In June 2025, the new energy vehicle battlefield remains fiercely competitive, with emerging tech companies racing ahead while traditional car manufacturers are also launching their new energy brands. Nowadays, a monthly sales figure of 30,000 has become the entry threshold, while 50,000 is viewed as the new ceiling. This competition has evolved from a single product battle to a triathlon that includes technological reserves, supply chain resilience, and global market rhythm.

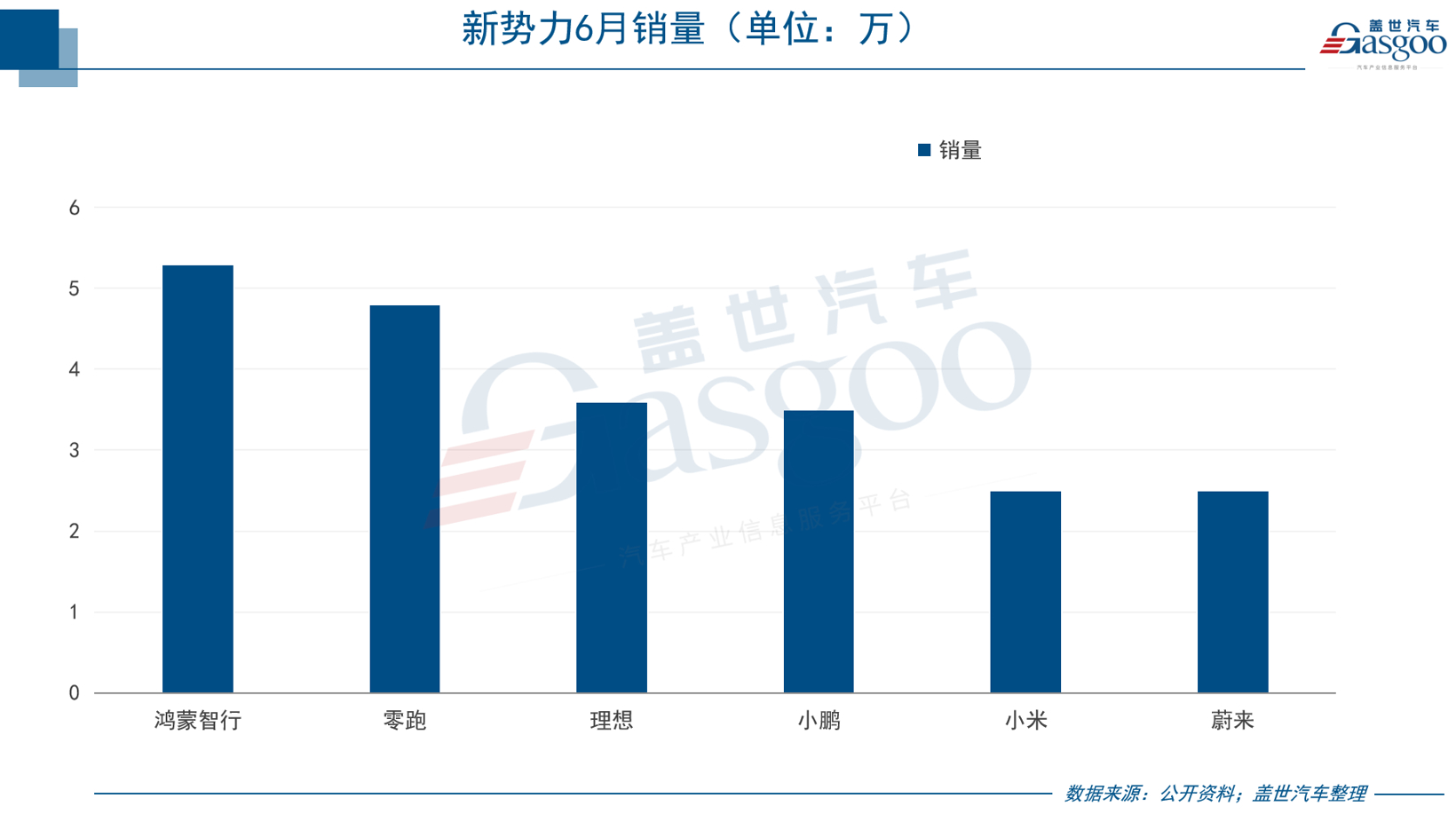

Li Auto, despite having monthly sales exceeding 30,000, is facing pressure from declining sales. In contrast, Leap Motor has claimed the throne with sales of 48,000 units, marking its fourth consecutive month of leading the Chinese new energy brand sales chart. The Hongmeng Smart Mobility brand has set a record with 53,000 units sold in June, while XPeng Motors continues to demonstrate impressive growth.

Leap Motor's total deliveries reached 48,000 units in June, soaring over 138% year-on-year, and its cumulative deliveries for the first half of the year reached 222,000 units. The C series models remain key contributors, with the main model, C10, surpassing cumulative deliveries of 100,000 units since its launch in March 2024. The 2026 model of C10 was officially launched on May 15, and pre-orders for June have exceeded 15,000.

The newly launched 2026 C16 on June 18 has a starting price of 151,800 yuan and includes a five-seat version with comprehensive upgrades in core performance, further enhancing its market competitiveness.

Meanwhile, the B series is becoming a crucial growth engine, with the B10 model contributing 14,000 units since its launch in April. The B01 model, aimed at the youth market, has started pre-sales on June 29, with a starting price of 105,800 yuan and advanced features like lidar and Qualcomm 8295 chips, showcasing its cost performance.

Hongmeng Smart Mobility achieved a historic milestone in June, with total monthly deliveries reaching 53,000 units. In just 39 months, it has accumulated total deliveries of 800,000 units, setting a record for the fastest delivery in the new energy segment. The AITO brand remains a major sales driver, delivering 45,000 units in June, with the 2025 AITO M9 contributing 14,000 units to cross the 200,000 mark cumulatively.

Li Auto has entered a bottleneck period in the range-extended market, facing short-term sales pressure and an urgent need for a shift towards pure electric vehicles. In June, Li Auto delivered 36,000 new cars, down 24% year-on-year and 11.2% month-on-month. The company plans to focus on its high-voltage pure electric product line in the second half of the year, with the family-oriented electric SUV, Li i8, set to launch in July and the Li i6 in September.

XPeng Motors also performed well in June, delivering 35,000 new cars, a year-on-year increase of 224%. The G6 model continues to sell well, delivering 8,700 units in June, while the XPeng X9 has made a strong showing in the pure electric MPV market.

Xiaomi launched its second model, the Xiaomi YU7, on June 26, with over 200,000 orders in just three minutes, hitting 240,000 within 18 hours. Despite some production capacity being allocated to YU7, the Xiaomi SU7 has still achieved over 25,000 sales.

NIO has also begun to reap benefits from its multi-brand strategy, with combined deliveries from NIO, Lantu, and Firefly brands reaching 25,000 units in June, a year-on-year increase of 17.5%. NIO's total deliveries for the first half of the year reached 114,000 units, up 30.6% year-on-year.

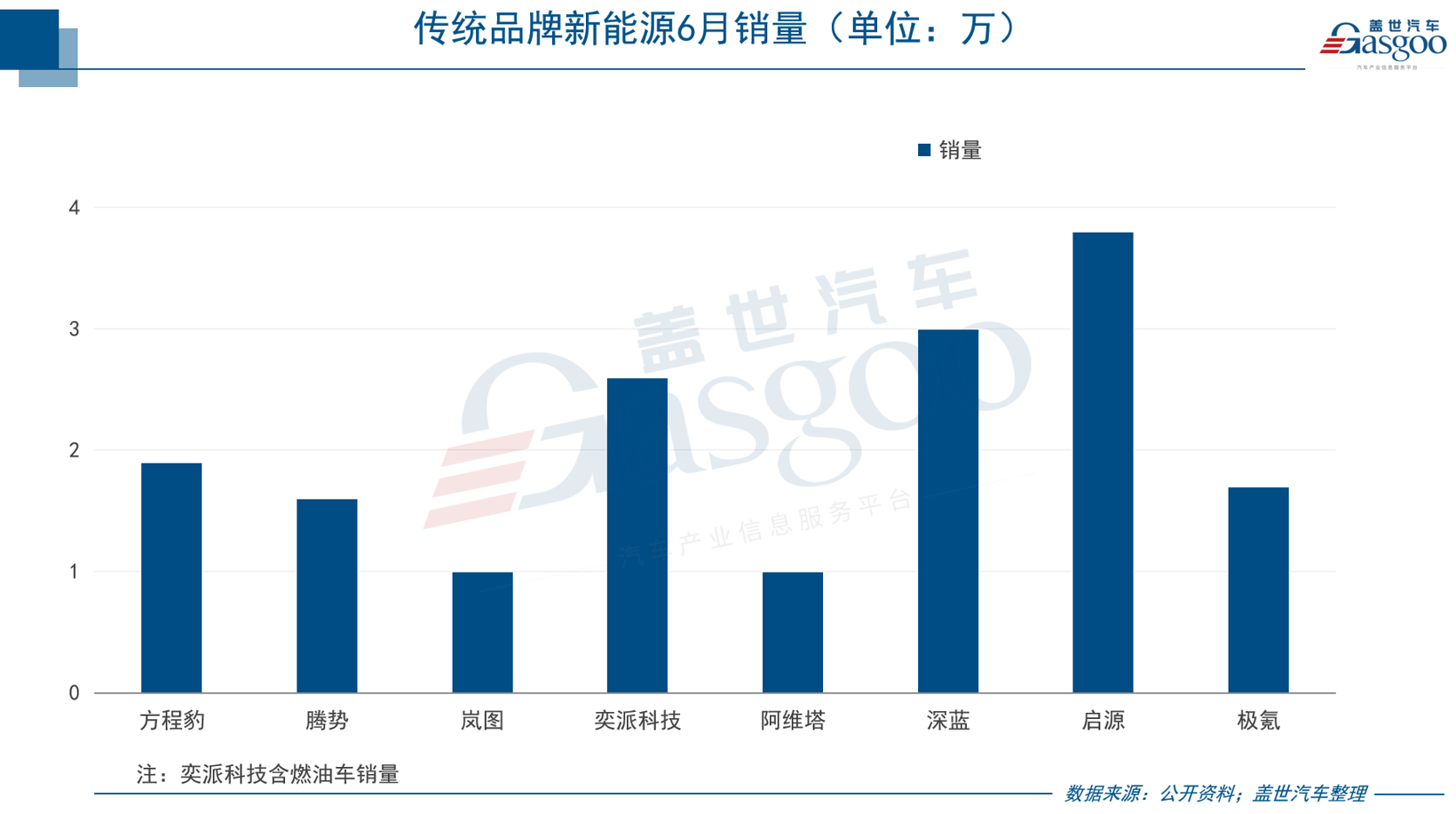

The competitive landscape is evolving, with brands like Farizon, Lantu, and Avita making significant strides. Farizon delivered 19,000 units in June, marking a staggering year-on-year increase of 605.3%. Lantu and Avita have also solidified their positions with sales above 10,000 units each.

In conclusion, the competition in China's new energy vehicles has entered a deep water zone, where players are competing not just on product or technology but on a comprehensive strategy involving product planning, technological development, supply chain management, channel construction, cost control, and global operations. The ability to quickly address weaknesses while reinforcing strengths will be crucial for success in the next phase of competition.

June 2025: The Intense Competition in the New Energy Vehicle Market

Images

Share this post on: