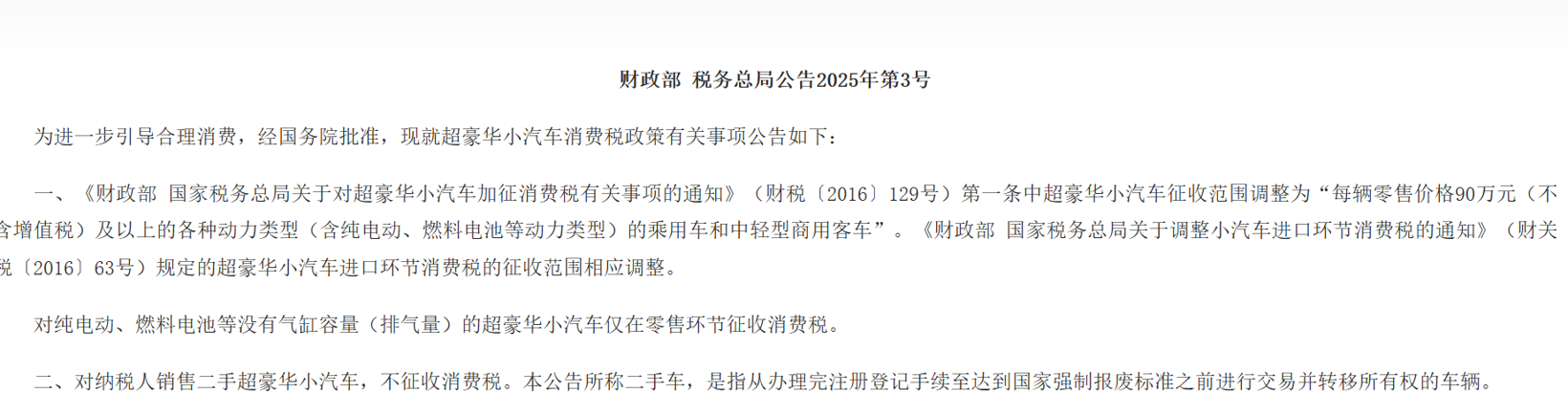

On July 17, the Ministry of Finance and the State Taxation Administration jointly announced significant adjustments to the consumption tax policy for ultra-luxury cars. Approved by the State Council, the new policy will take effect on July 20, marking a new phase in China's tax regulation of high-end car consumption. The most notable change is the substantial reduction of the consumption tax threshold, lowering it from a retail price of 1.3 million yuan (excluding VAT) to 900,000 yuan (excluding VAT). This adjustment significantly expands the coverage of the consumption tax, meaning that more high-end models priced between 900,000 and 1.3 million yuan will fall under the tax purview, likely impacting the core sales models of many luxury car brands.

The new policy clearly defines the taxation rules for various types of ultra-luxury vehicles, explicitly including pure electric and fuel cell vehicles as well as medium and light commercial passenger cars in the taxable range, filling a previous policy gap. Additionally, there are differentiated arrangements for new energy vehicles: for pure electric and fuel cell ultra-luxury cars that do not have cylinder capacity, consumption tax will only be levied at the retail stage. In contrast, traditional fuel vehicles are required to pay consumption tax at both the production (import) and retail stages. This design reflects both tax equity and the continued support for the development of the new energy vehicle industry.

The new policy also brings good news for the second-hand car trading market. It specifies that taxpayers selling second-hand ultra-luxury cars will no longer be subject to consumption tax, regardless of the original registration date or sales price. The policy provides a clear definition of 'second-hand cars' as vehicles that have completed registration and are traded before reaching the national mandatory scrapping standard. This move is expected to effectively lower the circulation costs of high-end second-hand cars and stimulate related market transactions.

Regarding the taxable basis for the retail stage, the announcement further clarifies that the sales amount for ultra-luxury cars includes all amounts charged to the buyer as well as any additional fees. It is particularly noted that any fees charged under the guise of vehicle decoration, configuration upgrades, or after-sales services are considered 'additional fees' and must be included in the sales amount for consumption tax calculation. This regulation aims to close tax collection loopholes and ensure a complete tax base.

To ensure unified enforcement of the tax policy, the consumption tax standard for imported ultra-luxury cars is also adjusted to 900,000 yuan (excluding VAT). The announcement emphasizes that the consumption tax policy for imported vehicles will remain consistent with that for domestically produced vehicles. This significant policy adjustment reflects the government's clear intention to guide automotive consumption towards a more rational and sustainable direction through tax leverage. On one hand, lowering the threshold expands the tax base and strengthens the regulatory effect on high-end, luxury car consumption; on the other hand, including new energy vehicles in the tax scope shows that tax policies are keeping pace with technological changes in the industry while maintaining support for their development through production stage tax exemptions. The cancellation of taxation on second-hand car transactions aims to promote effective circulation of existing resources. The overall design of the policy considers reasonable adjustments in fiscal revenue while addressing the practical needs of the automotive industry's transformation and upgrading. With the new policy taking effect on July 20, the sales structure, pricing strategies, and purchase decisions of consumers in the ultra-luxury car market will all face reshaping. In particular, models priced between 900,000 and 1.3 million yuan and high-end new energy vehicles will be directly affected by this tax policy adjustment, necessitating the industry to adapt to the new tax environment and prompting consumers to reassess acquisition costs.

China Adjusts Luxury Car Consumption Tax Policy to Stimulate Market

Share this post on: