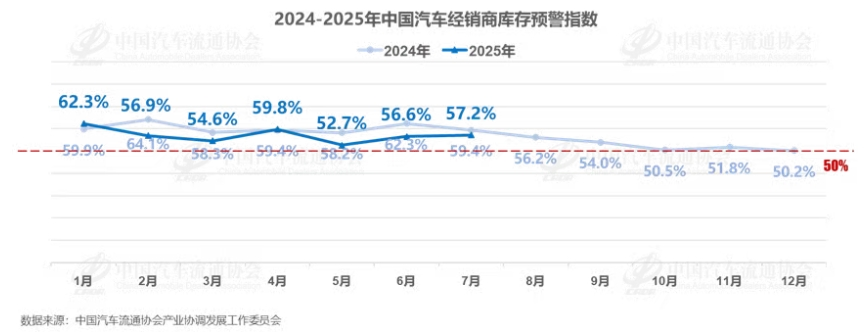

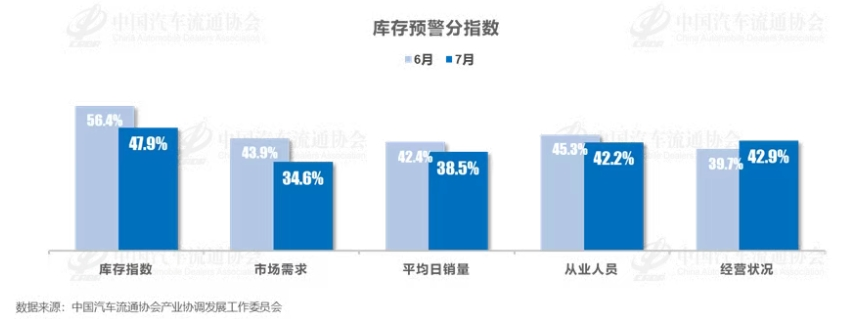

On July 31, the China Automobile Dealers Association released its latest "China Automotive Dealer Inventory Warning Index Survey," indicating that in July 2025, the inventory warning index for Chinese automotive dealers was 57.2%, a year-on-year decrease of 2.2 percentage points but an increase of 0.6 percentage points compared to the previous month, reflecting a slight decline in the automotive circulation industry's prosperity. July marks the traditional off-season for the automotive market, compounded by the mid-year push by manufacturers and dealers in June which consumed a significant amount of market demand. This explains the month-on-month decline in passenger vehicle sales and the rise in the inventory warning index. However, compared to the same period in 2024, the warning index has decreased, indicating that overall sales year-on-year in July still show growth, maintaining a degree of market heat.

As the traditional off-season sets in, July experienced a noticeable decline in sales. The extreme weather, along with phased reductions in subsidies in certain regions, lowered automotive consumption finance commissions, and tightened manufacturer promotions, have intensified consumers' wait-and-see attitudes. These factors have impacted sales for the month. Dealer feedback indicates that the market heat in July was not as strong as in June, with 47.7% of dealers perceiving an overall downward trend in the car market, with declines exceeding 5%.

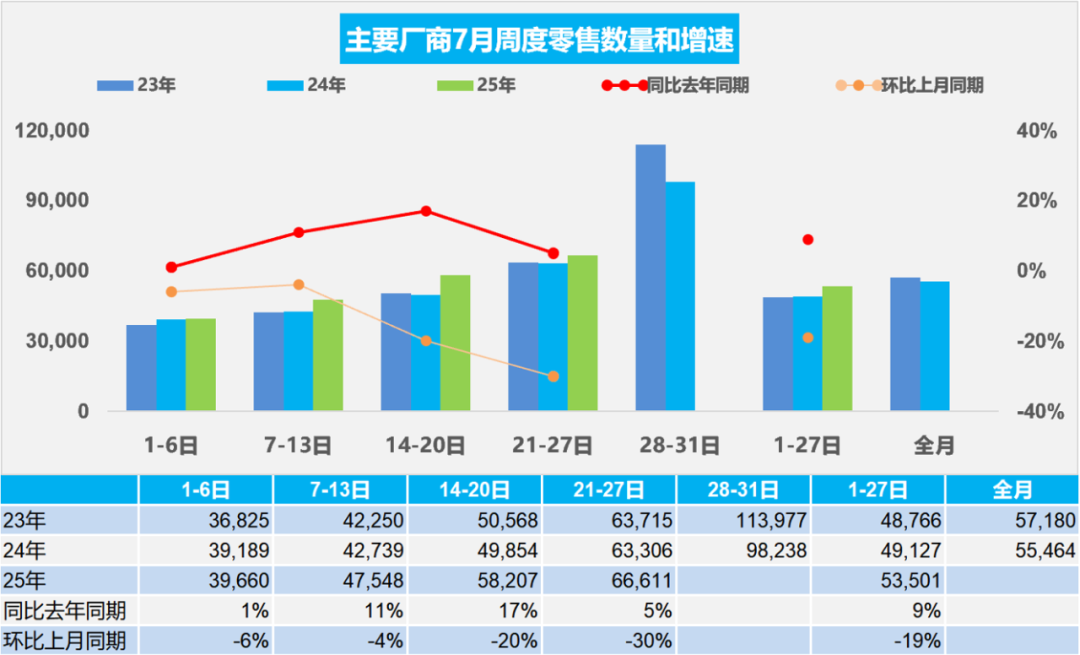

According to data from the Passenger Car Association, from July 1-27, national retail sales in the passenger car market reached 1.445 million units, a year-on-year increase of 9%, but a 19% decrease compared to the previous month; among these, new energy vehicle sales were 789,000 units, showing a year-on-year increase of 15%, but down 17% from the previous month. Thus, while the automotive market shows a significant month-on-month decline in July, the year-on-year performance is still relatively strong, particularly considering the higher sales base due to the vehicle trade-in policy launched in July 2024.

The China Automobile Dealers Association noted that July's passenger car sales slightly exceeded expectations, estimating a total of around 1.9 million units in terminal sales. The third batch of national subsidies amounting to 69 billion yuan was issued on July 26, further supporting local implementation of consumption replacement policies, with a fourth batch expected in October. National policy support will help sustain sales and alleviate some dealer pressures. However, dealers continue to face challenges: declining customer foot traffic, extended purchase decision cycles due to market conditions and policy adjustments, and slower inventory turnover leading to increased financial pressure.

The association advises dealers to rationally estimate actual market demand based on their circumstances and to enhance the promotion of trade-in and scrapping policies. As they prepare for August, despite the short-term suppression of consumer demand due to high temperatures and rainfall at the end of July, upcoming school season demands, promotional activities like the 818 shopping festival, and multiple auto shows in cities like Chengdu are expected to stimulate terminal sales, leading to a stable overall performance in the automotive market.

China's Automotive Dealer Inventory Warning Index Shows Mixed Signals for July

Images

Share this post on: