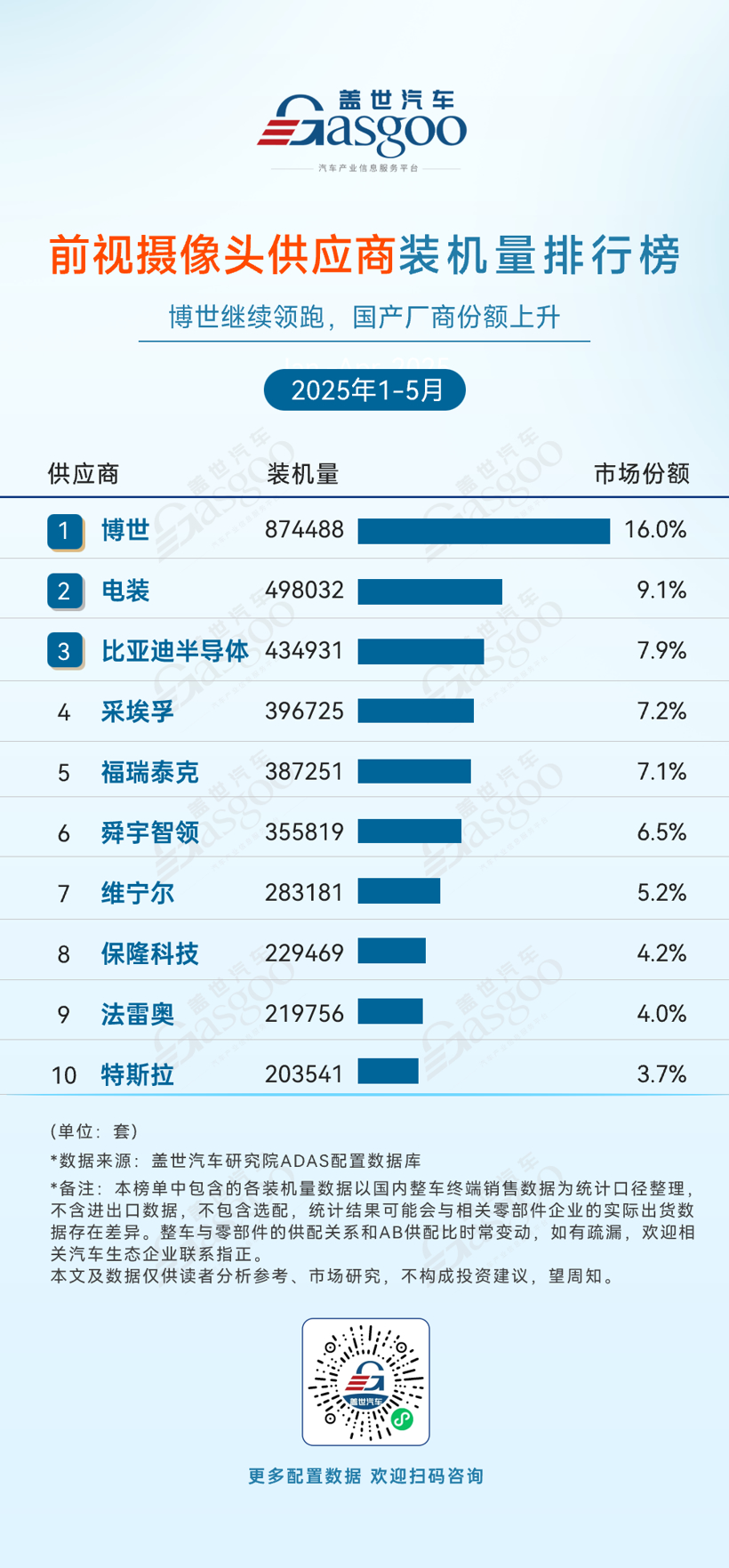

In May, the automotive ADAS (Advanced Driver Assistance Systems) supply market in China exhibited features of high concentration and the rise of local manufacturers. According to a report by the Gaishi Automotive Research Institute, from January to May 2025, the top three suppliers in the LiDAR sector - Huawei, Hesai Technology, and Suoteng Juchuang - collectively held a staggering 91% market share, highlighting the ongoing 'Matthew Effect'. In the air suspension market, local firms Konghui Technology, Top Group, and Baolong Technology dominated with a combined share of 88.4%, demonstrating strong momentum for domestic substitution. Meanwhile, in fields such as driving ADAS, front-facing cameras, and automatic parking, local players like BYD, Huawei, and Furitaek are rapidly penetrating the market, challenging the traditional advantages of international giants like Bosch and Denso, suggesting that technological barriers and localized services will be crucial in future competition. Detailed data shows that in the LiDAR supply market, Huawei led with 259,706 units and a market share of 35.6%, followed by Hesai Technology with 215,865 units (29.6%) and Suoteng Juchuang with 187,849 units (25.8%). The air suspension market was led by Konghui Technology with 125,954 units (37.7%), followed by Top Group with 90,257 units (27.0%) and Baolong Technology with 79,068 units (23.7%). In the driving ADAS sector, Bosch remained at the top with 878,558 units (15.8%), while BYD, as the only Chinese automaker in the top three, recorded 585,803 units (10.6%). The front-facing camera market was also competitive, with Bosch leading at 16% market share, followed by Denso at 9.1%. In the automatic parking solution market, Bosch again led with 397,257 units (14.3%). The high-precision map market saw Gaode with a dominant 55.5% share. Overall, the data indicates a high concentration within the ADAS supplier market, with local manufacturers increasingly challenging international brands across various sectors.

ADAS Supplier Market in China Shows High Concentration and Rise of Local Brands

Images

Share this post on: