In the first half of 2025, China's passenger car market continued to see a trend of differentiation between fuel and electric vehicles, with new energy vehicles (NEVs) on a strong upward trajectory while fuel vehicles maintained a stable base. According to a report by the Gaishi Automotive Research Institute, leading brands in the NEV sector like BYD and Tesla dominated the sales charts, with new entrants such as Xiaomi also making impressive showings. Meanwhile, domestic brands like Geely, Changan, and Chery excelled in the fuel vehicle category, solidifying their market shares. Overall, competition among car manufacturers over technology routes, product positioning, and intelligent experiences is intensifying, and the dual-battle pattern of NEVs and fuel vehicles is expected to continue evolving.

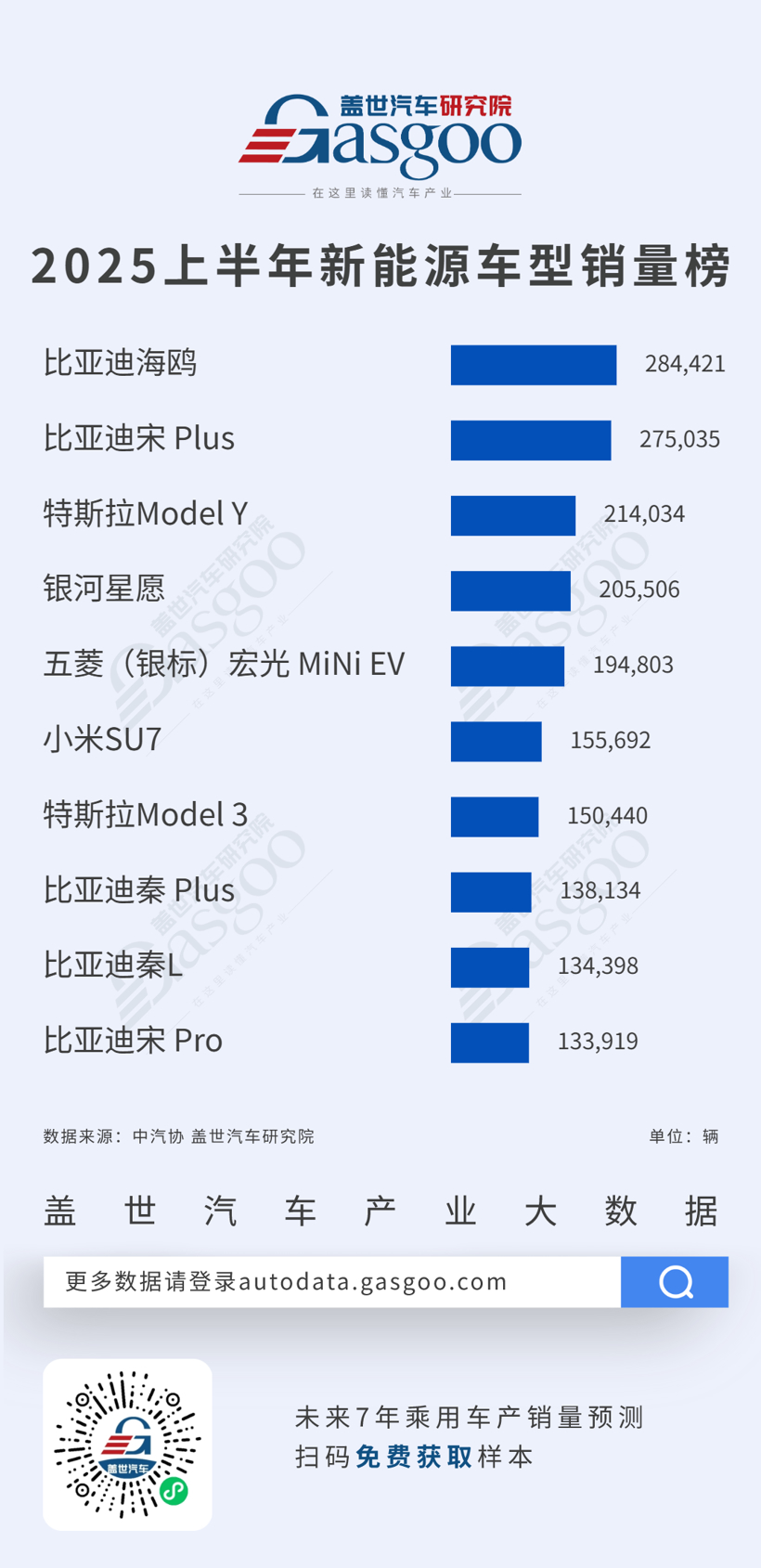

Specific sales data from the top ten NEV models in H1 2025 shows that BYD displayed absolute market dominance. The top models included the BYD Seagull (284,421 units sold), BYD Song Plus (275,035 units), and BYD Qin Plus (138,134 units), among others. Tesla's Model Y (214,034 units) and Model 3 (150,440 units) remain key players among foreign brands. Xiaomi's SU7 (155,692 units) entered the list as a representative of new forces, attracting young consumers with its intelligent features and trendy design. Geely's Galaxy Star Wish (205,506 units) and Wuling's Hongguang Mini EV (194,803 units) also performed well, further diversifying market competition.

With the market continuing to expand, the top ten models encompass both pure electric and plug-in hybrid vehicles, showcasing a trend of diversified technology routes. The concentration of sales among leading models is becoming increasingly evident, while the survival space for smaller brands is being further compressed. Future opportunities for breakthrough will depend on differentiated positioning, enhanced cost-performance, or intelligent experiences.

According to the sales rankings for fuel vehicles in H1 2025, Geely's Xingyue L topped the list with 155,435 units sold, followed by Nissan's Sylphy (135,213 units) and Geely's Binrui/Binrui Pro (116,689 units). Volkswagen's Sagitar (113,428 units) and Passat Pro (107,459 units) also made the top five. Domestic brands occupied six spots in the top ten, continuously building competitive advantages in price, configuration, and cost-effectiveness. Geely's dominance in the SUV market is evident with the performance of Xingyue L and Binrui. Meanwhile, while domestic brands are rising strongly, key Japanese and German models maintain a stable consumer base, with Nissan Sylphy, Volkswagen Sagitar, Passat Pro, and Magotan still holding market positions. However, joint venture brands no longer dominate the rankings as new-generation consumers are evaluating technology and pricing more rigorously. Despite the accelerated penetration of NEVs, the fuel vehicle market still shows strong consumer support, indicating significant market potential. Car manufacturers should enhance the competitiveness of their fuel models while accelerating their strategies in the NEV sector to adapt to the evolving market landscape.

China's Passenger Car Market Trends in H1 2025: Strong Performance of New Energy Vehicles

Images

Share this post on: