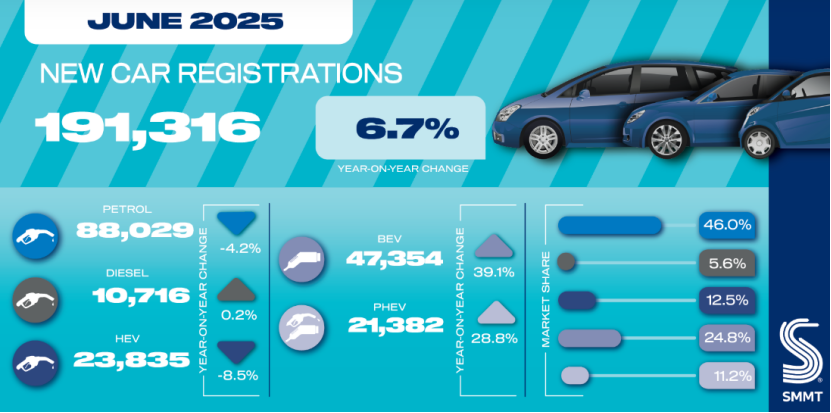

According to the latest data from the Society of Motor Manufacturers and Traders (SMMT), new car registrations in the UK increased by 6.7% year-on-year to 191,316 units in June, marking the second consecutive month of growth. This is the best June performance since 2019, contributing to a 3.5% year-on-year increase in new car registrations in the first half of the year, totaling 1,042,219 units, although this figure remains 17.9% lower than pre-pandemic levels. In terms of powertrain types, pure electric vehicle sales soared by 39.1% year-on-year to 47,354 units in June, capturing a market share of 24.8%. Plug-in hybrid vehicle sales rose by 28.8% to 21,382 units, while hybrid vehicle sales fell by 8.5% to 23,835 units. Gasoline vehicle sales decreased by 4.2% to 88,029 units, and diesel vehicle sales remained relatively stable at 10,716 units (up 0.2%). The combined market share of gasoline and diesel vehicles has dropped to 51.6%. In the first half of the year, registrations of pure electric vehicles increased by 34.6% to 224,841 units, leading to a market share of 21.6%, still below the legal requirement of 28%. Notably, to achieve the current market penetration, automakers have provided up to £6.5 billion in purchase incentives over the past 18 months. In a recent SMMT survey of automotive industry CEOs, over half (55%) of respondents believe that the UK is significantly lagging behind its target of a complete ban on new internal combustion engine vehicles by 2030. Currently, the demand for electric vehicles in the UK is being constrained by two factors: a lack of government purchase incentives and charging subsidies, and increased fiscal constraints, such as the high-value car tax (ECS) policy that has cost electric vehicle consumers over £360 million since April this year. Industry leaders unanimously agree that financial incentives for private purchases of electric vehicles are crucial for boosting demand, promoting economic growth, and strengthening the foundation of the UK automotive industry, in line with the core goals of the UK government’s new industrial strategy. SMMT CEO Mike Hawes stated, "The continuous growth of the UK new car market for two months is a positive sign, and the strong performance of electric vehicles is equally encouraging. However, the current growth of the electric vehicle market in the UK largely relies on substantial support from manufacturers and unsustainable discount strategies, and the market share of electric vehicles has not yet met legal requirements. International experience shows that government incentives can significantly accelerate market transformation; without this support, our collective climate goals will be at risk." Experts suggest that if the UK adjusts the ECS policy to exclude most pure electric vehicles from the tax, while reducing VAT on new electric vehicles and public charging services, demand for electric vehicles in the UK could see a significant boost. This would not only help create a vibrant domestic market but also position the UK as a leader in decarbonization and vehicle affordability. If related policies are implemented for three years, sales of pure electric vehicles in the UK are expected to increase by an additional 267,000 units, with annual carbon dioxide emissions reduced by 6 million tons. Additionally, data from the Automotive Research Institute shows that in May this year, China exported 28,050 passenger cars to the UK, including 13,052 pure electric vehicles.

UK New Car Registrations Increase by 6.7% in June, Electric Vehicles Surge

Share this post on: