The United States' indiscriminate imposition of tariffs is profoundly affecting the global trade landscape, presenting severe challenges to the overseas strategies of Chinese automotive companies. This article delves into the evolving logic behind U.S. tariff policies, their specific impacts on Chinese firms, and explores effective response strategies, becoming a focal point of current industry attention. It covers an overview of the U.S. tariffs, their impact on Chinese companies going abroad, corporate response strategies, and the opportunities and challenges faced by Chinese automotive enterprises.

**1. Overview of U.S. Indiscriminate Tariff Increases**

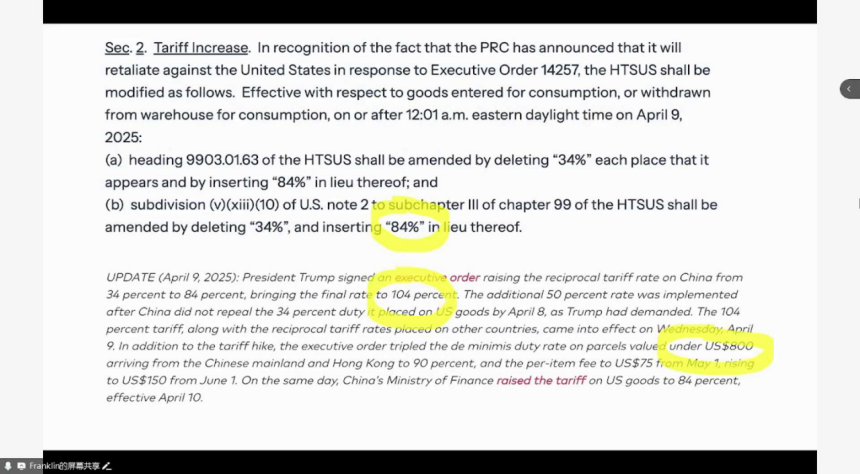

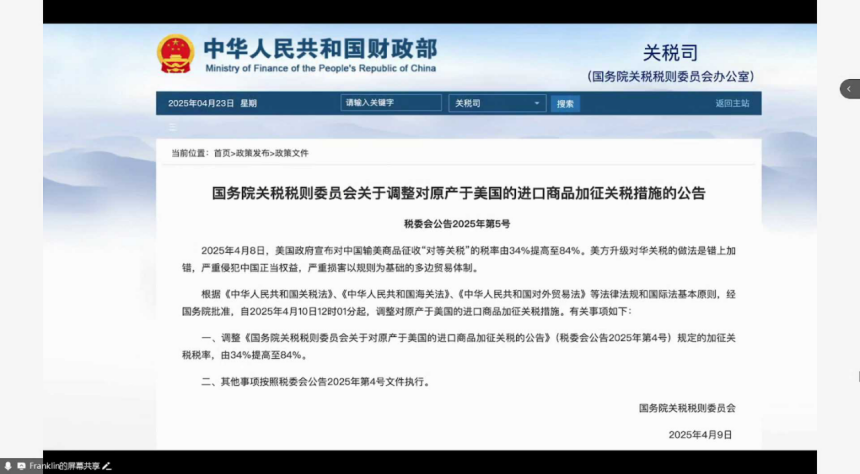

(1) **Evolution of Tariff Policies**: The U.S. has progressively escalated its indiscriminate tariffs on imported goods, with a broad impact range. Initially, a 34% tariff was imposed on Chinese goods, which later increased to 84%, 104%, and finally 145%. This rapid rise in tariffs has severely impacted exporting companies. The complex calculation of this tax rate includes a 20% basic tariff (Most-Favored-Nation tariff) plus a 125% additional tariff. The U.S. tariff adjustments primarily target low-value imports, explicitly aimed at manufacturing export powerhouses like China. In April 2025, the U.S. government issued an executive order removing the tariff exemption for small packages under $800, directly affecting cross-border e-commerce businesses like Shein and Temu, further broadening the tariff impact.

(2) **Tariff Calculations for Chinese New Energy Vehicles Exported to the U.S.**: For Chinese new energy vehicle manufacturers, the tariffs required for exporting to the U.S. are a critical issue. As of April 2025, the calculated tax rate is a 20% base tariff plus a 102.5% special tariff (increased from 25% to 100%), significantly squeezing profit margins and reducing the competitiveness of Chinese new energy vehicles in the U.S. market. Although there have been signals from the U.S. government suggesting a possible easing of tariffs, the likelihood of substantial reductions in the near term remains low. Thus, Chinese new energy vehicle manufacturers must prepare for prolonged high-tariff conditions.

**2. Impacts of U.S. Tariffs on Chinese Overseas Enterprises**

(1) **Increased Direct Costs and Profit Pressure**: The continuous rise in tariff rates has led to a significant increase in export costs for companies. For instance, the 102.5% comprehensive tariff raises the selling price of products in the U.S. If companies absorb these tariffs, their profit margins will be severely restricted; passing them onto U.S. consumers or dealers could undermine market competitiveness. This cost pressure extends not only to complete vehicle exports but also to parts and core components, impacting overall profitability.

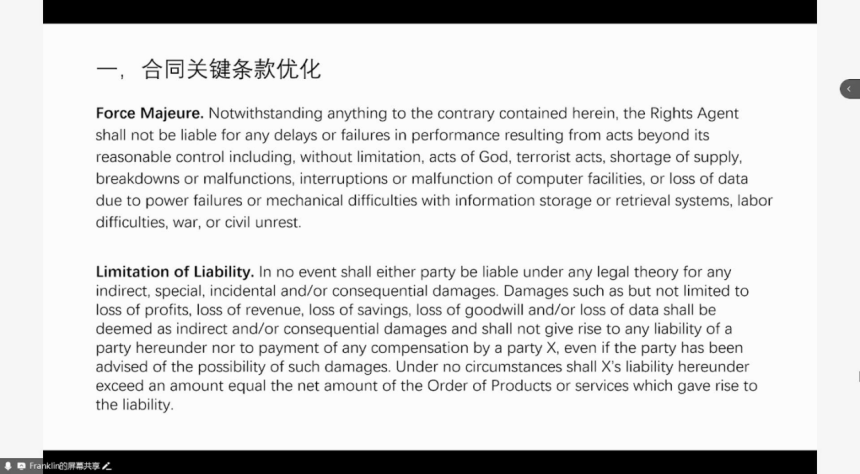

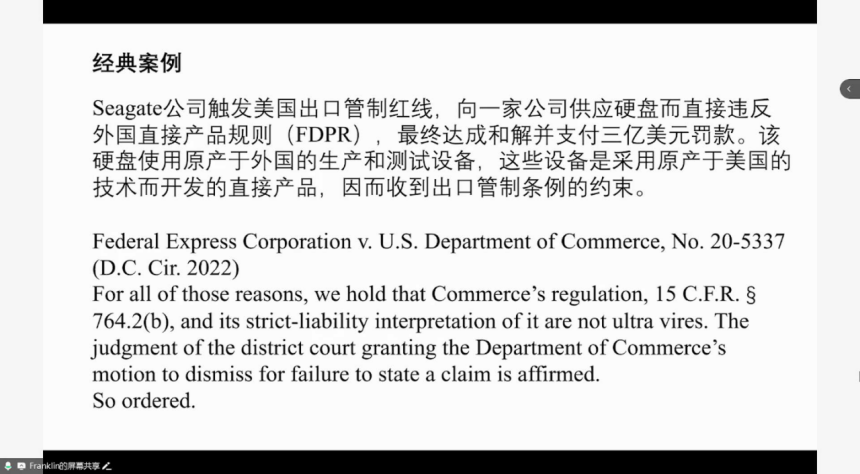

(2) **Policy Uncertainty Inducing Operational Risks**: Frequent adjustments in U.S. tariff policies create significant operational uncertainty for businesses. Companies struggle to formulate long-term export plans, as key decisions like shipment and pricing are influenced by policy fluctuations. Additionally, the rigid nature of tariff policies exacerbates long-term operational risks. Historical experience shows that once high tariffs are implemented, they are often difficult to revert due to lobbying by interest groups, potentially forcing companies into irreversible strategic adjustments, such as relocating production overseas.

(3) **Case Study Analysis**: A Shenzhen endoscope company invested 40 million yuan to acquire all qualifications, including FBA, to enter the U.S. market, but faced a standstill due to the tariff increases. Moving production to the U.S. would incur high labor and compliance costs, while maintaining the status quo risks market loss. Such cases highlight the severe constraints that policy uncertainty places on corporate decision-making, particularly in industries reliant on specific markets.

**3. Response Strategies for Chinese Overseas Enterprises**

(1) **National-Level Responses**: Utilize the WTO dispute resolution mechanism to appeal against U.S. tariff policies violating multilateral rules. Although U.S. compliance with the WTO system has declined, this approach can garner international support and exert pressure on the U.S. regarding its tariff policies. China can also implement reciprocal countermeasures by adjusting tariffs on U.S. imports in response to U.S. tariff increases.

(2) **Corporate-Level Responses**: Companies should strengthen risk identification and compliance management, adapt to new cross-border e-commerce regulations, and prepare to address legal risks effectively.

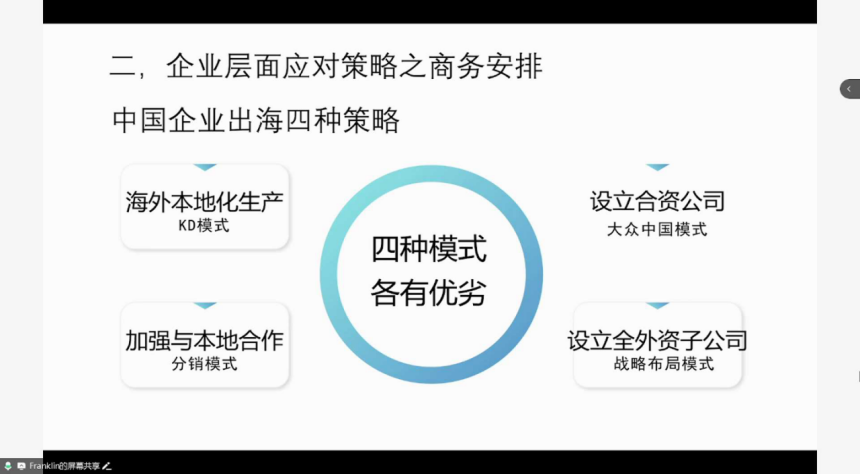

(3) **Optimizing Business Arrangements**: Companies can adopt localized overseas production strategies, collaborate with local distributors, establish joint ventures, and enhance legal arrangements to manage risks more effectively.

**4. Opportunities and Challenges for Chinese Automotive Companies**

(1) **Strategic Choices**: Explore diversified development paths, such as global tax planning and cooperation along the Belt and Road Initiative. Companies can establish production capacities in countries with lower tariffs and stable policies, enhancing their market share.

(2) **Responding to EU Anti-Subsidy and Anti-Dumping Measures**: Understanding the legal logic behind these measures and ensuring compliance with tariff calculation methods will be crucial for maintaining competitiveness in the EU market.

(3) **Monitoring Export Control Impacts**: Companies must stay alert about U.S. export control policies affecting high-tech automotive components, ensuring compliance to avoid penalties.

The indiscriminate imposition of U.S. tariffs presents both severe challenges and opportunities for Chinese automotive companies. In the short term, businesses must enhance compliance management, optimize supply chains, and actively respond to policy changes to alleviate cost pressures. In the long run, focusing on technological innovation and leveraging global strategies and the Belt and Road Initiative will be essential for market diversification. Despite the current significant tariff pressures, the competitiveness of the Chinese automotive industry is internationally recognized, and with strategic adjustments, companies can find viable paths for sustainable development in the global market.

The Impact of U.S. Tariffs on Chinese Automotive Companies' Overseas Strategies

Images

Share this post on: