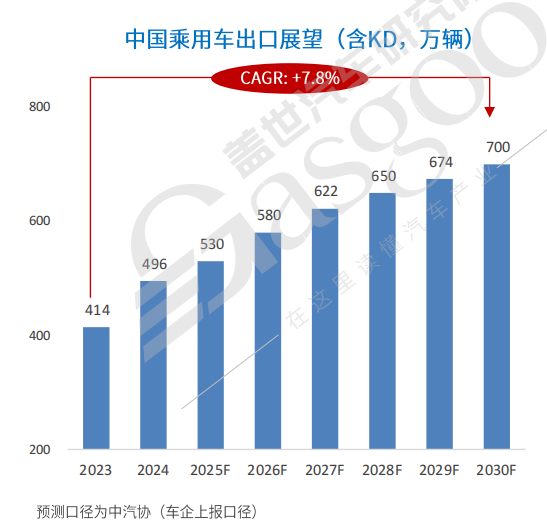

In 2024, China's passenger car exports reached a remarkable scale of 4.96 million units, marking a year-on-year increase of 21.4%. This achievement highlights the rapid expansion of market coverage, as two-thirds of the global automotive market has opened its doors to Chinese brands. With this accumulation of quantity leading to transformative changes, the market share of Chinese automotive brands has climbed to 22%. Notably, BYD and Geely have entered the ranks of the top ten global automakers. These developments are not isolated incidents but evidence of the shift in the global coordinates of the Chinese automotive industry, indicating a deep evolution in the competitive landscape of the global automotive market.

Since the beginning of this year, the momentum for Chinese automotive exports has continued. According to data from the China Passenger Car Association, from January to May 2025, China exported 1.988 million vehicles, a year-on-year increase of 7.4%. The Chinese automotive industry has aggressively transitioned from a domestic market focus to global competition, reflected not only in sales growth but also in innovative models and deeper global layouts.

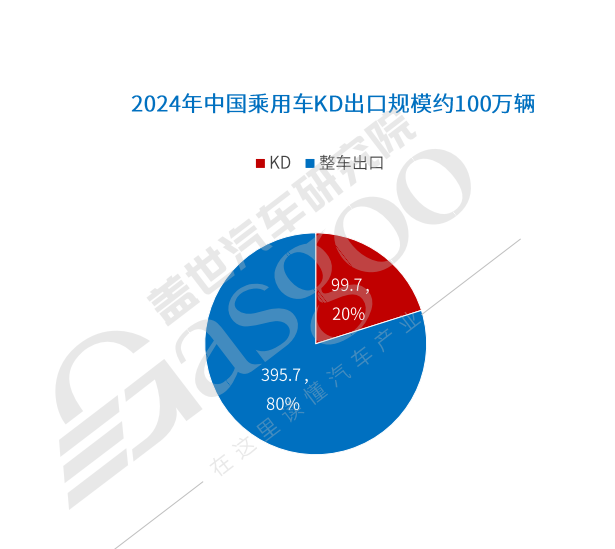

In response to increasingly stringent localization regulations in various countries, the overseas KD (knock-down) assembly model has become a key strategy for Chinese automakers to break through, effectively circumventing high tariffs on complete vehicles and local production barriers. Data compiled by the GaiShi Automotive Research Institute indicates that in 2024, the KD export scale of Chinese passenger cars is estimated to be about 1 million units, accounting for approximately 20% of overall exports.

The contributions of new energy technology and supply chains are also significant in achieving such accomplishments in overseas markets. In 2024, China accounted for 80% of the global new energy vehicle market. In the first quarter of this year, the export proportion of new energy passenger cars increased from 31.4% last year to 38.4%. Looking at the export structure, the growth rate of pure electric vehicles (BEVs) has slowed due to trade barriers in certain regions, while plug-in hybrids (PHEVs) and extended-range models are experiencing growth trends due to lower user conversion thresholds and relatively fewer policy restrictions, gradually becoming new engines for export growth.

Chinese automakers demonstrate varied development trends in the globalization race. Chery, a perennial leader in Chinese automotive exports, exported 1.145 million units in 2024, marking the 22nd consecutive year it has been the top exporter of Chinese passenger cars. In the first five months of this year, Chery exported 444,000 units, maintaining its leading position. Meanwhile, BYD is experiencing astonishing growth, with overseas sales exceeding 470,000 units in the first half of 2025, surpassing its total overseas sales for 2024 by over 50,000 units, a year-on-year increase of 80.6%. BYD's dual approach of focusing on both pure electric and plug-in hybrid vehicles has led to explosive growth in key emerging markets, such as Brazil, where it achieved a market share of 9.7% in May 2025, ranking fourth in total retail sales.

SAIC has leveraged its mature "global + local" combination strategy to achieve overseas sales of 494,000 units in the first half of this year, a year-on-year increase of 1.3%, with total overseas sales exceeding 6 million units. Despite challenges from EU anti-subsidy taxes, its main brand MG continues to show resilience in the European market, with total deliveries exceeding 150,000 units in the first half of 2025, achieving double-digit growth.

Geely is also accelerating its globalization efforts and showing systematic progress, with overseas sales exceeding 180,000 units in the first half of this year, including over 40,000 units in June, a 12% year-on-year increase. By 2024, Geely's global service network will cover over 80 countries with more than 900 outlets, having launched its high-end models in key markets like Saudi Arabia and Kazakhstan.

New energy vehicle manufacturers are also joining global competition with greater flexibility. According to official data from Leap Motor, its cumulative exports from January to May 2025 exceeded 17,200 units, ranking first among new energy brands in China. In April last year, Leap Motor and global automotive manufacturer Stellantis established a joint venture, Leap Motor International, which has significantly aided Leap Motor in launching in nine European countries and rapidly expanding into Asia-Pacific, the Middle East, Africa, and South America.

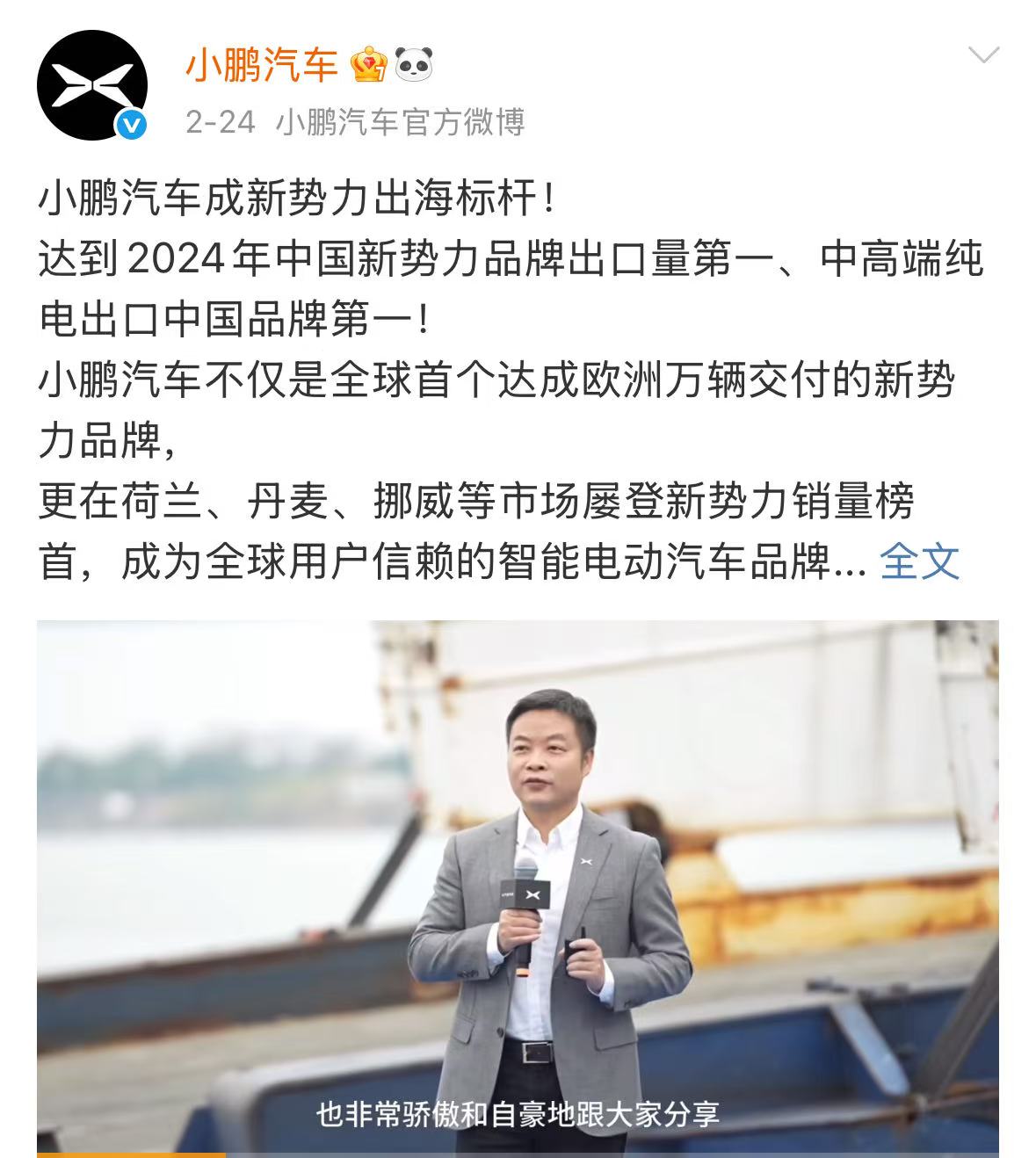

Xpeng Motors reported overseas sales of 18,700 units in the first half of 2025, a year-on-year increase of 217%, achieving the highest sales among new energy brands in countries like Ireland and the Netherlands. Xpeng views 2025 as a year of accelerated internationalization, planning to enter over 60 countries and establish more than 300 outlets, while also preparing to roll out its advanced driver-assistance technology overseas.

NIO is committed to maintaining its high-end positioning and plans to further expand into the European market between 2025-2026 by launching multiple models in countries like Portugal, Greece, and Denmark. Additionally, it has made inroads in the Middle East and North Africa.

As globalization deepens, Chinese automobile brands are evolving from simply selling cars to establishing overseas factories and joint ventures, as well as reverse technology transfers. This shift not only reduces tariffs and logistics costs but also allows them to directly address the real needs of overseas customers, seek new growth markets, and enhance brand promotion and after-sales service.

Chery has signed a cooperation agreement with Spain's EV MOTORS to establish its first joint venture factory in Europe, which began production in November last year. Chery plans to invest approximately 200 trillion Vietnamese dong in a new factory in Vietnam, expected to be completed by 2026. BYD is also expanding globally, with factories in Thailand and Indonesia slated for production by the end of this year, and a plant in Hungary expected to start operations this year.

In summary, the globalization journey of the Chinese automotive industry is akin to a long voyage, navigating through tariffs, technical barriers, and brand recognition challenges. As Chinese automakers continue to push forward, they must find ways to firmly root themselves in global markets and elevate their value amidst trade frictions, localization integration, cultural differences, and sustainable profitability challenges.

China's Passenger Car Exports Reach Record 4.96 Million Units in 2024

Images

Share this post on: