On July 17, Li Auto announced that reservations for its new model, the Li Auto i8, have officially begun, with an expected price range of 350,000 to 400,000 yuan. The final price will be revealed at a press conference on July 29. This is the second pure electric vehicle from Li Auto following the adjustments to its electric strategy after the MEGA setbacks, and it represents the brand's first pure electric SUV. From targeting the premium MPV market with MEGA to now aiming at the broader family SUV market with the i8, Li Auto is clearly determined not to miss the opportunity in the pure electric segment. The i8, as the inaugural model of the i series, is expected to have more practical market expectations compared to the MEGA. To achieve a balance between sales volume and profitability, relying solely on high-priced MPV models is insufficient; the i8 and the upcoming i6 are expected to take on the dual responsibilities of driving sales and reshaping the reputation of pure electric vehicles.

In comparison to the MEGA, which is positioned above 500,000 yuan, the Li Auto i8 has a clearer market target. The company has always viewed 'family users' as its core consumer group. While MPVs are irreplaceable in high-end family vehicle scenarios, they remain a relatively niche segment compared to SUVs. According to data from the China Automobile Association, the share of mid- to large-sized MPVs in the domestic new energy vehicle market is less than 3%, with June sales at 28,000 units. In contrast, the share of mid- to large-sized pure electric SUVs reached 8%, with sales of 88,000 units in June, indicating significant growth potential.

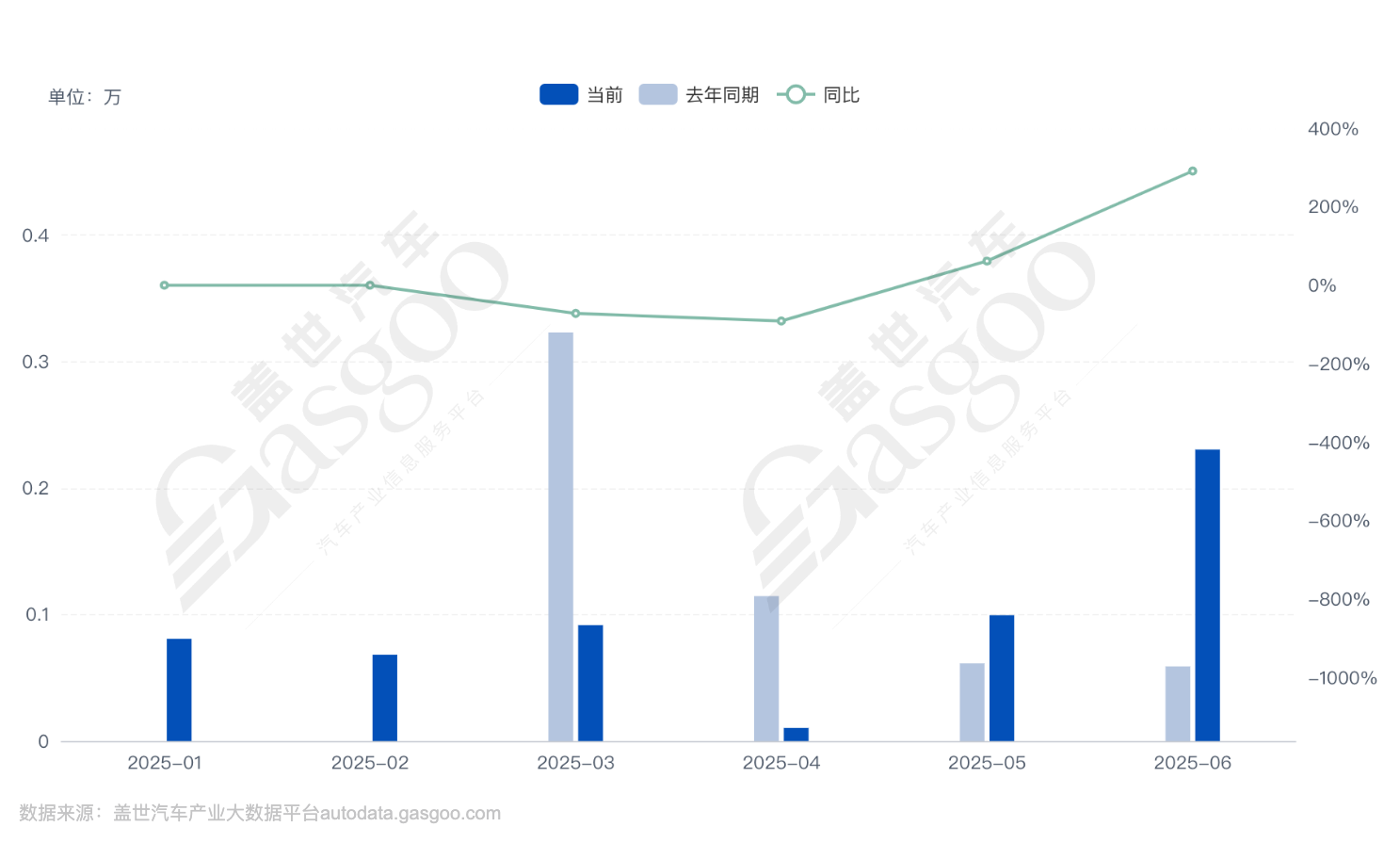

In 2024, the Li Auto MEGA served more as a trial for a premium image, with annual sales of 11,000 units, which is significantly lower than competitors like the Buick GL8 and the D9 from Tengshi. In April, following a comprehensive upgrade to all models, Li Auto began deliveries of the MEGA Home in late May, resulting in a substantial increase in competitiveness and exceeding order expectations. In June, MEGA's sales showed a notable recovery, with monthly deliveries reaching 2,304 units, resulting in a year-to-date total of 5,805 units, a slight increase of 4.1% year-on-year. However, compared to the 50,000 units sold by models L6 and L7, MEGA's contribution to Li Auto's overall sales is less than 3%. The true sales expectations now rest on the i8 and the upcoming i6 SUV products.

From a product perspective, the Li Auto i8 has several competitive advantages in the mid-to-large pure electric SUV segment. It is designed as a mid-to-large pure electric SUV with a 2+2+2 six-seat layout. All models come standard with a dual-motor intelligent all-wheel-drive system, with the front motor delivering a maximum power of 150 kW and the rear motor 250 kW, achieving a total system power of 400 kW. In terms of range, the new vehicle is built on an 800V high-voltage platform and offers two options of Kirin batteries with capacities of 90.1 kWh and 97.8 kWh, with a maximum CLTC pure electric range of up to 720 km, supporting a 5C charging rate that allows for an increase of up to 500 km of range within just 10 minutes.

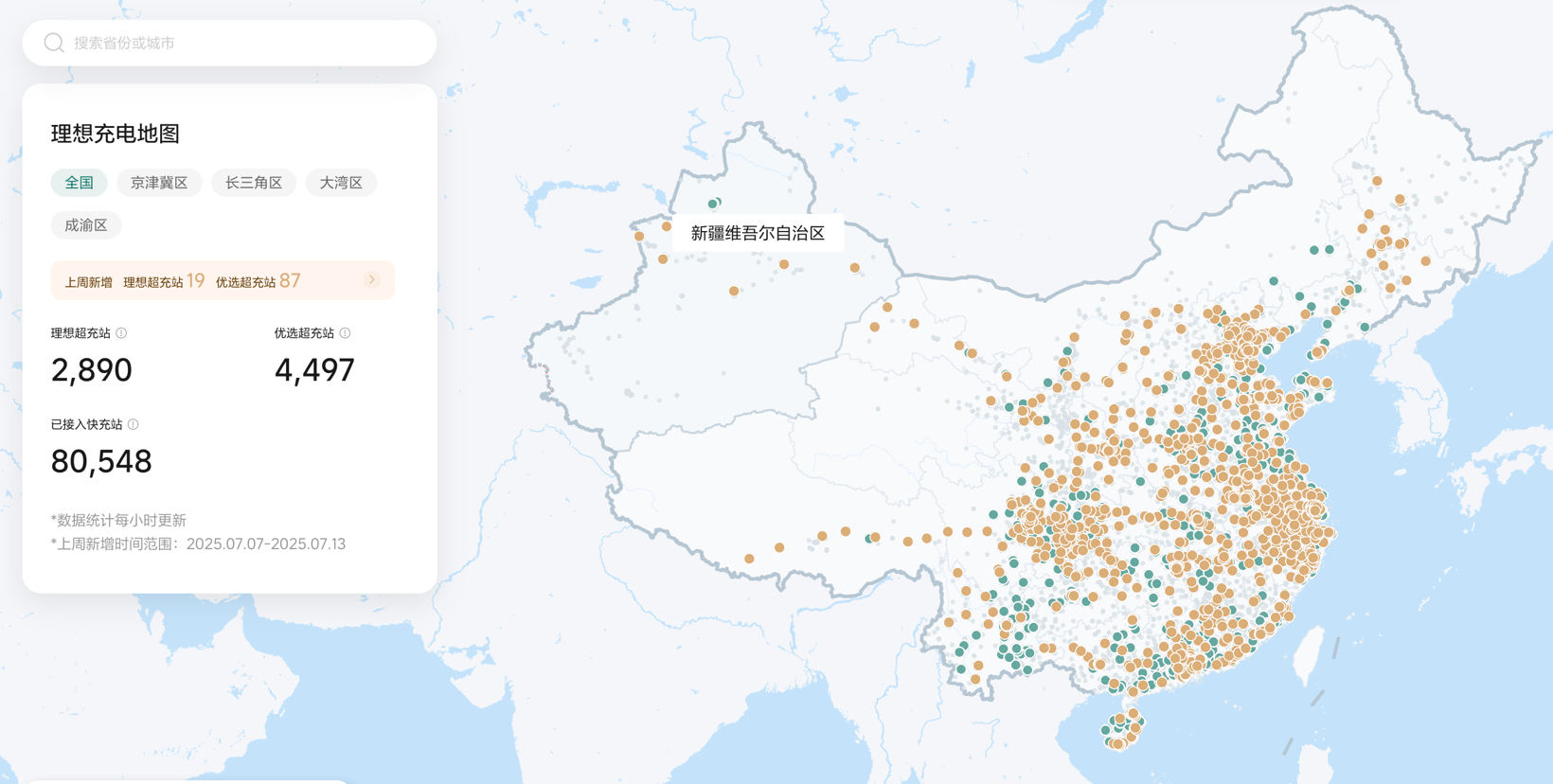

Overall, the competitive advantages of the Li Auto i8 mainly lie in several areas: first is the spatial advantage, with a spacious six-seat design catering to the needs of Chinese families; second is the charging infrastructure, as of July 17, the 'Nine Vertical and Nine Horizontal' high-speed supercharging network has been fully connected, with a total of 959 charging stations, laying a foundation for the promotion of pure electric models; third is the intelligent configuration, as the i8 will be equipped with the Li Auto VLA driver model, providing certain advantages in assisted driving.

Li Auto has set a sales target of 120,000 units for its pure electric products this year (including MEGA). Given the current delivery situation of the MEGA, the i8 and the i6, which will be launched in the second half of the year, will bear the main sales responsibilities. According to Li Auto's forecast, MEGA deliveries are expected to reach 2,500 to 3,000 units per month, representing a 150% to 200% increase compared to 2024. Based on this calculation, MEGA's total deliveries this year could reach around 30,000 units, so the remaining approximately 90,000 units will need to come from the i8 and i6. However, achieving an average monthly delivery of over 10,000 units will not be easy for these two new models. The Li Auto i8 needs to stand out in a highly competitive market to meet its expected sales targets.

The competition in the mid-to-high-end pure electric SUV market is becoming increasingly fierce. In the same week that Li Auto announced reservations for the i8, Tesla China unveiled the Model Y L version, a six-seat pure electric SUV set to launch this fall with an estimated price of around 400,000 yuan. This new model has increased overall dimensions and directly competes with the Li Auto i8. Meanwhile, Xiaomi's YU7, launched in June, received 200,000 orders in just three minutes and nearly 290,000 in one hour, making it one of the most talked-about hits of the year in the automotive world. Although the YU7 is more geared toward sports and smart technology, and its core user group does not completely overlap with that of the Li Auto i8, the significant traffic effect cannot be ignored.

On the day reservations for the i8 opened, Li Xiang candidly stated on social media that Li Auto's brand appeal is currently not comparable to that of Xiaomi, unable to achieve 'no small deposit, no press conference, direct sales from the official website.' This honesty reflects the challenges faced by new automotive manufacturers in the marketing ecosystem, facing more direct competition from 'new traffic nobles.' Conversely, Xiaomi's large-scale order locking also means that the Li Auto i8 could benefit from staggered deliveries and differentiated competition, potentially creating an extra window of opportunity. After all, the delivery timeline for the Xiaomi YU7 has been pushed out to nearly six months later, while the Li Auto i8 could start deliveries as early as the end of August, possibly shifting some potential users' demands.

Despite the intense market competition, the capital market's response to the arrival of the Li Auto i8 has been relatively optimistic. On July 17, driven by positive news such as the opening of i8 reservations and the completion of the supercharging network, Li Auto's Hong Kong stock price surged over 10% at one point, with significantly increased trading volume, ultimately closing with a 9.73% increase. Analysts generally believe that Li Auto's established brand recognition and user reputation in the extended-range SUV sector lays a solid foundation for its entry into the pure electric SUV market. If the i8 can maintain the stable performance of the L series in terms of pricing, delivery rhythm, and user experience, Li Auto is expected to quickly fill its position in the pure electric segment. The i8 marks just the beginning of Li Auto's full-scale entry into pure electrics. Following the i8, the family-oriented five-seat i6 is set to debut in September, further covering the compact and mid-size pure electric SUV markets, forming a product matrix that differentiates between high-end and low-end offerings alongside the L series. Li Auto plans to achieve a combination of four extended-range SUVs, one MPV, and two pure electric SUVs by the end of the year, consolidating its fortress in the high-end family new energy market.

Li Auto Opens Reservations for New Electric SUV Li Auto i8

Images

Share this post on: