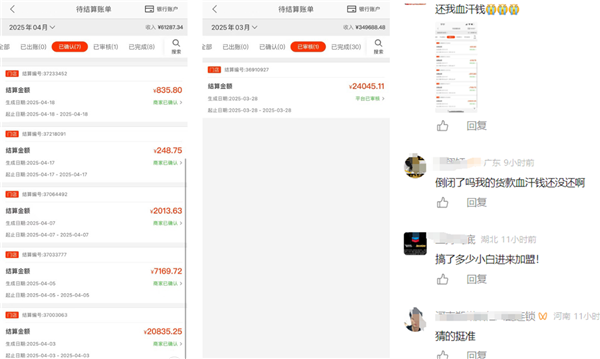

In 2025, the automotive parts industry is experiencing significant challenges, with two platforms facing dire situations. Recently, an internal letter from 'Jia Yi Bing Ding (Beijing) E-Commerce Co., Ltd.' stirred considerable attention in the industry, raising speculation about the company's potential dissolution. Franchisees have taken to social media, demanding the return of their investments, sharing screenshots showing pending payments totaling 55,000 yuan. A self-identified manager from Jia Yi Bing Ding admitted that the company has not completely absconded but suggested that franchisees pursue legal action for their rights, expressing a sense of helplessness. This is not an isolated incident. Earlier this year, 'Che Pei Bao', under Zhejiang Bai Yi Hui Automotive Technology Co., Ltd., similarly faced collective legal actions from franchisees. This platform aimed to connect suppliers directly to repair shops using an F2B model and planned to deploy over 500 satellite warehouses in 2023. A franchisee from Wuhan revealed that after paying a 300,000 yuan franchise fee, they discovered the actual operations of Che Pei Bao were far from what was advertised, and attempts to get a refund have been thwarted. They stated, 'I’m now in debt and my family has fallen apart.' Amidst these crises, franchisees who invested their savings and incurred debts are finding themselves in a difficult and often fruitless struggle for rights.

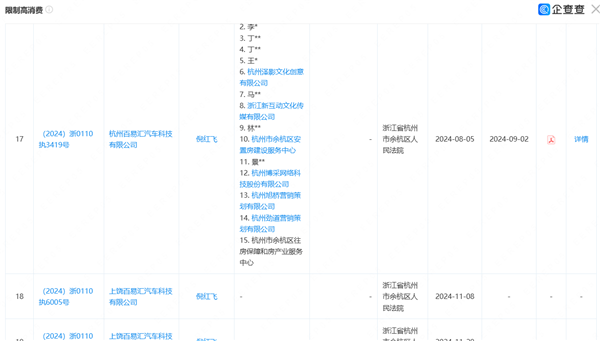

The crises faced by these companies often share striking similarities: changes in the core team, frozen assets, rising legal disputes, and a breakdown in external communication. The crisis at Jia Yi Bing Ding began to surface last year when one of the founders stepped down from his positions. By April 2025, the company was listed as an executing party, with 20 million yuan of its stakes frozen. The recent internal letter, website issues, and collective franchisee actions pointed towards an inevitable outcome. Che Pei Bao's situation mirrors this; after a significant change in ownership and management, the company has faced multiple consumption restriction orders totaling 7.98 million yuan as of July 2025. As of August 2024, Che Pei Bao's official WeChat and Douyin accounts have ceased updates, and their recruitment hotline redirects to errors, indicating severe operational difficulties.

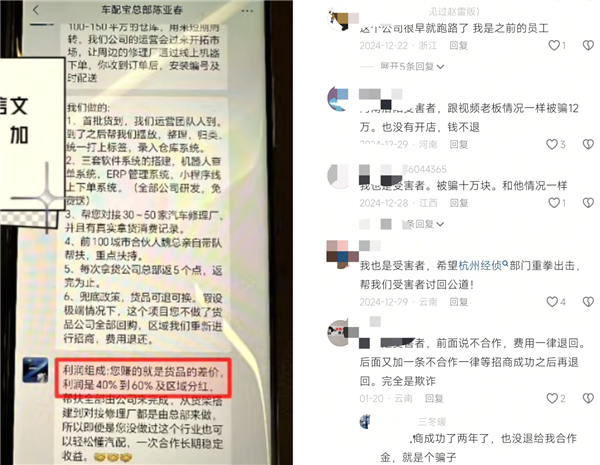

From the 'easy profit' narrative to heavy debts, franchisees have become the ultimate victims in this downturn. A franchisee from Wuhan shared their experience of being lured into the industry with no prior experience by a promotional event that boasted profits of 40%-60% from product markups and promised comprehensive support from headquarters. However, upon questioning the project's reliability and pausing payments, they faced obstacles in getting refunds. Legal cases have shown that franchisees often end up with minimal returns on their investments, while those who attempt to return goods face steep losses. With platforms shutting down and refund requests left unresolved, the phenomenon of operational irregularities and unmet promises will likely become more common.

The current downturn in the automotive parts industry is backed by data. Many categories, including passenger car tires and brake components, are seeing significant demand declines. This situation is exacerbated by more rational consumer behavior and the accelerated penetration of new energy vehicles. As a result, existing business models are under pressure, with weakened purchasing intentions from end stores and increasing supply chain difficulties. Even established players in the industry are struggling, as seen with Che Pei Bao's founder, who has decades of experience yet also faces challenges in the current climate. The significant capital investments and the late entry into the market have further complicated the situation for these platforms. Ultimately, when platforms falter, the franchisees relying on them bear the brunt of the fallout. The existing legal framework allows platforms to shift operational risks to franchisees, leaving them in a position where proving their claims and obtaining compensation is challenging. The most vulnerable in this scenario are new entrants, drawn in by promises of easy profits but trapped by the lack of operational support and high exit costs. As the industry faces a shakeup and recruitment chaos, what was once touted as innovative business models has become a game of passing the buck, leaving those who believe in 'guaranteed profits' to bear the consequences.

Automotive Parts Platforms Face Crisis as Franchisees Demand Rights Amid Financial Struggles

Images

Share this post on: