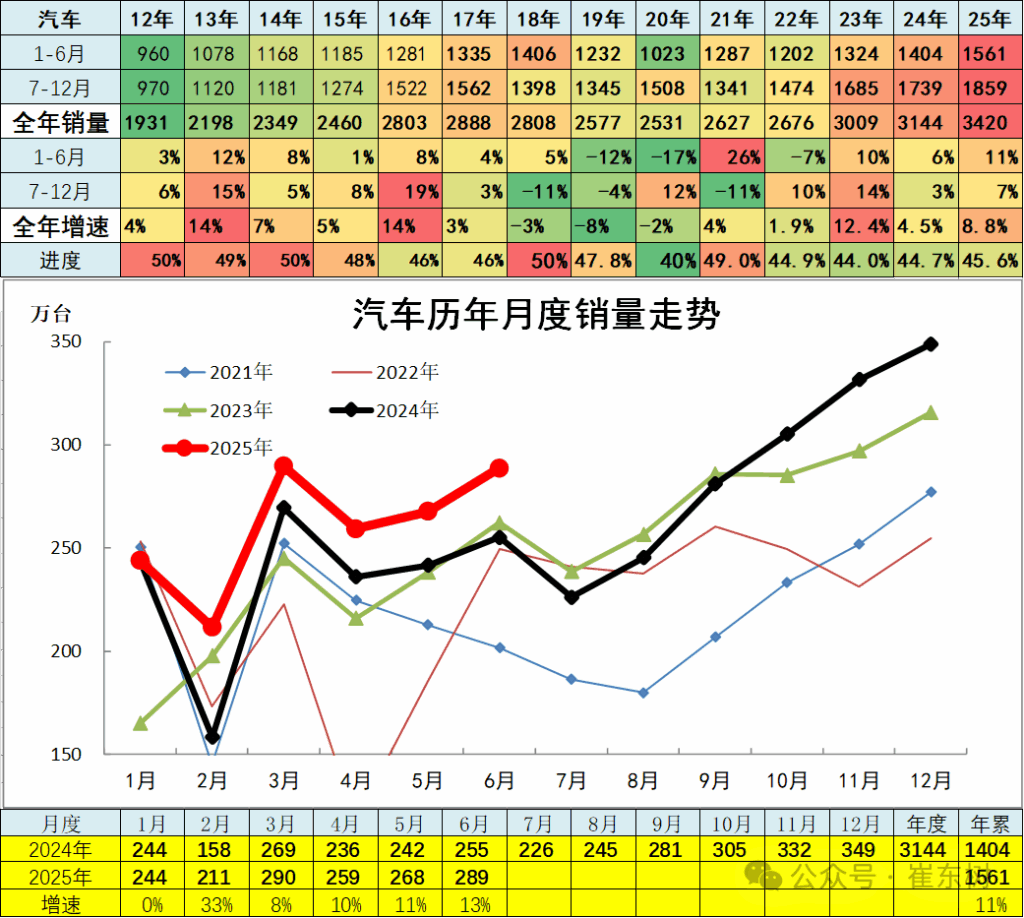

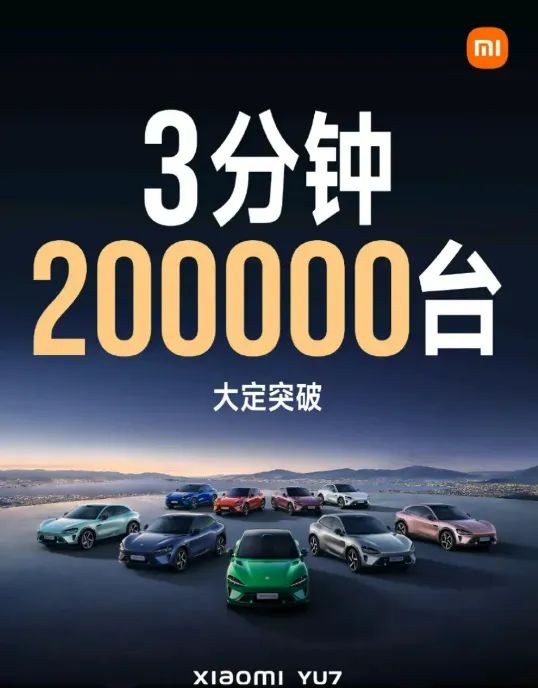

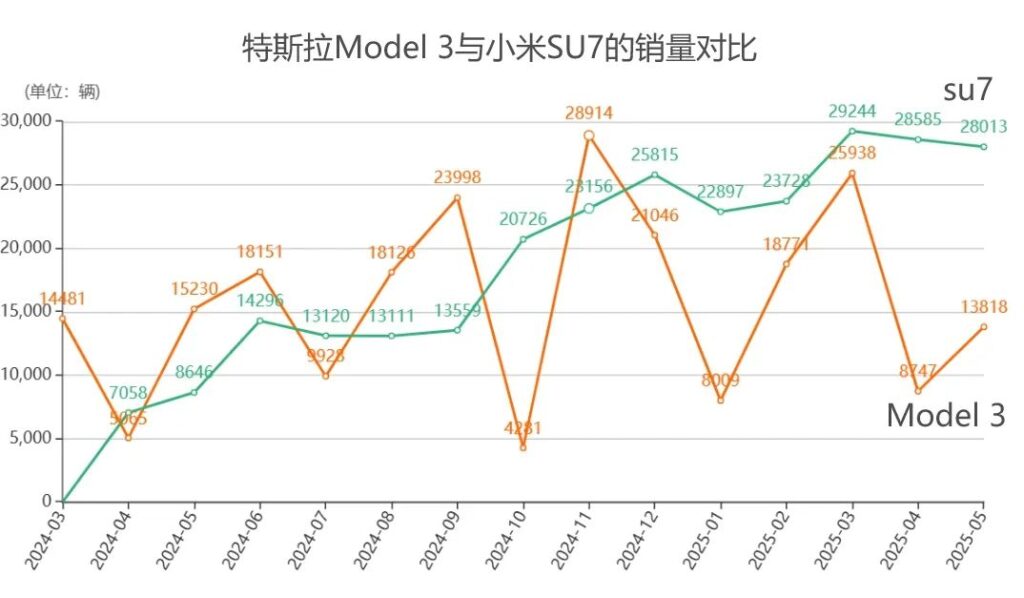

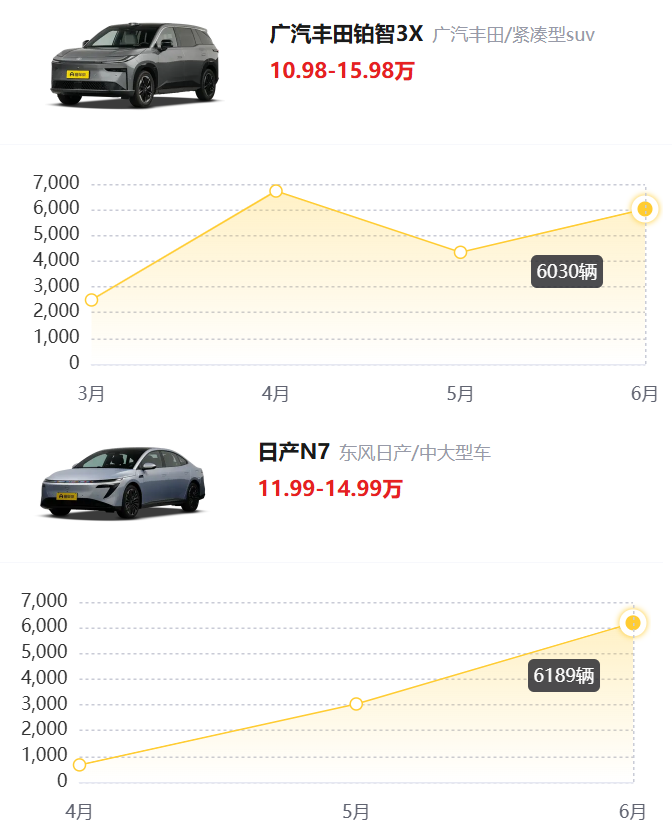

As we reach the midpoint of 2025, we reflect on the past 180 days in China's automotive market. This period has been characterized by a mix of competitive pressures, price wars, and shifts in consumer preferences. The data from the China Passenger Car Association shows that retail sales of passenger cars reached 10.901 million units in the first half of the year, marking a 10.8% increase year-on-year. Despite some fluctuations, the market has generally maintained a growth range of 13% to 20%. Major domestic automakers have reported strong sales, and even traditional joint ventures like Volkswagen and Toyota continue to hold their ground with classic models despite fierce competition from new energy vehicles (NEVs). However, underlying issues persist, such as low industry profits and a challenging competitive environment characterized by fierce price wars and market saturation. The phenomenon of 'involution'—where companies engage in harmful competition—has been widely discussed, especially with the government's push to curb such practices. The entry of tech giants like Huawei and Xiaomi into the automotive industry has further complicated the landscape, bringing new competitive dynamics. As we look ahead to the second half of 2025, the outlook remains uncertain, with the potential for continued price wars and market adjustments. The focus will likely shift towards sustainable growth and innovation as companies navigate these challenges.

Reflections on the First Half of 2025: Trends and Challenges in China's Automotive Market

Images

Share this post on: