growth and a 2.6% market share, up 0.90%. In South Korea, the top three companies, LGES, SK On, and Samsung SDI, totaled 69.8GWh, with a combined market share of 17.5%, all experiencing declines. LGES ranked 3rd with 39.9GWh, a 14.3% increase, yet its market share decreased by 2.10%. SK On ranked 5th with 16.8GWh, up 18.1%, but saw a market share decrease of 0.70%. Samsung SDI ranked 7th with 13.1GWh, a decline of 8.8%, and a market share decrease of 1.60%. In Japan, Panasonic ranked 8th with 11.7GWh, down 12.9%, and a market share decrease of 1.70%. SNE analysis indicates that the global electric vehicle market is showing signs of recovery, particularly in Europe, where sales are surging due to stricter CO₂ emission regulations in countries like Germany and the UK. In contrast, the US market is facing limited demand despite potential tax reductions. China's growth trend is supported by new energy policies, but it also faces risks of intensified price competition due to excess inventory. Furthermore, SNE points out that under the Trump administration, policies regarding the IRA, the withdrawal of electric vehicle mandates, and tax legislation are undergoing rapid changes, significantly impacting the global electric vehicle supply chain and market demand. As these policy shifts occur, South Korea's battery and material exports are generally on a downward trend, necessitating battery companies to develop defensive strategies to ensure stable long-term market demand amidst increasing competition in Europe and policy risks in North America.

Global Power Battery Installations Reach 401.3GWh in Early 2025

Images

Share this post on: