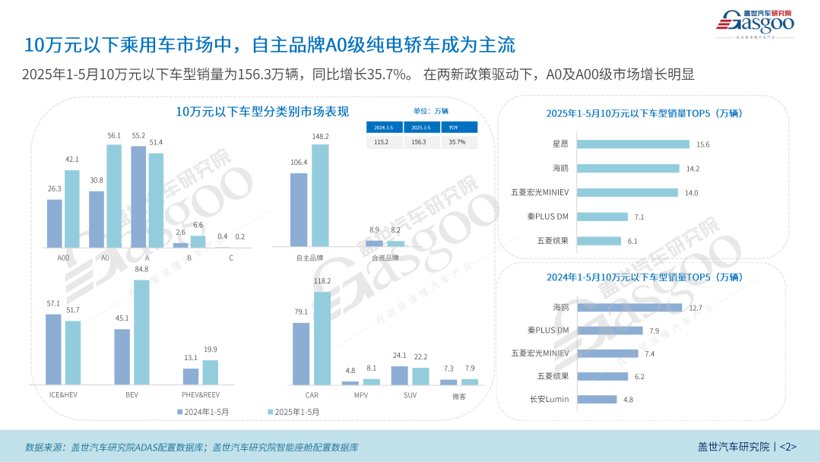

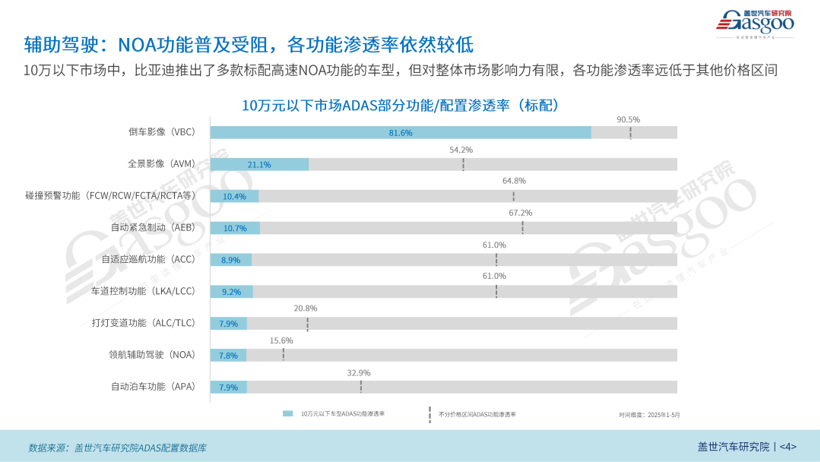

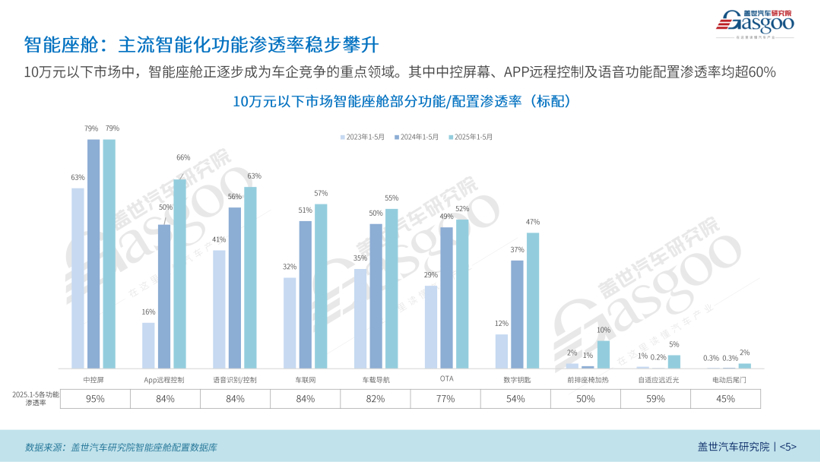

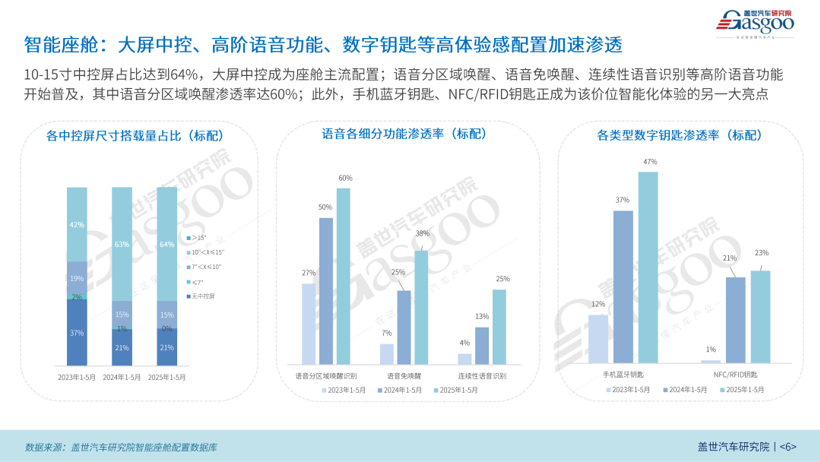

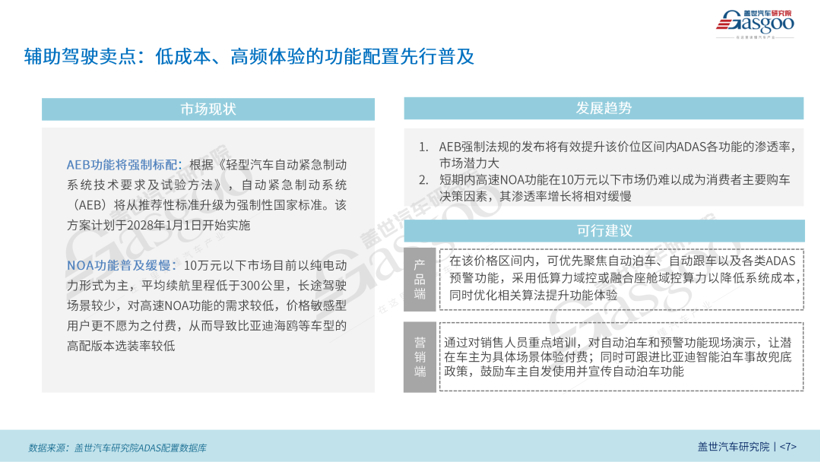

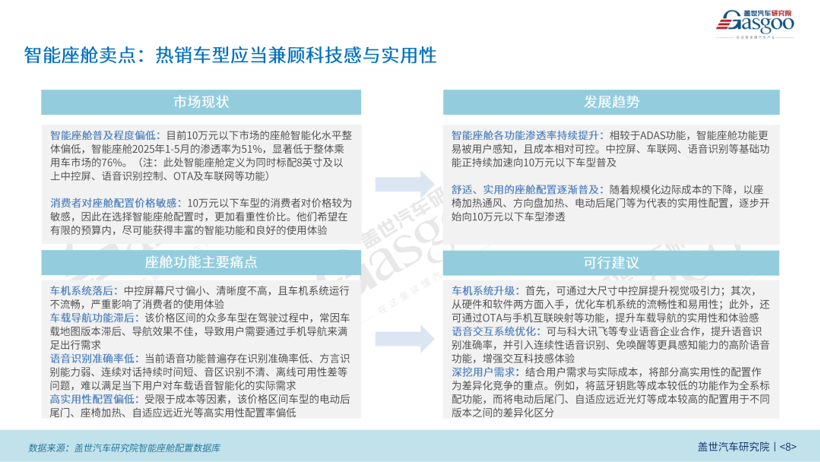

From January to May 2025, the sales of vehicles priced under 100,000 yuan reached 1.563 million units, showing a year-on-year increase of 35.7%. Driven by two new policies, the A0 and A00 segments have seen significant growth, with domestic pure electric sedans becoming mainstream in this market. Geely's Xingyuan topped the sales charts for vehicles under 100,000 yuan, with its spacious interior and smart cabin experience being key advantages, while ADAS features are only available as optional. In this price segment, smart cabin configurations are gradually becoming the primary competitive focus. Features such as large central displays, in-car navigation, APP remote control, advanced voice functions, and digital keys are increasingly penetrating the market. Conversely, although BYD launched several models with high-level ADAS features like high-speed NOA at the beginning of the year, their impact on the under-100,000 yuan market has been limited, with the penetration of these features significantly below the market average. For ADAS selling points, it is recommended to prioritize low-cost, high-demand features. Currently, the penetration of AEB functions in this market is only 10.7%. With the upcoming mandatory regulations for AEB, this penetration is expected to increase significantly. AEB is often bundled with L2-level and above ADAS systems, indirectly promoting the adoption of higher-level ADAS features, indicating substantial market potential. Additionally, since the majority of vehicles under 100,000 yuan are pure electric with an average range of less than 300 kilometers, the demand for high-speed NOA features is low, especially among price-sensitive customers who are reluctant to pay for such features, leading to a slow growth rate in this area. Thus, the focus should be on low-cost and high-demand ADAS features like automatic parking, adaptive cruise control (ACC+LCC), and various safety warning functions. Demonstrations of these features before purchase and offering accident coverage policies can make them appealing comfort features, encouraging consumers to pay for them. In terms of smart cabin selling points, popular models should balance technology and practicality. Currently, the penetration of smart cabins in vehicles under 100,000 yuan is only 51%, significantly lower than the overall passenger car market at 76%. Basic functions like central displays and voice recognition are rapidly spreading, while practical features such as heated and ventilated seats and electric tailgates are gradually emerging. However, many models in this price segment suffer from outdated vehicle systems, lagging navigation systems, low voice recognition accuracy, and small, poor-quality displays, which significantly affects user experience. Furthermore, due to cost constraints, the prevalence of high-utility features like electric tailgates, heated seats, and adaptive headlights remains low. It is recommended for car manufacturers to invest more in the design of central displays and system fluidity to enhance visual impact and operational smoothness, and strengthen practical functions like navigation and mobile connectivity. For voice interaction, collaborating with professional voice technology companies to improve recognition accuracy and promote advanced features like continuous voice recognition and wake-word-free interaction can enhance the technological appeal of smart cabins. In configuration strategies, combining user needs with cost differences is crucial, offering low-cost features like Bluetooth keys as standard across all models while using high-cost configurations such as electric tailgates and adaptive headlights to differentiate versions, effectively integrating intelligence and practicality.

Sales of Cars Under 100,000 Yuan Surge in Early 2025

Images

Share this post on: