Recently, global power battery giant CATL released its half-year report for 2025, showcasing impressive results across various dimensions such as revenue, profit, battery installation volume, technological innovation, and global expansion. High profits and substantial cash reserves provide the "King of Batteries" with ample resources for breakthroughs, but its ability to maintain leadership during the growth transition phase depends on the speed of technological iteration and the depth of ecosystem collaboration.

1. "Cash Cow" with Daily Net Earnings of 170 Million Yuan

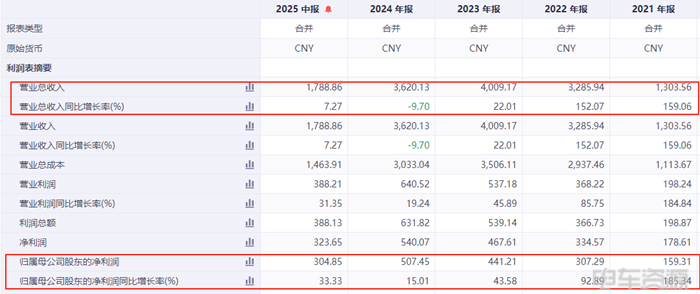

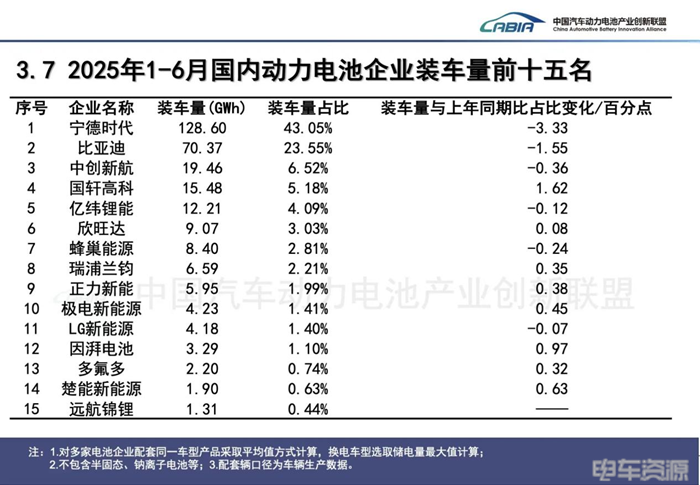

On July 30, CATL announced its semi-annual report for 2025. In the first half of this year, the company achieved revenue of 178.89 billion yuan, a year-on-year increase of 7.27%; net profit attributable to shareholders reached 30.49 billion yuan, a year-on-year increase of 33.33%, averaging a net profit of 170 million yuan per day; cash reserves soared to 350.58 billion yuan, setting a historic high. These impressive financial results stem from CATL's high shipment volume and improved cost control capabilities. According to data from the China Automotive Power Battery Industry Innovation Alliance, the total installed capacity of power batteries in China from January to June reached 299.6 GWh, a year-on-year increase of 50.4%, with CATL accounting for 43.05% of that at 128.6 GWh. During the reporting period, CATL's gross profit margin returned to 25.02%, an increase of 0.58 percentage points from the end of 2024.

However, compared to the growth rates of 2021 and 2022, CATL has moved past the phase of high growth, largely due to the high penetration rate of new energy vehicles (NEVs) in the domestic market, which limits further growth potential. According to the China Association of Automobile Manufacturers, the sales of NEVs in China from January to June 2025 reached 5.878 million units, with NEV passenger car sales hitting 5.524 million units, a year-on-year increase of 34.3% and a penetration rate of 50.4%, indicating limited space for further increase; NEV commercial vehicle sales reached 354,000 units, a year-on-year increase of 55.9%, with a penetration rate of 21.8%. In overseas markets, the penetration rate of NEV passenger cars in Europe has reached 26.1%. From a downstream market perspective, CATL faces a ceiling on revenue growth in the domestic NEV passenger car sector and urgently needs to pivot to more promising commercial vehicles and international markets. Currently, CATL's revenue and profit growth rates, as well as gross margins from overseas operations, significantly exceed those in the domestic market, showing a rapid upward trend. In the first half of this year, CATL's overseas revenue reached 61.21 billion yuan, a year-on-year increase of 21.14%, with gross margin rising to 29.02%.

2. Analysis of Four Main Products

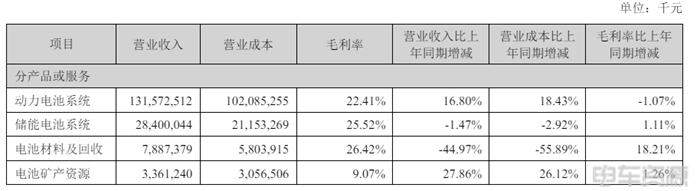

CATL is aware of the growth bottlenecks it faces and has been continuously expanding its business through multi-dimensional strategies in recent years. Its layout involves not only expanding production capacity but also achieving technological breakthroughs, vertically integrating the upstream and downstream supply chains, global expansion, and multi-scenario applications. However, at present, CATL still relies heavily on its primary product, the power battery system.

- Power Battery System: In the first half of the year, revenue reached 131.57 billion yuan, a year-on-year increase of 16.8%, accounting for about 74% of total revenue, though gross margin slightly declined to 22.41%. CATL currently has a production capacity of 345 GWh for battery systems, with 235 GWh under construction, and a utilization rate of 89.86%, which is relatively high.

- Energy Storage Battery System: From January to June, revenue declined by 1.5% year-on-year to 28.4 billion yuan, with a gross margin of 25.52%. According to Xinluo Information, the company ranks first globally in energy storage battery production.

- Battery Materials and Recycling: This business primarily supports the supply of key resources and materials for battery production. In the first half of the year, revenue significantly decreased, falling 45% year-on-year to 7.89 billion yuan, but the gross margin remained high at 26.42%.

- Battery Mineral Resources: Currently, this segment has a small revenue scale, with only 3.36 billion yuan in revenue in the first half of the year. However, with strengthened upstream resource allocation, this business is expected to grow further.

3. New Business Layout

In the first half of the year, CATL has been active in launching new products. In the passenger vehicle sector, it released the second-generation Shenxing ultra-fast charging battery, the Xiaoyao dual-core battery, and sodium-ion batteries; in the energy storage sector, it mass-produced and delivered the 587Ah large-capacity energy storage dedicated cells. Regarding solid-state batteries, CATL stated in its performance briefing that the scientific issues in the solid-state battery industry have mostly been resolved, but some engineering challenges remain, and commercialization, including supply chain integration, is still some distance away. In terms of battery swapping business progress, by the end of July, CATL had built over 400 battery swapping stations for passenger vehicles, aiming for a total of 1,000 stations by the end of the year; around 100 battery swapping stations for heavy trucks have been built, with an estimated 300 to be constructed this year. Additionally, the company has collaborated with automotive clients to launch over 20 new chocolate battery-swapping models and partnered with companies like Sinopec, NIO, and Didi to accelerate the development of the battery swapping ecosystem.

4. Conclusion

CATL's semi-annual report for 2025 showcases its strong profitability and strategic resilience as a global power battery giant. However, the nearing ceiling of domestic NEV penetration and the slow growth of the power battery business highlight the urgency of business expansion. In the future, CATL needs to further unlock the potential of energy storage, battery swapping, and upstream resources, while accelerating the commercialization of solid-state batteries and overseas production capacity to tackle industry competition and geopolitical risks.

CATL Reports Strong Half-Year Performance Amidst Growth Challenges

Images

Share this post on: