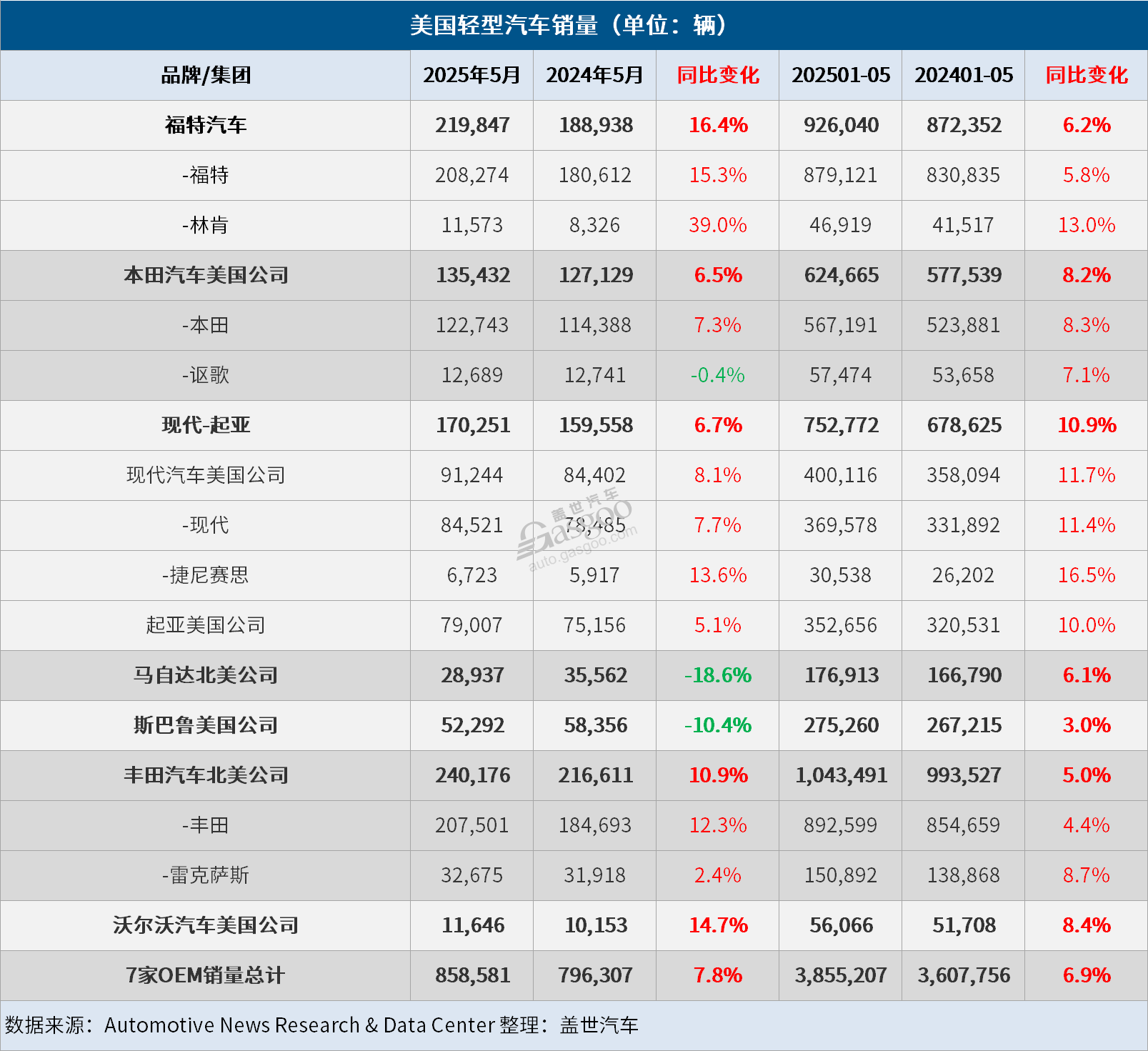

Despite American consumers' eagerness to purchase new cars or SUVs in May to avoid price hikes due to tariffs, the buying frenzy has significantly slowed down compared to the robust momentum seen in March and April. A preliminary report released by GlobalData on June 4 indicates that sales of new passenger cars and light trucks in the US rose slightly by 1.5% year-on-year in May, but the daily sales rate dropped from 56,700 units in April to 54,200 units. Additionally, the seasonally adjusted annual sales rate (SAAR) for May was notably lower at 15.3 million, falling short of the 15.6 million to 16.0 million forecast range by Cox Automotive, J.D. Power-GlobalData, and S&P Global Mobility, and also down from 17.2 million in April and 16.1 million in May last year. GlobalData and J.D. Power forecast that fleet sales in the US market reached 254,069 units in May, a decrease of 7% year-on-year; fleet deliveries are expected to account for 17.1% of total US light vehicle sales, down 1.2 percentage points from last year. Currently, automakers and dealers prioritize retail sales since fleet business profits are generally lower. The rental vehicle segment is expected to hold a 20.7% share of the US light vehicle market in May, down 3.3 percentage points year-on-year. In terms of power types, J.D. Power and GlobalData report that sales of internal combustion engine vehicles are estimated to account for 74.9% of new retail vehicle sales in the US, down 4.1 percentage points year-on-year; hybrid vehicles hold a 14.8% share, up 4.3 percentage points; plug-in hybrids are expected to represent 2.1%, up 0.1 percentage points; and electric vehicles are projected to account for 8.1%, down 0.4 percentage points. In May, several major automakers experienced year-on-year sales increases in the US, benefiting from strong retail market performance and Memorial Day promotions. Toyota North America saw its sales rise by 11% in May, marking its third consecutive month of growth and the largest monthly sales increase since a 16% rise in May last year; sales of the Toyota brand increased by 12% while Lexus sales grew by 2.4%. Despite tight inventory, Toyota’s top three selling models (Tacoma, Corolla, and Camry) achieved double-digit growth in May, and its electrified models saw total sales leap by 39% to 118,853 units, accounting for 49.5% of the company's total sales in the US for the month. Ford Motor Company’s sales rose by 16% year-on-year in May, with the Ford brand up 15% and Lincoln brand up 39%. Notably, Ford SUVs and crossovers saw a 25% increase in sales, while its pickups grew by 11%, with F-Series trucks rising by 15%. Ford surpassed Toyota in monthly sales for the second time this year, marking the eighth time since January last year. However, over the first five months of the year, Toyota still leads Ford by 13,478 units. Honda saw its sales increase by 6.5% in May, with the Honda brand up 7.3% and Acura down 0.4%. Strong deliveries of Honda models such as Civic, Ridgeline, Passport, and Prologue compensated for slight declines in HR-V sales. Hyundai and Kia also reported sales growth in May, driven by strong demand for crossovers and hybrids as well as retail promotions. Hyundai's sales increased by 7.7% to 84,521 units, while Kia's sales grew by 5.1% to 79,007 units, though they did not maintain the double-digit increases seen in March and April. Both brands have achieved eight consecutive months of sales growth. Meanwhile, Mazda's sales in May dropped by 18.6% to 28,937 units, ending a streak of 12 consecutive months of growth. Subaru's sales fell by 10% to 52,292 units, breaking a 33-month growth streak. Volvo's sales, on the other hand, grew by 15%, marking its second consecutive month of growth. In terms of Chinese brands, exports of Chinese passenger cars to the US have been limited due to tariffs, with Changan Ford leading the way with 11,970 units exported in the first five months. The overall inventory of light vehicles in the US continues to decline, affected by the dual impact of the tariff policy and adjustments in production and sales by automakers. According to Cox Automotive, new vehicle inventory at dealerships stood at 2.49 million at the beginning of May, down 7.4% month-on-month and 10.5% year-on-year. Chief economist Charles Chesbrough emphasized that the inventory decline has made it increasingly difficult for consumers to find their desired models. Analysts warn that if China does not ease restrictions on rare earth magnet exports, US automotive inventory may face further challenges. The slowdown in US light vehicle sales growth in May indicates that the automotive market may weaken significantly in the second half of the year. Analysts highlight that the tariff policy has led consumers to purchase vehicles in advance to avoid price increases, which could hinder sales for the remainder of the year. If tariffs remain in place, automakers might reduce certain models or configurations, limiting consumer choices. Price adjustments are expected from various automakers, with Ford, Subaru, and Hyundai planning to raise prices to offset increased tariffs on all imported light vehicles. The extent and methods of price hikes are anticipated to vary among manufacturers, with a general expectation of rising automotive prices in the US, albeit at a rate lower than the tariff increase.

US Car Sales Slowdown in May Amid Rising Tariffs

Share this post on: