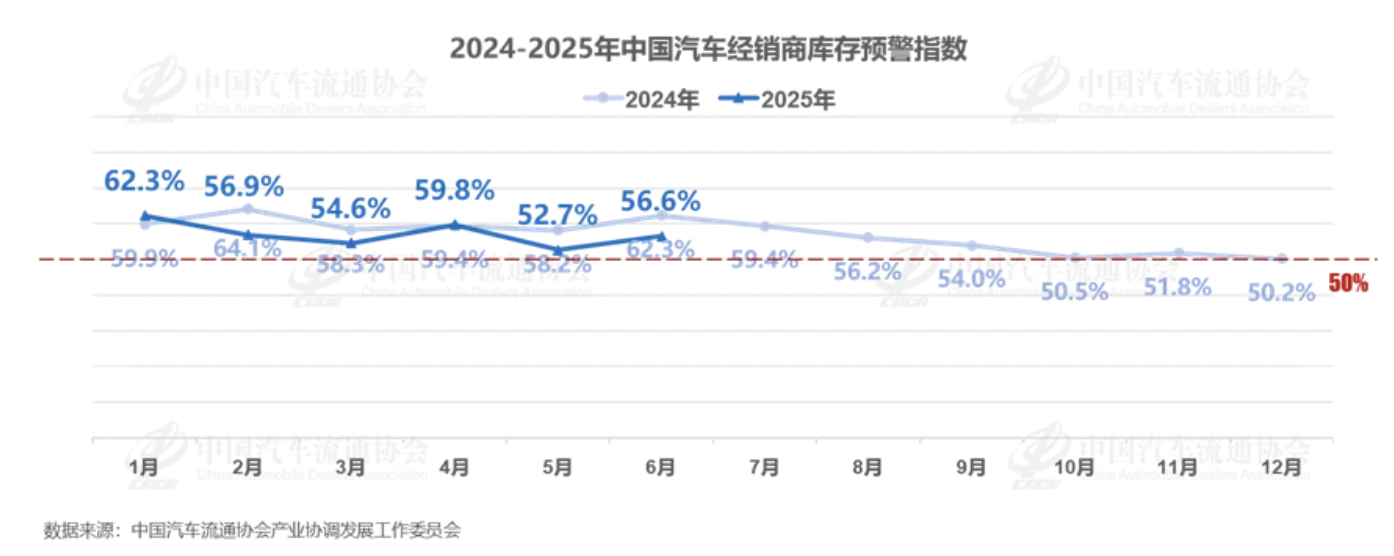

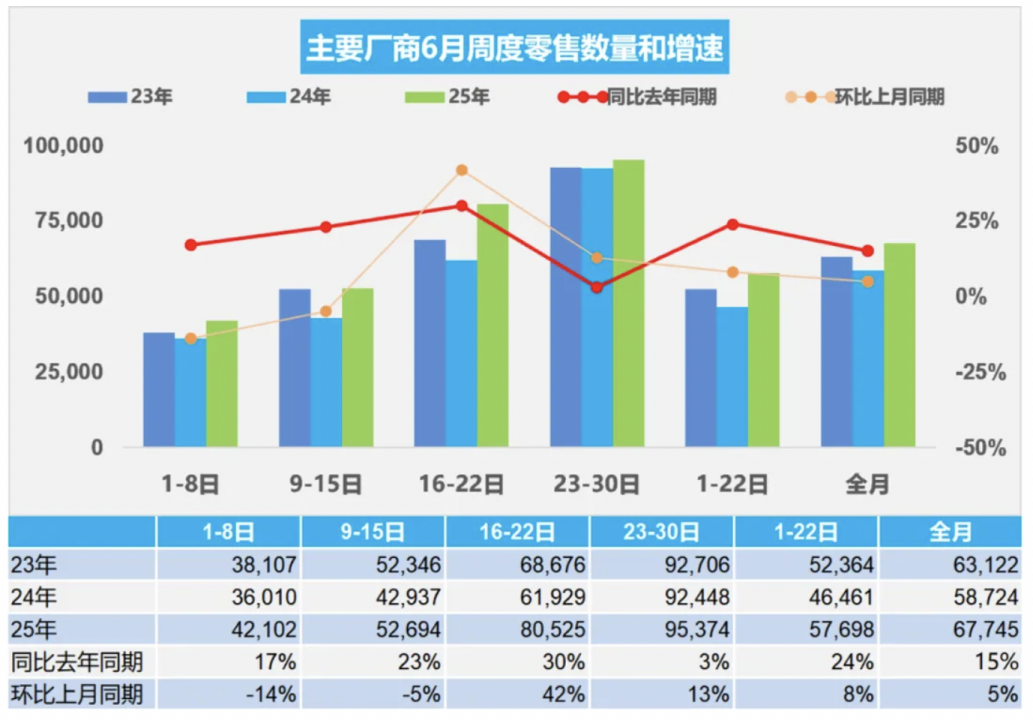

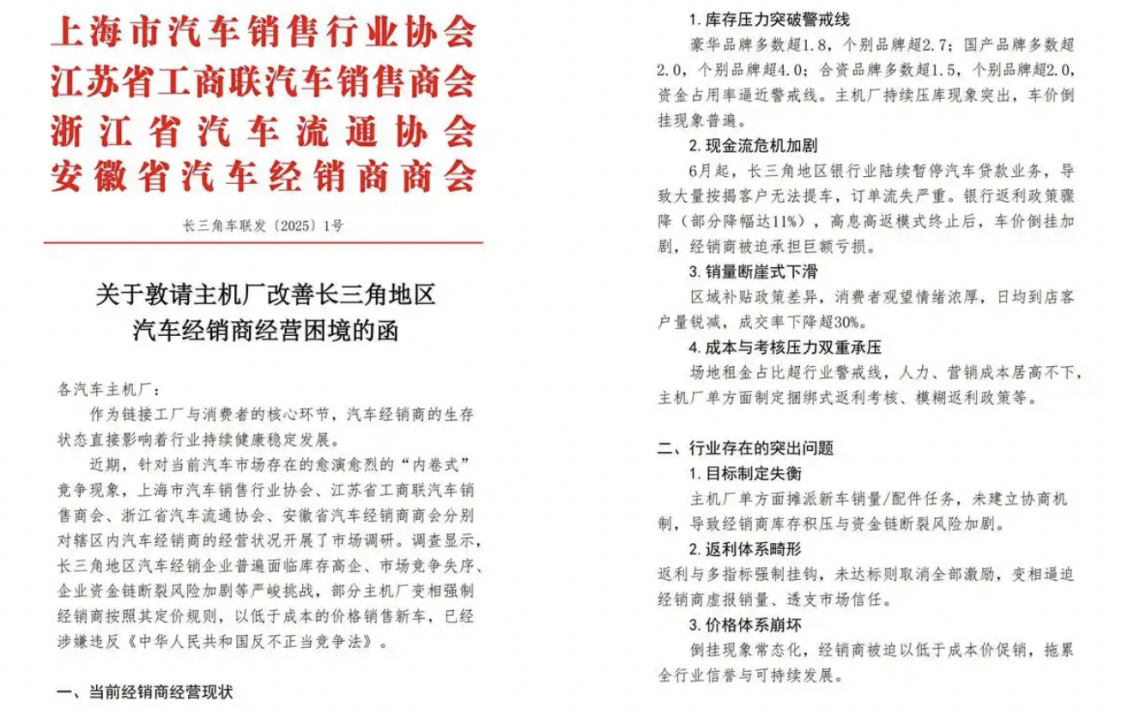

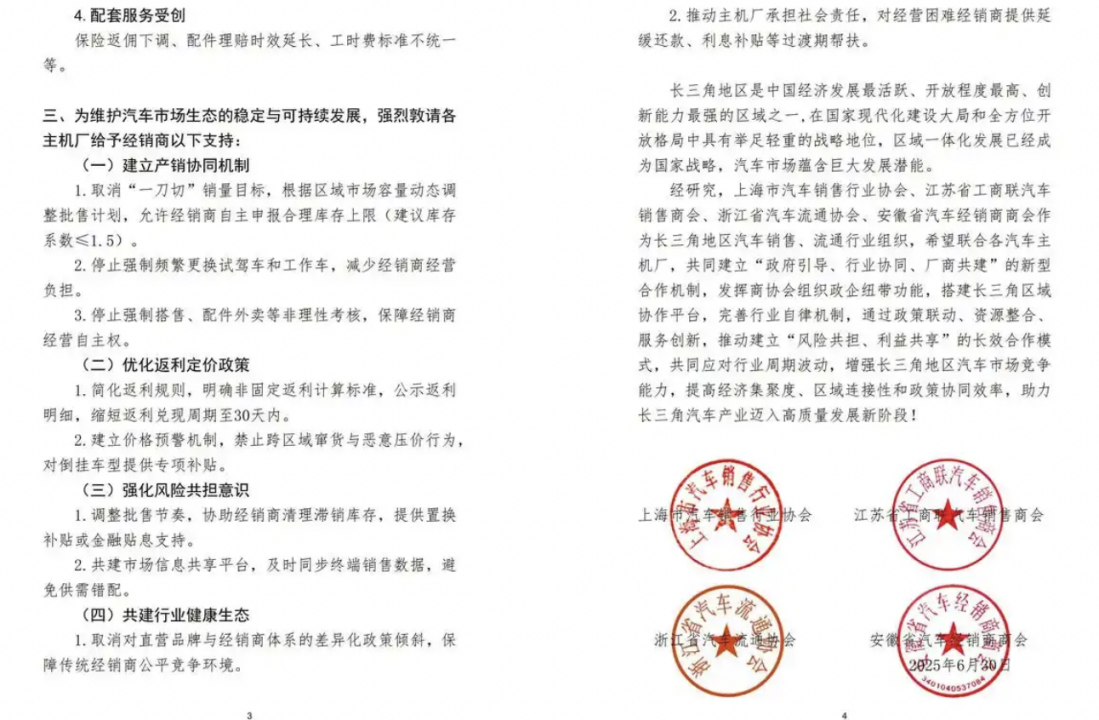

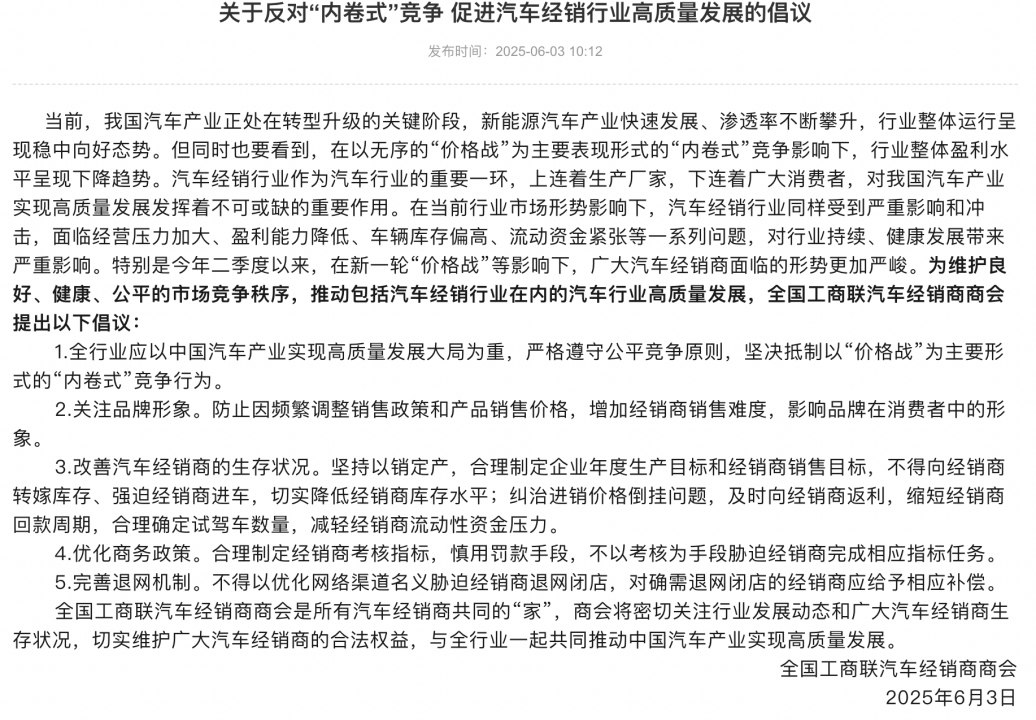

Recently, the China Automobile Dealers Association released the latest edition of the "China Automotive Dealer Inventory Warning Index Survey," indicating that in June 2025, the inventory warning index for automotive dealers in China stood at 56.6%, a year-on-year decrease of 5.7 percentage points, but a month-on-month increase of 3.9 percentage points. The index remains above the threshold, suggesting a decline in the automotive circulation industry’s prosperity. As sales in the automotive market continue to rise, the operational conditions for dealers are deteriorating. June, being a key assessment point for the year, saw manufacturers actively promoting sales to meet semi-annual targets, leveraging holidays and events such as the Dragon Boat Festival and the "6.18" shopping festival. Additionally, with some regions experiencing temporary tightness in subsidy funds, dealers intensified their promotional efforts to seize opportunities from trade-in policies, coupled with increased demand for summer road trip purchases, collectively boosting automotive sales in June. According to the China Passenger Car Association, from June 1-30, national retail sales of passenger cars reached 2.032 million units, up 15% year-on-year and 5% month-on-month; the cumulative retail sales for the year to date reached 10.849 million units, marking a 10% increase year-on-year. Among these, the retail sales of new energy vehicles in June reached 1.071 million units, up 25% year-on-year and 4% month-on-month, with a cumulative total of 5.429 million units for the year so far, up 32% year-on-year. Despite the overall solid performance in automotive sales in June and the first half of the year, dealer operational conditions remain concerning. The survey indicates that only 27.5% of 4S stores met or exceeded their sales targets in the first half of the year, while the remaining 72.5% fell short. Among these, 16.3% were close to completion (in the 90%-100% range), highlighting that most dealers faced significant sales pressure in the first half of the year, leading to a notable increase in inventory risk. The China Automobile Dealers Association predicts that due to demand exhaustion, adverse weather in some regions, and the traditional off-peak consumption season, automotive market demand in July is expected to decrease month-on-month. However, manufacturers continue to increase wholesale volumes, which will exacerbate inventory pressure on dealers. In response to these challenges, industry organizations and associations have begun to voice their concerns, urging the industry, especially auto manufacturers, to address these issues. On June 30, the Shanghai Automotive Sales Industry Association, Jiangsu Provincial Federation of Industry and Commerce Automotive Sales Chamber, Zhejiang Provincial Automobile Circulation Association, and Anhui Provincial Automotive Dealers Association jointly issued a letter requesting manufacturers to improve the operational difficulties faced by automotive dealers in the Yangtze River Delta region. The letter pointed out that an investigation into dealer operations showed that automotive dealers in the region are generally facing severe challenges such as high inventory levels, chaotic market competition, and increasing risks of financial chain breaks. Many of these issues are linked to imbalances in manufacturer target setting, a distorted rebate system, and a collapsed pricing system. To maintain the stability and sustainable development of the automotive market ecosystem, the manufacturers are urged to support in four ways: establish a production-sales coordination mechanism, eliminate one-size-fits-all sales target setting; optimize rebate and pricing policies; adjust wholesale rhythms to assist dealers in managing stagnant inventory; and abolish differential policy support between direct sales and dealers. Recently (on June 3), the National Federation of Industry and Commerce Automotive Dealers Chamber also issued a proposal opposing "involutionary" competition and promoting high-quality development in the automotive dealership industry, calling for strict adherence to fair competition principles to improve the survival conditions of automotive dealers. The frequent statements from industry organizations further reflect the crisis and anxiety among dealers. Historically, manufacturers and dealers have depended on each other, but under increasing competitive pressure in the industry, their relationship has gradually become imbalanced. It is hoped that through heightened industry attention and standardization, the automotive circulation environment will improve. Given the current situation, the China Automobile Dealers Association advises dealers to rationally estimate actual market demand based on real conditions. They should also enhance promotion of trade-in and scrapping policies, strengthen service to boost consumer confidence, and prioritize cost reduction and efficiency enhancement to mitigate operational risks.

China's Automotive Dealer Inventory Warning Index Shows Mixed Signals for June 2025

Images

Share this post on: