In recent years, China has become the core of global automotive growth, leveraging its advantages in new energy technology and supply chains. By 2024, China is projected to hold 80% of the global market share for new energy vehicles (NEVs) and achieve the highest export volume in the world. Domestic automakers like BYD and Geely have entered the global top ten in sales, continuously reshaping the competitive landscape of the industry. According to Zhou Xiaoqing, CEO of Gaishi Automotive, the Chinese passenger car market has matured since entering a golden development period over the past two decades. This maturity has spurred new industry models and numerous tech enterprises. Currently, the automotive market is witnessing a trend of 'reverse joint ventures' and self-empowerment through technology, where Chinese companies are transitioning from technology importers to exporters.

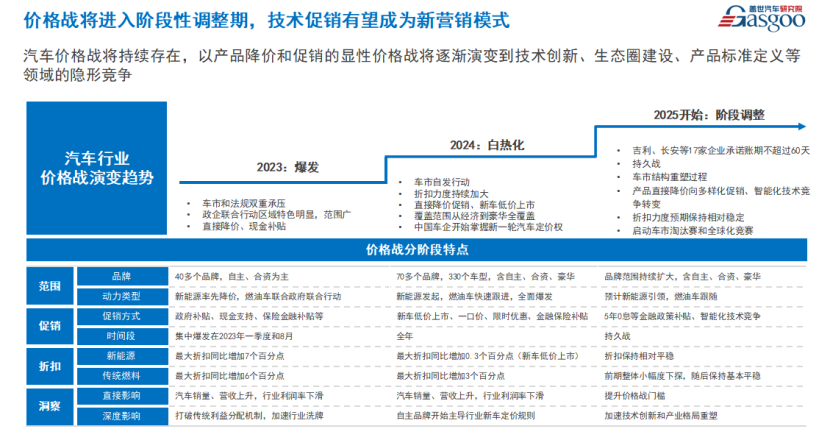

The ongoing price war in the automotive sector is evolving from overt competition focused on product discounting to more subtle forms of competition such as technological innovation and ecosystem building. The future of China's passenger car market still holds significant growth potential. As a dedicated service platform within the automotive industry, Gaishi Automotive aims to focus on constructing and improving the safety protection systems for intelligent connected vehicles, addressing challenges in cybersecurity and data privacy.

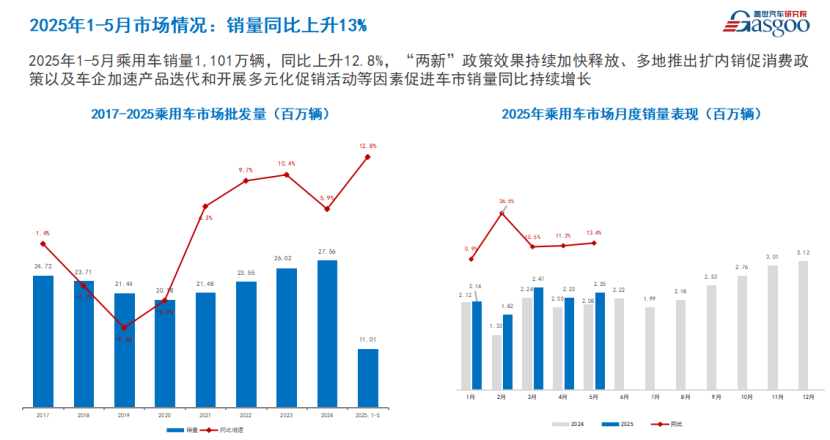

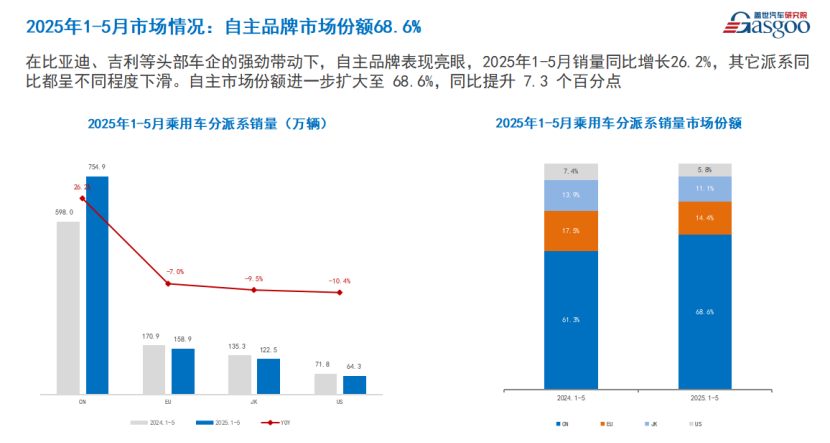

From January to May 2025, China’s passenger car sales reached 11.01 million units, a year-on-year increase of 12.8%, but structural differentiation continues to deepen. Private automakers are rising rapidly through aggressive technological innovation: BYD has become the world’s sixth largest pure NEV company, with overseas sales of 357,000 units from January to May, representing a significant growth rate and a 96% capacity utilization leading the industry. Geely's Galaxy series is also gaining traction, with annual sales forecasts being raised from 2.71 million to 2.84 million vehicles. New forces in the market are rewriting the high-end segment landscape, with brands like Li Auto, Aito, and Zeekr entering the top five in sales of models priced above 250,000 yuan.

Major state-owned enterprises face dual challenges, as their penetration in new energy remains below 15%, while also bearing the social responsibility of maintaining employment. Joint ventures are generally failing, with Japanese brands like GAC Honda and Dongfeng Nissan experiencing declines of 27% and 12% respectively, while GM's sales are expected to plummet by 57% in 2024, with a projected recovery of only 10% in 2025. This differentiation is reflected in capacity distribution, with 31 companies producing fewer than 5,000 vehicles monthly in 2024.

China's automotive industry faces serious capacity mismatches, with planned capacities reaching 54 million vehicles in 2024, while the domestic market is only 31.44 million (including exports), leading to a mere 51.1% actual capacity utilization rate. The supply-demand imbalance has intensified market competition, with over 180 new models expected to launch in 2024, equating to a new model every two days. The price war is evolving through three distinct phases: in 2023, government subsidies and cash discounts dominated, covering over 40 brands; in 2024, competitive pricing strategies have emerged, particularly in the large SUV segment; by 2025, a shift to technology-driven promotions is expected, with mainstream automakers adopting strategies such as 'adding features without raising prices'.

The industry is forming a self-healing mechanism as 17 leading automakers commit to keeping supply chain payment terms within 60 days, moving from a 'cost-only' focus to value creation, and avoiding the industry trap of emphasizing safety in words while neglecting it in practice.

China's automotive industry is transitioning from being a technology importer to an exporter, with joint ventures now entering a new phase of 'reverse empowerment'. In the area of technology licensing, Volkswagen and XPeng have signed a joint development agreement for electronic and electrical architecture, investing $700 million to co-develop EE architecture. Furthermore, Stellantis and Leap Motor have formed a joint venture to leverage the former's global channels for overseas expansion. The core logic of this 'reverse joint venture' is resource complementarity—foreign companies provide global channels and compliance systems, while Chinese companies export their battery and intelligent connectivity technologies.

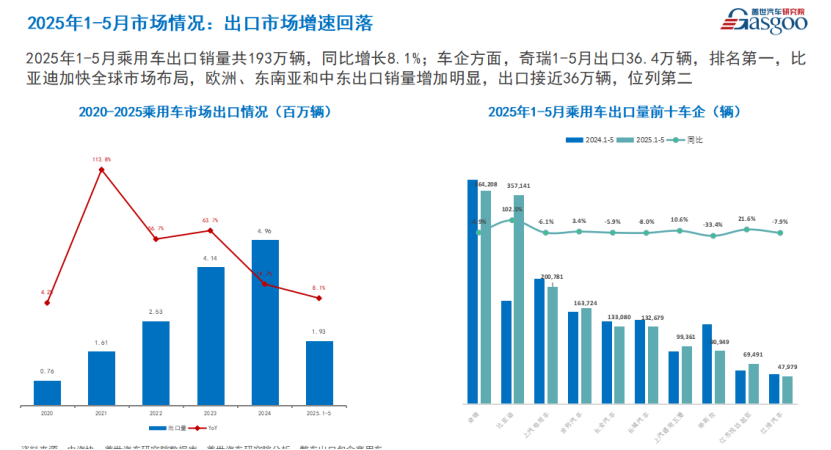

The export market is undergoing structural changes, with passenger car exports reaching 1.93 million units from January to May 2025, reflecting an 8.1% year-on-year increase, albeit with a noticeable slowdown in growth. Regional markets are shifting significantly, with the Russian market suffering from quality issues due to insufficient product verification, while Mexico has seen a temporary spike due to tariff advantages, and the UAE and other Middle Eastern regions are emerging as new growth points. This underscores the necessity for a localization strategy, as the purely trade-based export model has hit a ceiling.

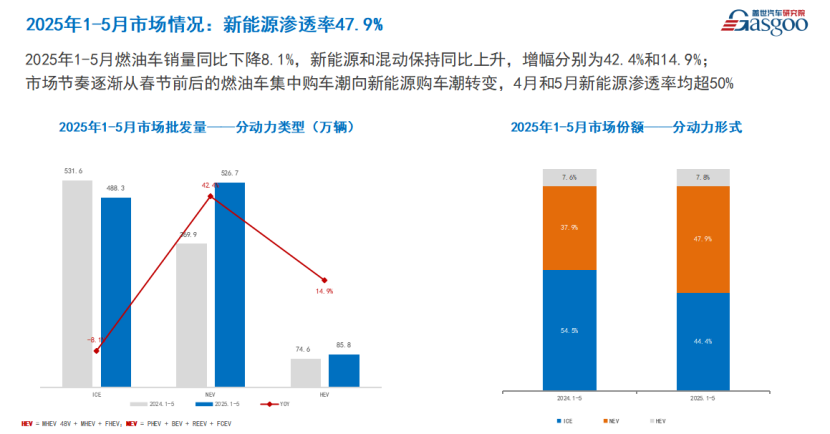

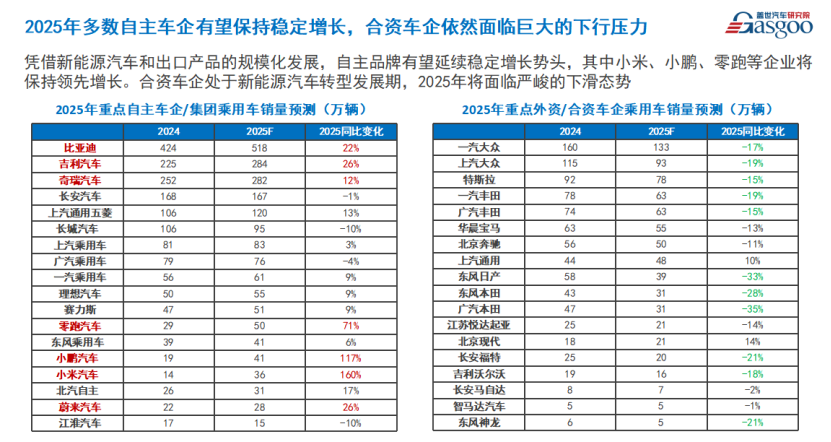

As the Chinese automotive market progresses, two certain trends are emerging: the penetration rate of new energy continues to break through, with both April and May 2025 seeing monthly penetration rates exceed 50%, while the share of domestic brands accelerates to 68.6%, a year-on-year increase of 7.3 percentage points. Predictions from Gaishi Automotive Research Institute suggest that by 2030, both the new energy penetration rate and the share of domestic brands will surpass the 80% milestone. Leading companies are showing strong growth momentum, with BYD expected to sell 5.18 million vehicles in 2025 (up 22%), including over 150,000 units of overseas capacity; Geely's Galaxy series is projected to boost sales to 2.84 million units (up 26%). In the new forces segment, Leap Motor and Xiaomi are expected to see growth rates of 71% and 160%, respectively.

In contrast, the joint venture segment, apart from SAIC General Motors expecting a 10% growth due to pricing strategy adjustments, is generally facing double-digit declines, with FAW-Volkswagen anticipated to drop by 17% and GAC Toyota by 15%. This shift in market dynamics arises from the rapid transformation of Chinese companies in electrification and intelligence, while foreign enterprises are increasingly losing their R&D resources and headquarters advantages in the Chinese market.

As AI drives the wave of intelligentization, the security perimeter of the Internet of Vehicles is expanding. The introduction of new technologies brings new risks, including AI hallucinations and challenges in automated programming defense, necessitating the establishment of a comprehensive protection system covering 'cloud-network-end' to ensure safety and control throughout the R&D and operation phases. Compliance for overseas operations has become a new focus, with the need for compliance in cross-border data flow and building local production and service capabilities.

Lessons from the Russian market warn the industry that insufficient verification of Chinese vehicles in extremely cold environments can lead to quality and reputation declines, exacerbated by inadequate after-sales service capabilities. Gaishi Automotive's industry big data platform is providing decision-making support by analyzing global capacity layouts and compliance risk warning systems, helping companies balance technological innovation with compliance requirements. Particularly in an era defined by AI, the security of the Internet of Vehicles has extended beyond traditional information security to include data privacy and algorithm security.

As a global leader in automotive industry information services, Gaishi Automotive's core mission is to 'discover good companies, promote good technologies, and empower automotive professionals'. Building on its deep engagement in the automotive industry, Gaishi is actively expanding into intelligent and low-altitude economy sectors, given that over 65% of the supply chains in these two industries are shared with the automotive sector. Especially with the push of AI large models, the logic behind physical layer AI is inherently aligned with automotive advanced driving assist technologies—shifting from layered perception and decision-making to end-to-end intelligence, with this technological spillover set to reshape multiple industries.

The Chinese automotive industry is at a historical crossroads of a 'golden cycle' and 'deep adjustment'. Technological competition is leading the transformation of the price war, reconstructing value through democratized advanced driver assistance and high-end configuration availability. Globalization has entered its 2.0 stage, where technological feedback and localized operations become the core model. Compliance and safety are the cornerstones of overseas expansion, crucial to avoiding a repeat of the 'Russian-style dilemma'. In the next five years, being a leader in the Chinese market means being a leader globally, but this requires establishing a dual pillar of 'technological innovation' and 'safety compliance'. As the 14th Five-Year Plan progresses, predictions that by 2030, the penetration rate of new energy and the share of domestic brands will both exceed 80% reflect confidence in the industry. However, only by fulfilling the mission of 'discovering good companies, promoting good technologies, and empowering automotive professionals' can the industry make a historic leap from being first in scale to first in quality.

China's Automotive Industry: Shifts in Growth and Competition Amidst New Energy Trends

Images

Share this post on: