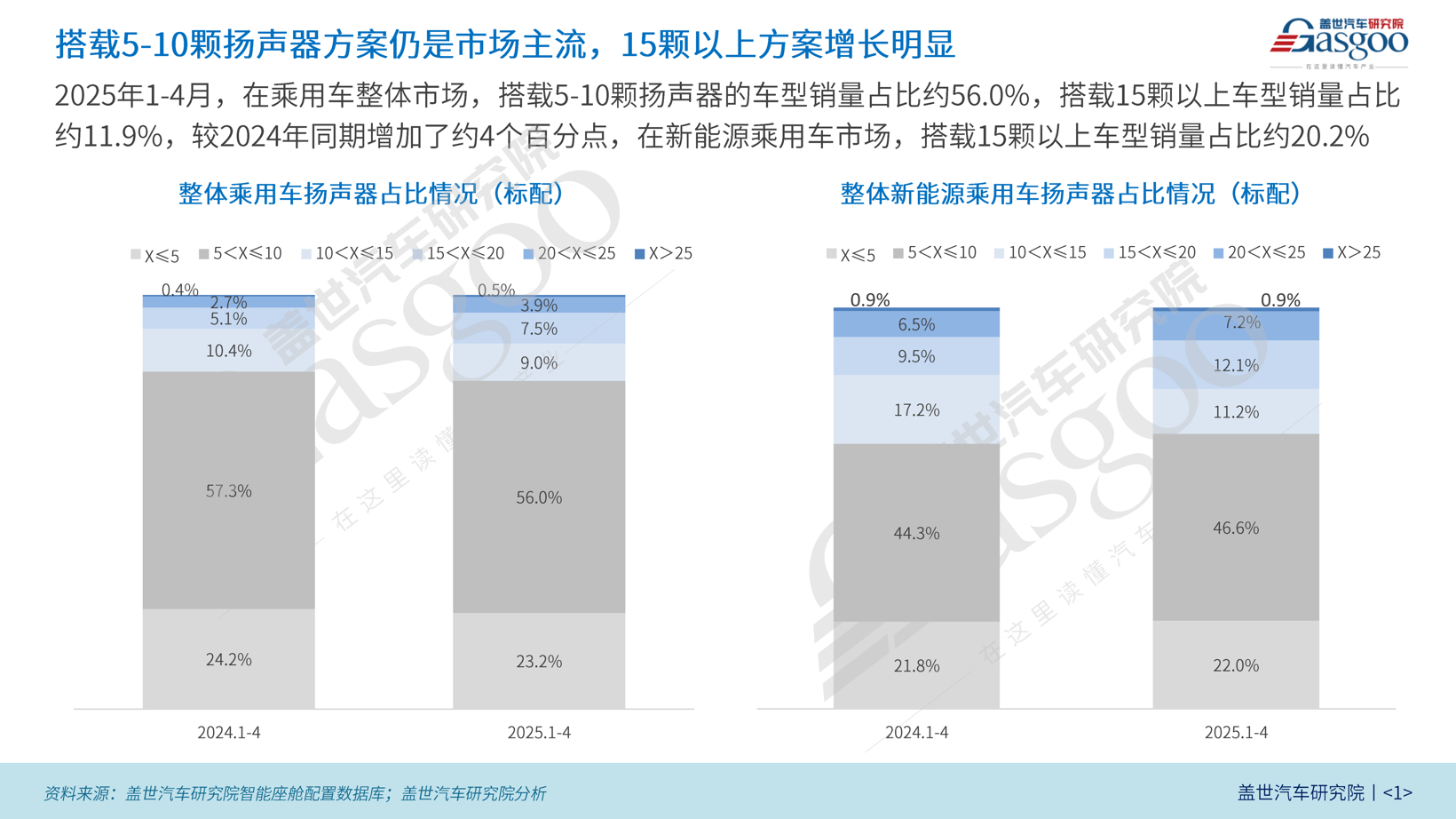

As the automotive industry continues to advance, in-car acoustic configurations are becoming an essential part of enhancing vehicle quality and driving experience. According to data analysis from the Gaishi Automotive Research Institute, from January to April 2025, vehicles equipped with 5 to 10 speakers accounted for approximately 56.0% of total passenger car sales, a slight decrease of 1.3 percentage points compared to the same period last year. Despite this, this configuration remains dominant as it effectively balances sound quality with cost, catering to the majority of consumers' demand for value for money. However, the growth of vehicles equipped with more than 15 speakers cannot be overlooked. In the overall passenger car market, from January to April 2025, the sales percentage of models with more than 15 speakers reached about 11.9%, an increase of 4 percentage points compared to 2024. In the new energy passenger vehicle market, this proportion rose to 20.2%. The growth of the 15+ speaker configuration reflects the upgrading of market demand and a shift in consumer preferences. Overall, models equipped with 5 to 10 speakers are expected to maintain their status, continuing to meet the basic audio quality demands of the majority of consumers. Meanwhile, the 15+ speaker models are likely to keep growing, as ongoing technological advancements and cost reductions may expand their application, providing consumers with a superior acoustic experience.

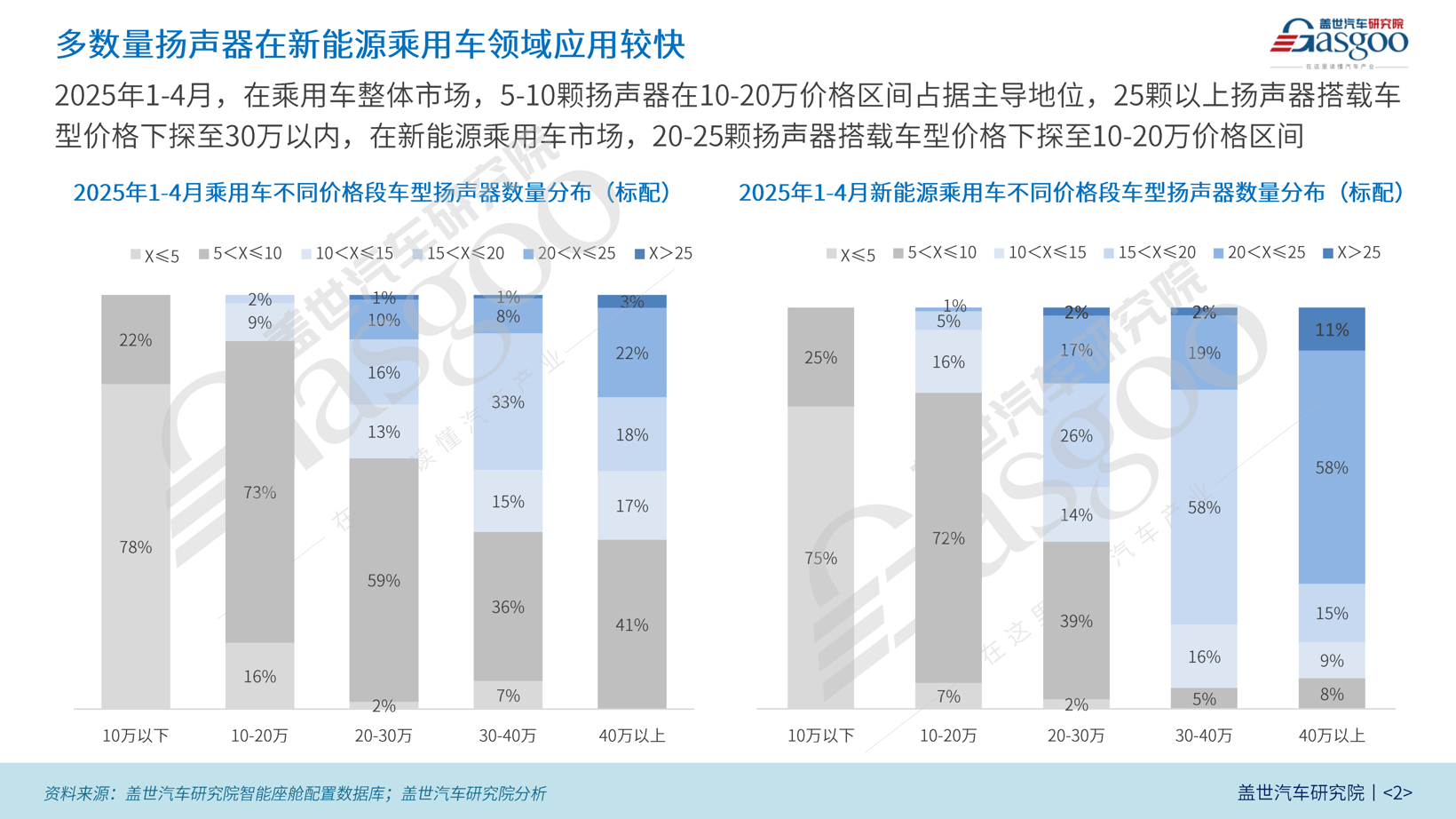

From January to April 2025, vehicles priced between 100,000 to 200,000 yuan primarily featured 5 to 10 speakers, which not only satisfies most consumers' value-for-money expectations but also highlights cost control as a critical consideration in this market segment. However, in the new energy vehicle sub-sector, a different trend emerges: configurations with 20 to 25 speakers have penetrated the 100,000 to 200,000 yuan price range, indicating that high-end audio systems are gradually making their way into the mid-range market. This suggests that as technology evolves and market demands change, more mid-range new energy models are starting to incorporate more advanced audio systems to enhance the driving experience. For instance, in the new energy passenger vehicles priced over 400,000 yuan, the proportion of models with more than 25 speakers reached 11%, while those with 20 to 25 speakers accounted for a notable 58%. These figures clearly indicate the strong demand for high-quality audio systems in high-end new energy vehicles, and they also illustrate a gradual expansion of multi-speaker configurations from the high-end market to the mid and lower-end sectors. Further analysis reveals that in the price segment below 200,000 yuan, most models still come equipped with 10 speakers or fewer, reflecting that cost control remains a significant consideration in this segment. However, with technological advancements and increasing consumer demands for in-car entertainment experiences, it is expected that more mid to low-end models will adopt higher speaker configurations in the future. Some brands have already started introducing systems with more than 15 speakers in their entry-level models to meet the growing consumer demand.

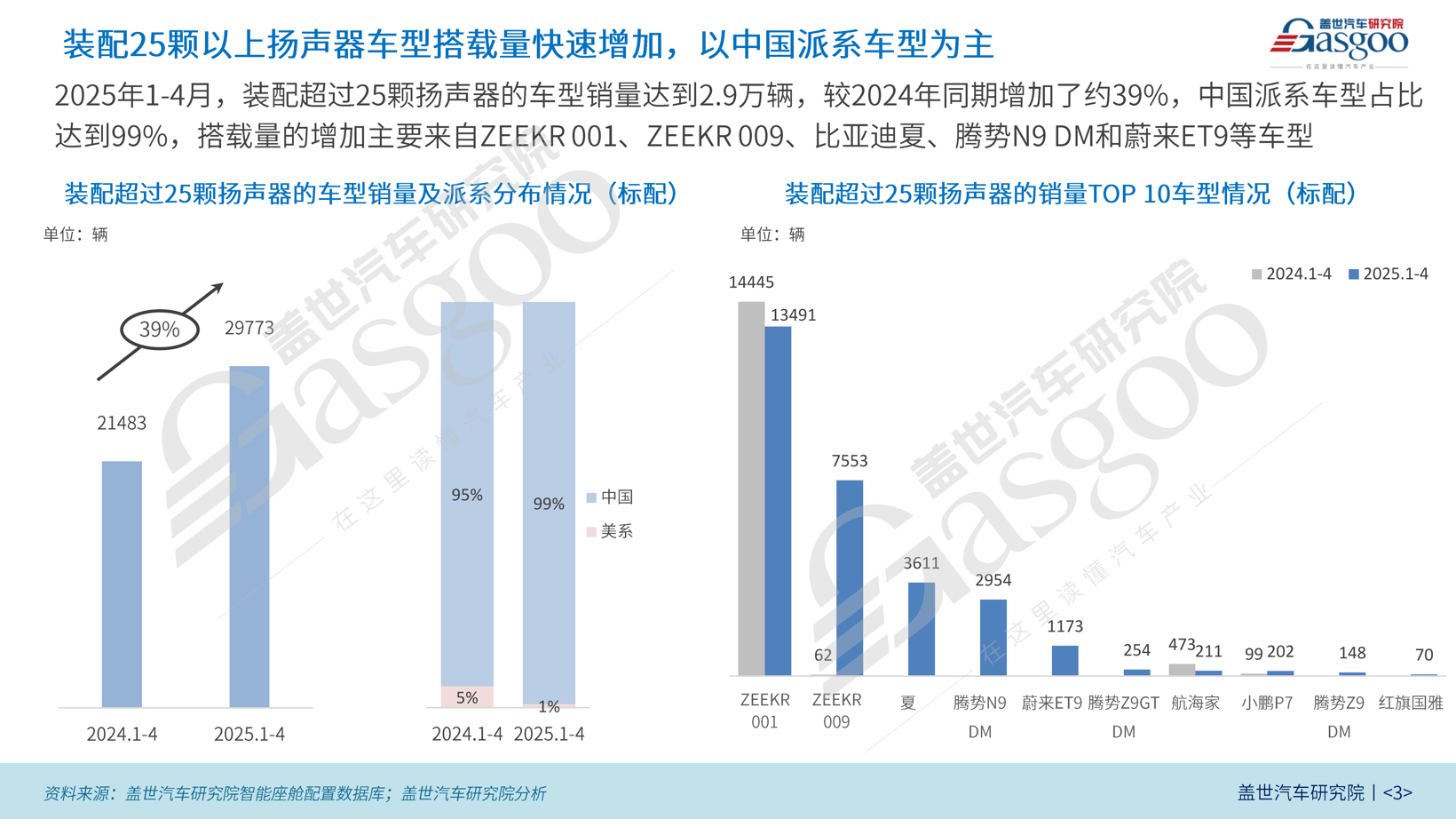

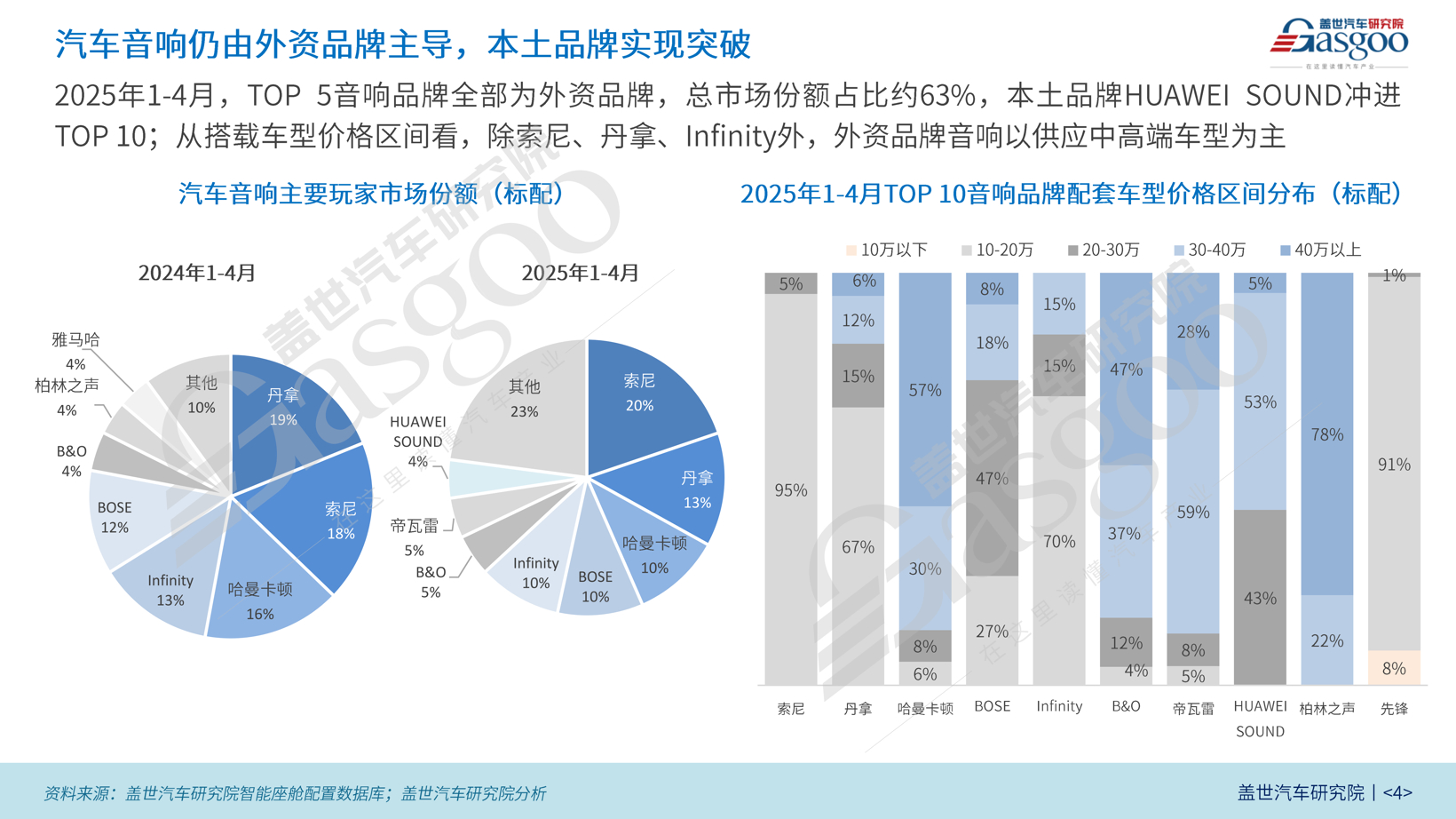

As the automotive industry continues to upgrade, in-car acoustic configurations are becoming a vital element in enhancing vehicle quality and driving experiences. Currently, the number of models equipped with more than 25 speakers is rapidly increasing, led primarily by Chinese brands. In the new energy passenger vehicle market, cabin acoustic configurations exhibit distinct high-end characteristics. Historically, luxury audio systems with numerous speakers were typically found in expensive imported or luxury models; however, this configuration is now accelerating its adoption among domestic new energy vehicles. According to the latest data, from January to April 2025, vehicles equipped with 25 or more speakers totaled 29,773 units, representing a year-on-year increase of nearly 39%. Distribution by brand shows that Chinese brands dominate the market, with a 99% share in the same period, reflecting a 4 percentage point increase from last year. This growth is primarily driven by models such as the Zeekr 001, Zeekr 009, BYD Xia, Tengshi N9 DM, and NIO ET9, showcasing the ongoing investment and innovative capabilities of Chinese new energy automakers in cabin intelligence and luxury feel. The rapid increase in models with over 25 speakers highlights the growing consumer demand for high-quality cabin acoustic experiences. It also indicates that Chinese automotive brands are not only making breakthroughs in power systems and intelligent driving but are also competitively positioned in cabin comfort and entertainment configurations against international luxury brands. With continuous technological advancements and further upgrades in consumer demand, it is anticipated that models equipped with over 25 speakers will increasingly appear on the market, offering users a more immersive and technologically advanced auditory experience, thus elevating the overall cabin experience to new heights. For a long time, foreign brands have held a strong market presence in the automotive audio field due to their extensive technical accumulation and powerful brand influence. According to data analysis from Gaishi Automotive Research Institute, from January to April 2024, brands such as Sony, Dynaudio, Harman Kardon, BOSE, and Infinity held significant market shares of 20%, 13%, 10%, 10%, and 10%, respectively. These foreign brands occupy a crucial position in the global automotive audio market due to their advanced audio technology, exquisite tuning craftsmanship, and well-established reputations. In terms of price range for equipped models, foreign brand audio systems primarily supply mid to high-end vehicles, except for Sony, Dynaudio, and Infinity. However, in recent years, domestic brands have achieved significant breakthroughs in in-car acoustic configurations. Notably, from January to April 2025, HUAWEI SOUND, as a domestic brand, successfully entered the TOP 10 with a 4% market share. The models equipped with HUAWEI SOUND are mainly concentrated in the 200,000 to 400,000 yuan price range, with 43% in the 200,000 to 300,000 yuan category and 53% in the 300,000 to 400,000 yuan category. This indicates that domestic brands have developed a competitive edge in the automotive audio market, capable of meeting mid-range consumers’ demands for high-quality audio.

The Rise of In-Car Acoustic Configurations in China's Auto Market

Images

Share this post on: