During a recent speech at the World Artificial Intelligence Conference, Bosch's President for Intelligent Driving in China, Wu Yongqiao, made a bold statement that reverberated across the industry: "We can no longer promote free offerings and equal access to intelligent driving. All models with combined advanced driving assistance features must be charged." He further emphasized that installing all high-level assistance driving features for free would lead to catastrophic consequences for the intelligent driving assistance industry in China. As the industry grapples with a 'revenue without profit' dilemma and with Tesla's Full Self-Driving (FSD) priced at 64,000 yuan, the question arises: must Chinese automakers depend on 'charging for intelligent driving' to break free from this competitive spiral?

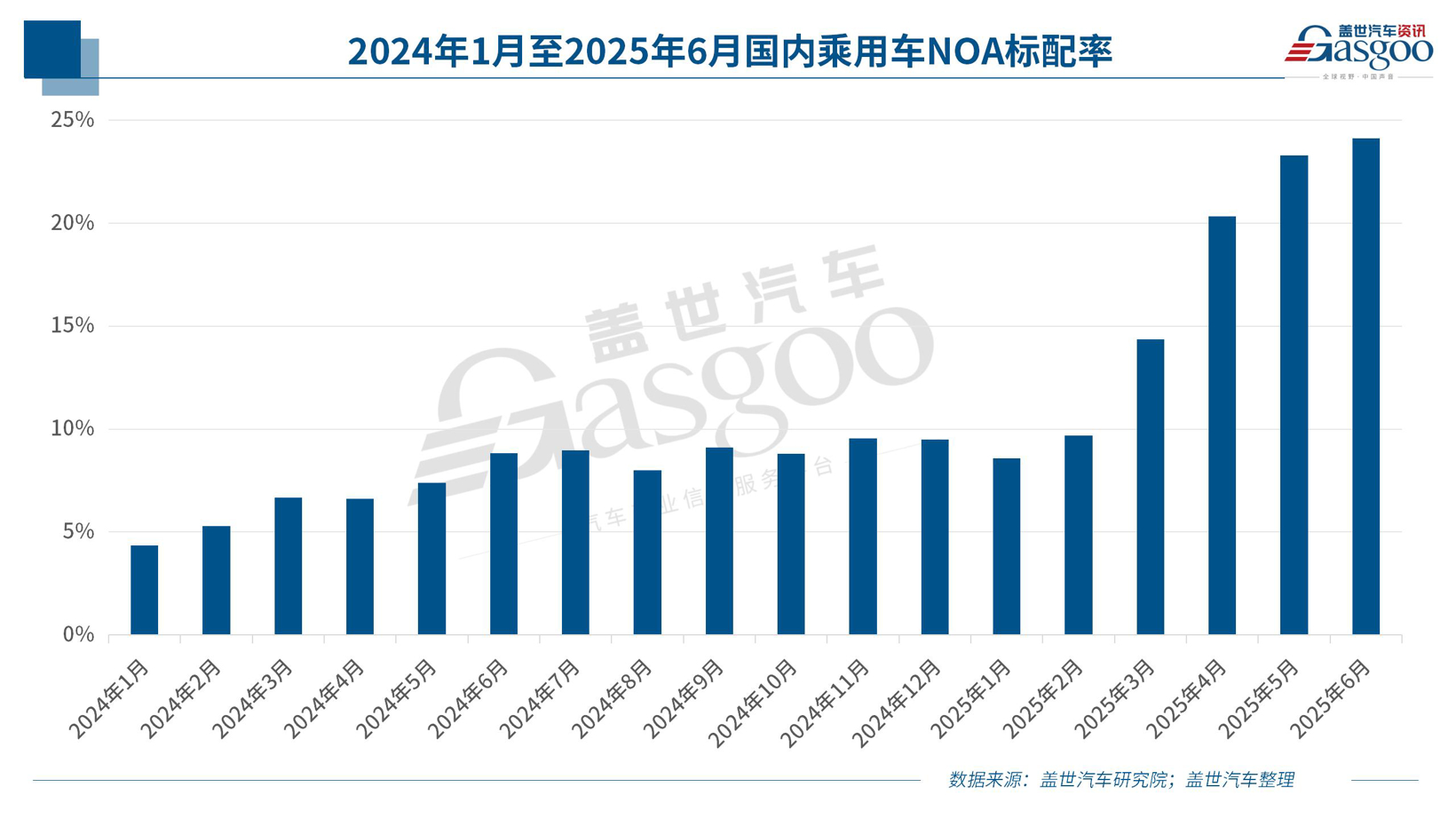

The first half of 2025 witnessed a significant push for 'equal access to intelligent driving' among major automakers like BYD, Geely, Chery, Changan, and GAC. BYD was the first to offer models with the advanced 'Tianshen Eye' system at the 100,000 yuan market level, while Changan announced that all its models would come standard with hardware for assistance driving post-2025. Leap Motor even refunded users who had paid for assistance driving software. Data from the Gaishi Automotive Research Institute shows that by June 2025, the standard rate for Navigation Assistance (NOA) in China's passenger car market rose to 24.1%, up from just 9.5% in December 2024.

However, contrasting the enthusiasm for intelligent driving is another striking set of data from the National Bureau of Statistics, which revealed a recovery in profits for the automotive manufacturing industry in the first half of 2025. This reversal raises questions about how much of this improvement stems from recent efforts to combat 'internal competition' within the industry. Over the past year, 'declining profits' has become a key concern for the industry, forcing automakers to pass the burden of cost control upstream to suppliers. Wu Yongqiao candidly remarked that in the entire Chinese automotive parts industry, only Huawei and CATL have some pricing power, while other suppliers, including Bosch, face brutal price competition.

In this environment of low profits, the software subscription models represented by Tesla's FSD and Huawei's ADS (Advanced Driving System) appear particularly appealing. Currently, Tesla's Enhanced Autopilot (EAP) is priced at 32,000 yuan, with quarterly payments of 1,399 yuan, or a monthly option of 699 yuan. The FSD is priced at 64,000 yuan. Huawei's ADS functionality is available for a one-time purchase of 36,000 yuan or a subscription of 720 yuan per month, while the basic version is offered for 5,000 yuan or 100 yuan monthly. NIO also employs a subscription strategy for its intelligent driving features at a monthly price of 380 yuan.

Wu Yongqiao believes that if intelligent driving technology is brought to perfection, providing users with unparalleled experience, safety, and confidence, it can penetrate the fog of price competition, leading users to willingly pay for it. He warns that while many automakers are attracting users with 'free strategies' (such as standard NOA hardware and several years of software services), this model undermines the industry's ability to generate revenue and innovate. Without appropriate commercial returns for top technologies, the virtuous cycle of research and development will collapse like a house of cards.

In response to Wu Yongqiao's call for charging, advocates for the 'free model' cite data from the McKinsey 2024 China Automotive Consumer Insights report, which shows that while acceptance of intelligent driving features has increased, the willingness to pay has significantly declined. The competition landscape in China’s smart electric vehicle market has become a red ocean, with fierce battles over everything from battery costs to advanced driving capabilities. In this context, free or low-cost bundling strategies have become standard tactics for automakers seeking to differentiate themselves. Some leading companies adopt a 'hardware pre-installation + limited free software service' model, believing that consumers have a limited understanding of the value of intelligent driving and weak long-term subscription willingness. They aim to lower the initial decision threshold to capture the user experience first.

However, the reality of this long-term strategy faces financial pressure. Achieving an 'extremely confident, safe, and comfortable' intelligent driving experience relies on costly hardware and extensive data training. The high costs of pre-installed hardware continue to squeeze profit margins for automakers. Moreover, the actual conversion rate from free to paid users remains a significant challenge. A deeper concern lies in the fact that the 'free' strategy fundamentally obscures the value transmission path of intelligent driving technology, making it difficult for automakers to accurately convey the true R&D and deployment costs to consumers.

Wu Yongqiao's warning that the widespread free distribution of high-level intelligent driving could lead to industry disaster underscores this dangerous trend. As the entire industry's technological value is systematically underestimated, how can China's intelligent driving maintain its competitive edge globally? In fact, even Tesla and Huawei have not been able to withstand the pressure from other automakers offering free services. On March 17, Tesla China announced a 30-day free trial for its FSD, while Huawei offered limited-time discounts for its advanced driving feature packages, which have been extended multiple times.

On July 27, discussions on Wu Yongqiao's speech gained momentum, with a consistent core viewpoint emerging: "If we charge, we must take responsibility." This sentiment became particularly urgent after a recent test result for fully intelligent driving vehicles was released, which dashed the hopes of many consumers. A representative from the Ministry of Public Security clarified that the 'intelligent driving' systems in cars sold in the market do not possess 'autonomous driving' capabilities yet, remaining in the stage of assistance driving where human control is still necessary. The question of liability becomes unavoidable; once the combined assistance driving system takes control, the boundaries of traditional driver's responsibility become blurred, and critical driving data often remains undisclosed, complicating the situation for consumers.

As a result, if a system causes an accident under a paid model, should the automaker, algorithm provider, and hardware supplier bear legal responsibility? The current regulatory framework provides little clarity on this issue, creating barriers for consumers to assert their rights and making automakers cautious about promoting paid assistance driving services. From a broader perspective, responsibility and payment should be two sides of the same value coin, inseparable. Clear legal responsibilities will compel automakers to invest more resources into ensuring system safety, incurring higher technical safety costs for every 'function liberation.' Therefore, for consumers, a clear delineation of rights and responsibilities and a robust accountability mechanism are not excessive demands but essential guarantees for the value of their payments.

For instance, BYD recently announced that it has achieved L4-level intelligent parking and committed to covering all losses and safety guarantees for its Tianshen Eye vehicles in intelligent parking scenarios in the Chinese market, even before charging for these services. This raises the question: if they charge, shouldn't they also provide full coverage? The cognitive barrier for consumers regarding the value of intelligent driving remains significant. Transitioning from 'usable' to 'excellent' is not an overnight process. Especially as basic L2 assistance driving becomes standard, how can the differentiated value of higher-level capabilities take root in consumer consciousness? The charging model necessitates a disruptive leap in reliability and user experience, serving as the ultimate test of technical strength and the ability to construct genuine user value.

Wu Yongqiao's call for 'high pricing' resonates beyond mere commercial pricing strategies; it serves as a profound inquiry into the industry's chilly winter and the search for a breakthrough path. In the short term, free or low-cost bundling strategies will remain the reality for most automakers amid fierce competition. However, looking ahead, the deep integration of responsibility and value is bound to become a core issue in future business models. Only when companies are willing to commit and take on the full responsibility behind charging functionalities can consumers truly trust and pay for the vision of 'liberating hands.' Only with sufficient commercial returns can the industry establish positive loops, injecting inexhaustible momentum for safe technological evolution and continuous breakthroughs. The road to exploring the value of China's intelligent driving is bound to be challenging. However, when the foundations of 'charging' and 'responsibility' are firmly placed together, this path to future technology can truly embody hope. After all, the future that users are willing to pay for is the intelligent driving experience that is safe, reliable, and genuinely liberates their hands.

Bosch Executive Calls for Charging for Advanced Driving Assistance Features in China

Images

Share this post on: