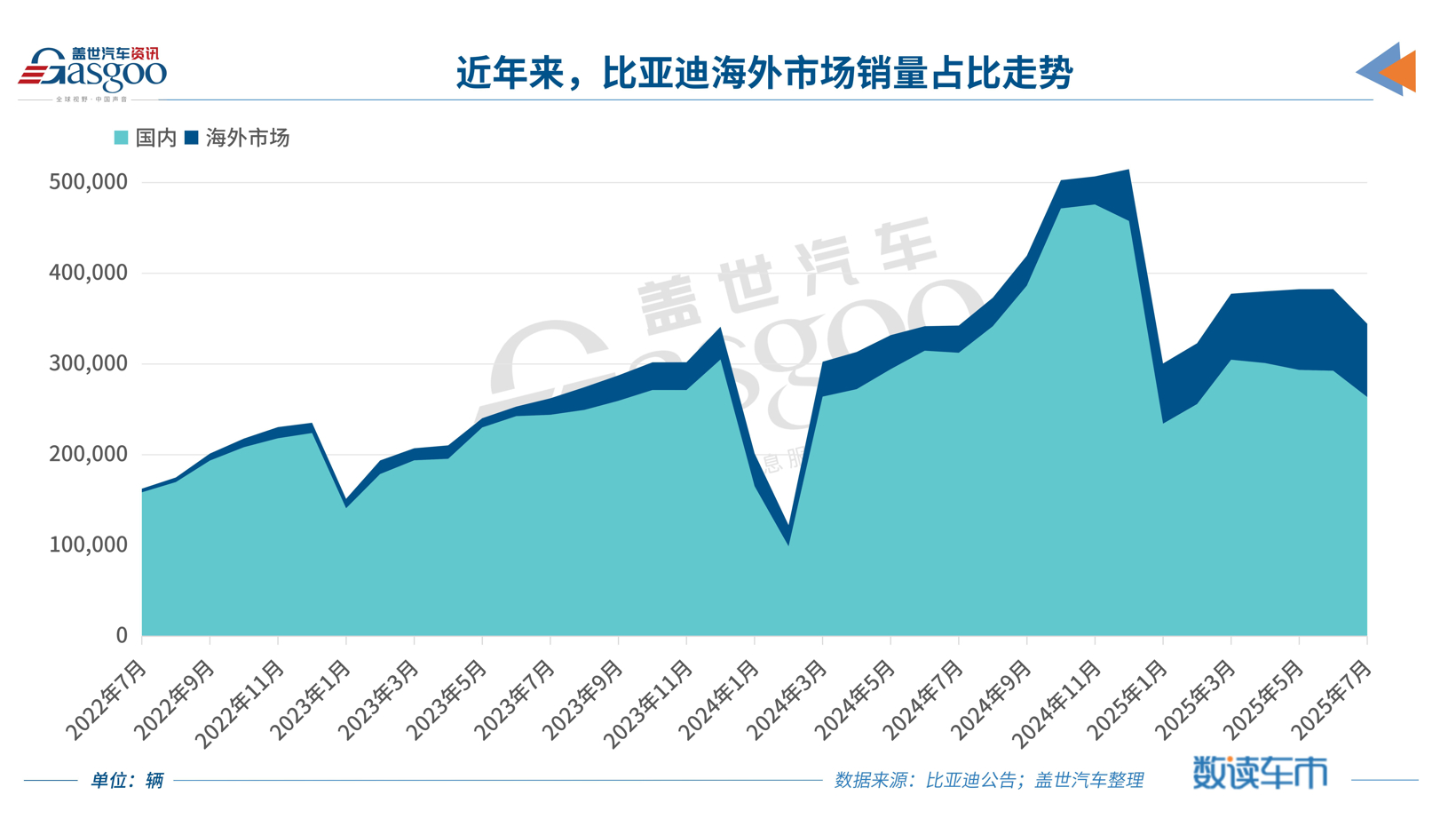

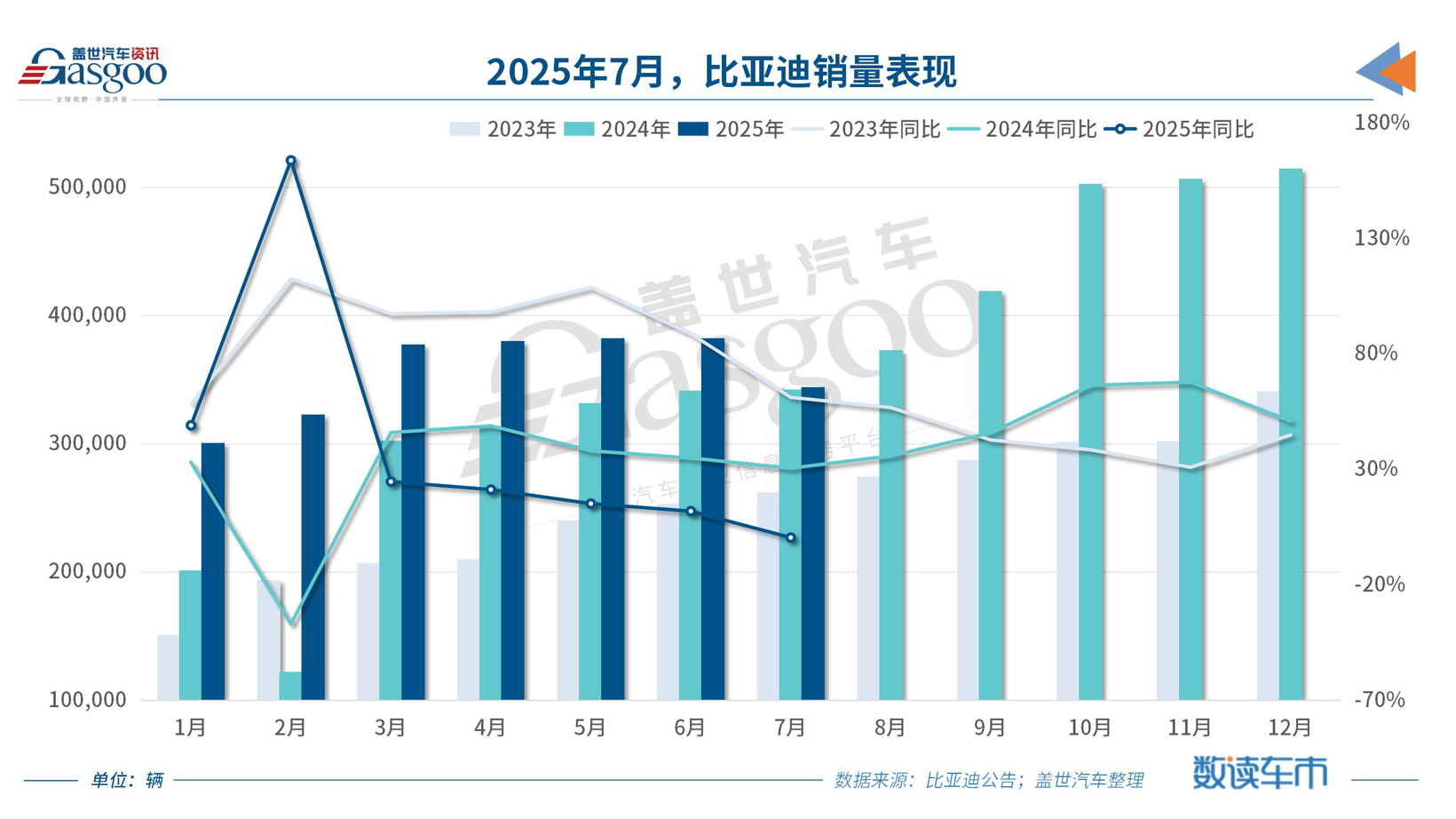

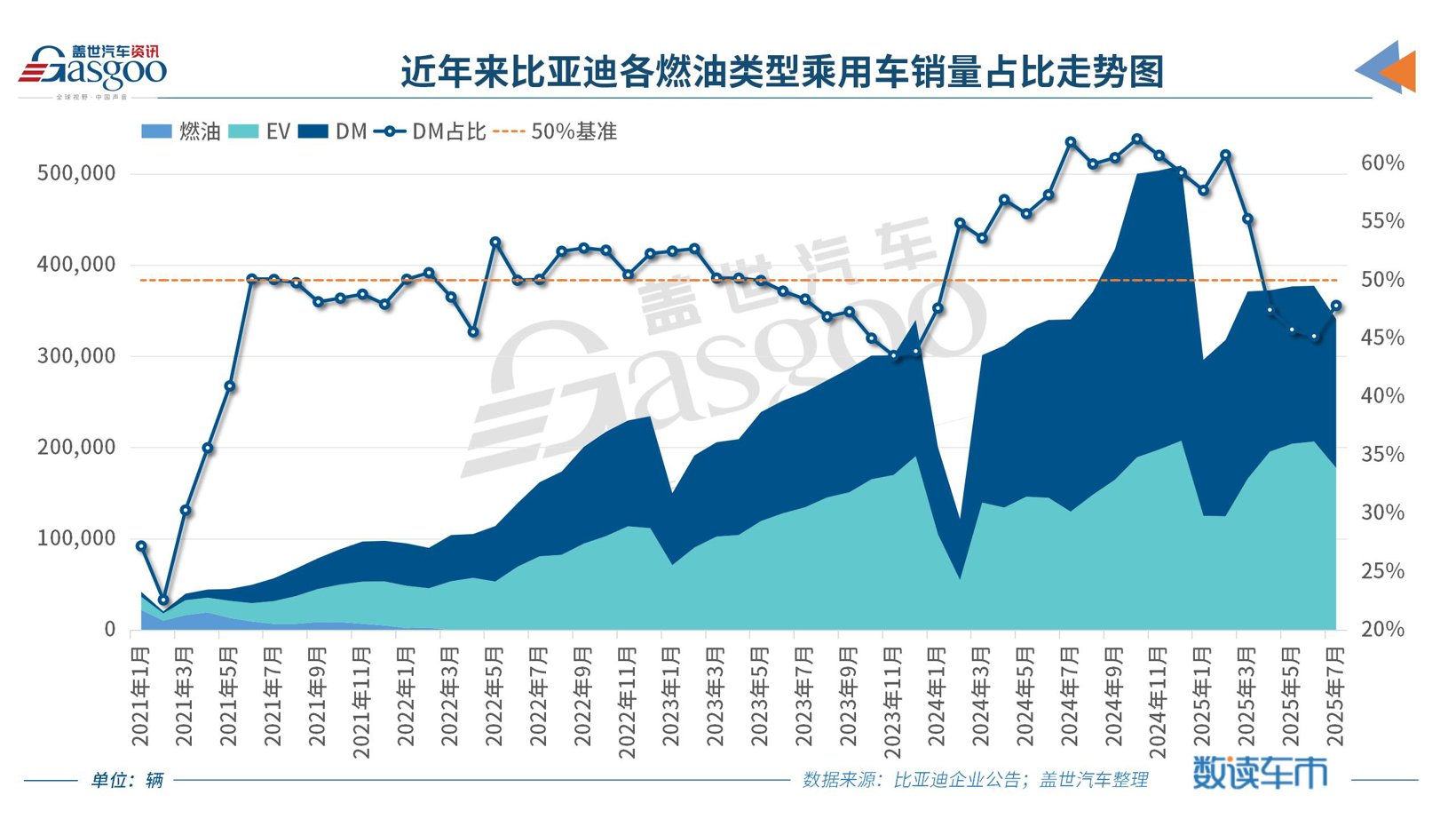

On August 1, BYD announced its latest production and sales data, revealing that by July 2025, it had sold a total of 344,296 new energy vehicles, a slight year-on-year increase of 0.56%, but a decline of 10.01% compared to June. This data reflects two key signals: the domestic demand is slowing down, and there are pains from structural transformation. The overseas expansion is accelerating, with new markets becoming a growth engine. In the first seven months of 2025, BYD's internationalization process exploded. BYD's factory in Camasari, Bahia, Brazil, rolled out its first new energy vehicle on July 1. This super factory, which cost 5.5 billion Brazilian Reais (about 7.1 billion RMB) and has an annual production capacity of 150,000 vehicles, achieved this milestone in just 15 months, setting a record for the speed of automobile industrial construction in Brazil. A few days later, BYD's factory in Rayong, Thailand, celebrated its first anniversary of production and officially delivered its 90,000th new energy vehicle—the Tengshi D9. Just days ago, BYD's fifth and sixth self-owned automobile roll-on/roll-off ships, 'BYD XI’AN' and 'BYD CHANGSHA', respectively carried 7,000 new vehicles to Brazil and Europe. This simultaneous advance by land and sea makes BYD's upcoming overseas mission full of hope. In this context, data shows that overseas sales exceeded 540,000 units in the first seven months of this year, a staggering year-on-year increase of 133.49%, accounting for 28.02% of total sales. In July alone, export sales surpassed 80,000 units, slightly lower than the previous month, reaching 30.63%. This structural growth confirms Chairman Wang Chuanfu's previous judgment at the earnings meeting: the overseas market has become BYD's core incremental engine. The set goal of more than 800,000 overseas exports by 2025 (accounting for only 14.55%) is likely to be significantly surpassed this year, driven by improved operational efficiency and a slowing domestic market. BYD's overseas offensive continues to accelerate as it actively expands into new markets and introduces more models. For instance, the first locally produced BYD Destroyer 05 rolled off the line at the Thailand factory, further solidifying its technological leadership in the Southeast Asian PHEV market, achieving parity between plug-in hybrid and pure electric models in Thailand. Additionally, at the GIIAS International Auto Show in Indonesia, BYD showcased its sub-brand Tengshi and simultaneously launched the Seagull model, significantly enriching the local product matrix and continuously strengthening brand influence. Furthermore, the all-new pure electric compact SUV—Yuan UP (BYD ATTO 2) was officially launched in Kuala Lumpur, Malaysia. However, while the global success is impressive, it comes against the backdrop of a slowdown in overall sales pace. After several months of consecutive growth, BYD's July sales of 344,000 vehicles fell by over 10% compared to June, with an annual target of 5.5 million vehicles, achieving only 45% completion by the end of July. This means that BYD has just five months left, with over 3 million vehicles still to sell, necessitating an average monthly sales increase to 600,000 units—an extremely challenging task compared to historical peaks and the best monthly performance achieved in 2025. In July, the product structure showed a slight rebound in the proportion of DM hybrid models to 47.84%, but it has been below 50% for four consecutive months, indicating a mismatch between the strategy for transitioning to pure electric and actual market demand. After the penetration rate of new energy vehicles in the domestic market surpassed 60%, the incremental space has narrowed amidst intensified price wars, leading to fierce competition in the mid-to-low-end market. A series of new products are being launched, with high-end breakthroughs pending verification. The recently launched Sea Lion 06 dual-power model (priced between 139,800 and 156,800 RMB for DM-i, and between 143,800 and 163,800 RMB for EV) is expected to achieve substantial sales, featuring standard 'God Eye' intelligent driving and Cloud Liang C system, with a comprehensive range of 1,670 km for the DM-i version, directly competing with models like the Model Y. In the high-end line, the Yangwang U8L is entering the luxury hard-core SUV market with a pre-sale price of 1.3 million RMB. Notably, the Tengshi D9 has performed remarkably overseas, winning the luxury MPV sales crown in Thailand, Indonesia, and Malaysia, with a price exceeding 1.6 million RMB in Singapore, becoming a benchmark for brand premium. Technical upgrades and capacity coordination are crucial for breakthroughs. The fifth-generation DM hybrid system and the 'God Eye' intelligent driving (supporting high-speed NOA) are rapidly penetrating new models, such as the upcoming Tang L, which will be equipped with lidar and advanced intelligent driving capabilities. However, compared to the new forces' ultra-fast charging technology that allows for 500 km of range in just 12 minutes, BYD still needs to strengthen its intelligent features in mid-to-low-end models. BYD stands at a crossroads of target sprinting and structural optimization. The sales capability of the Sea Lion 06, the gross profit contribution of high-end models, and the efficiency of intelligent driving technology will determine whether it can reconstruct its growth logic in the red ocean market. Focusing on 'electricity-intelligence integration', BYD invests 5,000 personnel to tackle intelligent driving. As sales come under pressure, BYD is anchoring its long-term competitiveness through technology. In July 2025, two initiatives caused a stir in the industry. One was BYD's commitment to providing comprehensive coverage for safety and loss in intelligent parking scenarios for all vehicles equipped with the 'God Eye' system in the Chinese market, as the number of such vehicles surpassed one million. This means that users in intelligent parking assistance scenarios do not have to go through insurance processes for safety and losses that are legally covered by the vehicle; they can directly contact BYD's after-sales service. The greatest benefit for users is that their insurance premiums will not be affected next year, and they will not increase. This commitment sets a precedent in the industry, bolstered by the two hard strengths of 'God Eye'—the millisecond-level multi-domain control based on the Xuanji architecture, which can achieve stable control in the event of a tire blowout by coordinating suspension, braking, and torque distribution systems; and the 3D high-precision digital map covering over 90% of parking lots nationwide, which establishes a digital foundation for scenario-based decision-making. The deep integration of electrification and intelligentization was further clarified at the technical communication meeting in Shenzhen on July 28. R&D head Yang Dongsheng first revealed the dual-line offensive system: on the electrification base layer, the Xuanji architecture achieves nanosecond-level collaboration of 'power battery - drive motor - power semiconductor', ensuring that the CTB 3.0 battery pack can control thermal runaway for up to 43 minutes at 800V, far exceeding the industry average of 25 minutes; on the intelligent integration level, a team of 1,000 algorithms is working to reduce the false trigger rate of the 'God Eye' L2++ system's urban NOA to 0.02 times per 100 kilometers. To validate the reliability of these technologies, BYD has built the world's largest dynamic testing ground—the Shenshan Extreme Control Test Field, which includes 128 types of extreme road surfaces and a heavy rain simulation system, with a cumulative testing mileage for intelligent driving exceeding 180 million kilometers. The ultimate goal of these technological breakthroughs is to elevate the brand. The choice of the Yangwang U7 as the vehicle to mark the 13 millionth unit off the production line is no coincidence. This flagship sedan, equipped with the 'Cloud Liang-Z' magnetic suspension chassis and 'God Eye' advanced intelligent driving, received over 8,000 orders within 72 hours of pre-sale, pushing the cumulative deliveries of the Yangwang brand to exceed 10,000 units. End-user research shows that 42% of Yangwang owners come from BBA users, with an average transaction price of 1.08 million RMB, completely rewriting the price ceiling for Chinese brands. Despite the month-on-month sales decline in July, BYD has not slowed its pace. From the first vehicle rolling off the line at the Brazilian base to deep localization in Thailand and new product layouts in Malaysia, its global manufacturing and product network is expanding with unprecedented density. This ambitious layout is a key support for seeking structural breakthroughs under severe annual target pressure. Meanwhile, the core strategy driven by technology is becoming increasingly clear. This sprint concerning the annual target of 5.5 million vehicles, though challenging, is far from over.

BYD's Electric Vehicle Sales Reach 344,296 Units in July 2025, Global Expansion Accelerates

Images

Share this post on: