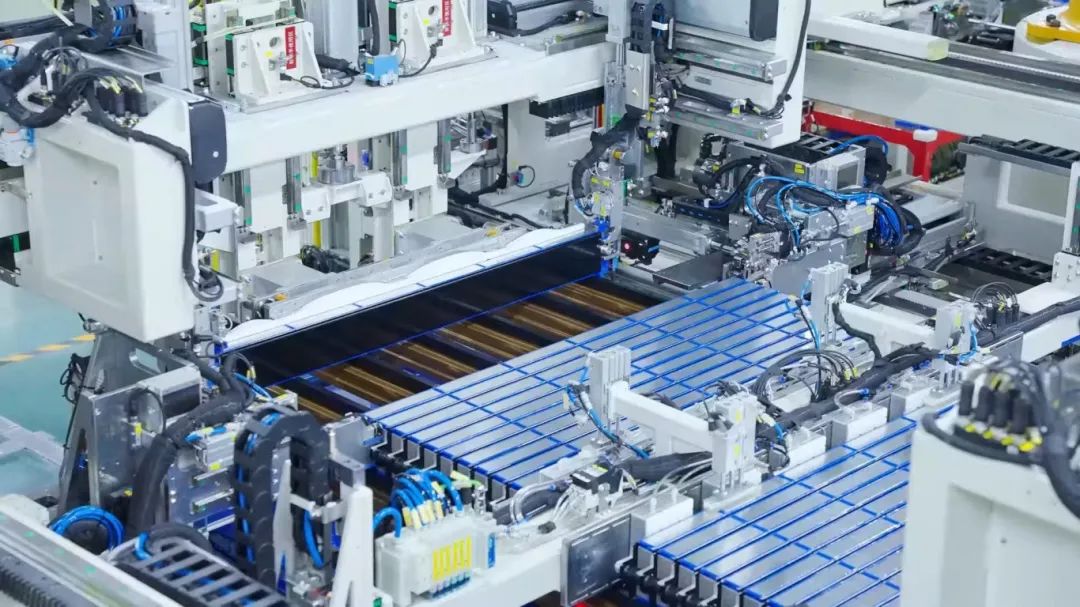

Geely has taken the lead in the industry by raising its annual sales target from 2.71 million to 3 million units, reflecting an 11% increase. The adjustment is primarily supported by a significant breakthrough in the new energy vehicle sector. In the first half of the year, the cumulative sales of new energy vehicles, including Geely's Galaxy, Lynk & Co, and Zeekr, reached 725,100 units, representing a year-on-year increase of 126%. This explosive growth in new energy vehicles contributed to more than half of Geely's total sales of 1.409 million units in the first half of the year. While Geely has reaped the rewards of this rapid transition to new energy, it has also faced increased pressure on its supply chain. For instance, the recently launched new models have created a significant demand for power batteries, leading to a tense supply situation. According to a new batch of announcements from the Ministry of Industry and Information Technology, Geely's upcoming new energy models, including the Galaxy A7, Galaxy M9, and Lynk & Co 10 EM-P, will source battery cells from major suppliers such as CATL and the joint venture battery company between Changan Automobile and CATL. This reliance on external battery suppliers indicates that Geely's rapid growth in new energy development has outpaced its internal battery production capabilities. Despite announcing in April the integration of its battery supply chain and the establishment of the battery industry group, Jiayao Tongxing, Geely still faces challenges in meeting battery supply needs. The company aims to achieve a battery supply capacity of 70 GWh by 2027, which would adequately support the production of 1.5 million new energy vehicles annually. However, questions arise regarding Geely's battery supply challenges given this ambitious target. As Geely ventures deeper into the new energy sector, it recognizes that battery costs account for 30-50% of the total vehicle cost, making effective management of battery supply crucial. The balance of accurately forecasting new vehicle sales and maintaining supply chain flexibility is essential. Previous experiences of joint ventures have highlighted the risks associated with misjudging battery demand, leading to wasted investments or supply shortages. Geely has encountered such situations with the Galaxy E5 and Galaxy Star Wish models, where rapid sales growth revealed supply chain constraints. Fortunately, Geely's strong supply chain capabilities have enabled it to adapt and address these challenges effectively. In 2024, Geely's two major battery companies expect to achieve significant production volumes, positioning themselves among the top domestic suppliers. Geely's approach to battery supply emphasizes diversification, working with multiple suppliers, including CATL, Honeycomb Energy, and others, ensuring sufficient battery supply for its expanding new energy vehicle lineup. While Geely has made strides in battery self-sufficiency, its strategy remains focused on collaboration with external suppliers to maintain flexibility and competitiveness in a rapidly evolving market.

Geely Raises Annual Sales Target to 3 Million Units Amid Strong Growth in New Energy Vehicles

Share this post on: