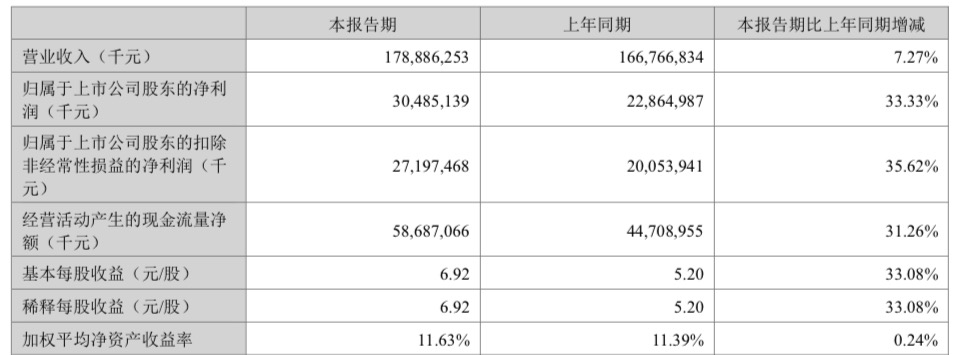

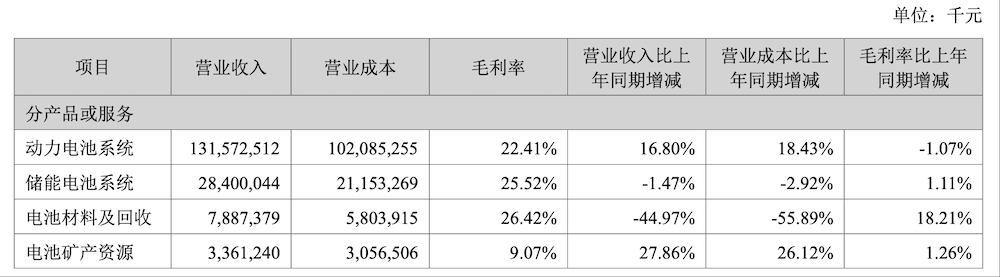

In the current global wave of electrification, power batteries are undoubtedly the 'heart' of the new energy industry. Known as 'King Ning,' CATL continues to hold the top position in the industry. On the evening of July 30, CATL disclosed its half-year report for 2025, revealing that the industry giant achieved a net profit of 30.4 billion yuan in the first half of the year, maintaining its lead in the global power battery market. The company's revenue for the first half reached 178.886 billion yuan, a year-on-year increase of 7.27%, with a net profit attributable to shareholders of 30.485 billion yuan, up 33.33% from the previous year. The comprehensive gross profit margin stood at 25.0%, an increase of 1.8 percentage points year-on-year, and operating cash flow reached 58.7 billion yuan, with cash reserves exceeding 350 billion yuan by the end of the period. During the reporting period, CATL's market share in power and energy storage batteries remained strong. In the power battery segment, according to SNE Research data, from January to May 2025, CATL's global market share for power battery usage was 38.1%, up 0.6 percentage points from the same period last year. In the energy storage sector, according to Xinhua Information data, from January to June 2025, CATL ranked first in global production of energy storage batteries. The report showed that in the first half of the year, CATL's power battery systems generated revenue of 131.573 billion yuan, a year-on-year increase of 16.80%, with a gross margin of 22.41%. The energy storage battery systems generated revenue of 28.4 billion yuan, down 1.47% year-on-year, with a gross margin of 25.52%. However, CATL's dominance in lithium iron phosphate batteries is facing challenges. Recently, LG signed a $30 billion order with Tesla for energy storage batteries to be produced domestically in the U.S., causing CATL to lose its exclusive supplier status for Tesla's lithium iron phosphate batteries. Notably, while releasing its half-year report, CATL also announced its mid-year dividend plan for 2025, proposing a cash dividend of 10.07 yuan (tax included) for every 10 shares, totaling a cash dividend of 4.573 billion yuan (tax included). This is CATL's second mid-year dividend announcement since going public in 2018. Previously, in August 2022, CATL announced a cash dividend of 6.528 yuan (tax included) for every 10 shares, totaling 1.593 billion yuan (tax included). CATL stated that the proposed mid-year dividend plan for 2025 aims to enhance investors' sense of gain without causing liquidity shortages or other adverse impacts. During the earnings presentation held on July 30, CATL confirmed that its overall capacity utilization rate remained at a high level of about 90% in the first half of this year. Market demand remains strong, and the company plans to expand capacity based on market demand, with capital expenditures (CAPEX) expected to increase compared to last year. In the first half of this year, CATL continued to introduce new products to the market, including the second-generation supercharging battery, dual-core battery, and sodium battery for passenger vehicles, as well as the mass production of a 587Ah large-capacity energy storage cell. Additionally, CATL is vigorously promoting its battery swapping strategy, having built over 400 battery swapping stations for passenger vehicles by the end of July, aiming for a total of 1,000 stations by the end of the year. Approximately 100 heavy-duty truck battery swapping stations have been built, with around 300 expected to be constructed throughout the year. To strengthen technological barriers and lay the groundwork for the commercialization of cutting-edge technologies like solid-state batteries, CATL invested approximately 10.095 billion yuan in R&D in the first half of the year, a year-on-year increase of 17.48%. During the earnings presentation, a company spokesperson emphasized the progress in solid-state batteries. CATL's research in this area is at the industry-leading level, and the company believes that the scientific problems have been largely resolved, with the main challenges now being in engineering. CATL expects small-scale mass production of solid-state batteries by 2027 and large-scale application by 2030. To accelerate its global strategy, CATL successfully listed on the main board of the Hong Kong Stock Exchange on May 20, 2025, with a total of 155,915,300 shares issued (after exercising the over-allotment option) at a price of 263.00 HKD per share, raising a total of 41 billion HKD. The company stated that the H-share listing has established an overseas capital operation platform that facilitates further integration into the global capital market, accelerating the advancement of its global strategy and enhancing its overall competitiveness. Currently, CATL's overseas capacity expansion is progressing simultaneously, with a battery factory in Indonesia having commenced construction in June. Earlier this year, CATL's co-chairman Pan Jian stated at the Davos Forum that the company plans to establish a joint venture battery factory with Stellantis in Spain, with announcements of new joint factory projects in Europe expected later this year. Including the Spain project, CATL has already set up three battery factories in Europe. According to CATL's half-year report, the company's overseas revenue reached 61.208 billion yuan, accounting for 34.22% of total operating revenue, with battery systems being the main products sold overseas, showing no significant changes compared to the previous year.

CATL Reports Strong Half-Year Earnings for 2025

Images

Share this post on: