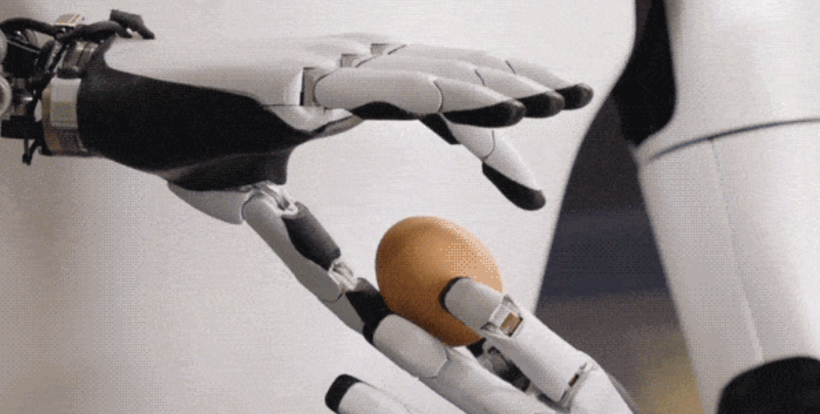

Yesterday, Tesla released its financial report for Q2 2025. Despite a nearly 5% drop in stock price following the report, the overall performance was not as disappointing as many anticipated. The total revenue for Q2 reached $22.5 billion, a 12% year-over-year decline, marking the largest quarterly drop in at least a decade, though this figure was close to market expectations of $22.8 billion. The net profit for the quarter was $1.172 billion, slightly above market forecasts, and the gross margin for vehicle sales increased by 2.5% to 15% due to price hikes on new models and improved economies of scale. Research and development expenses and capital expenditures continue to rise, with R&D costs at $1.59 billion and capital investment at $2.4 billion, both significantly higher than before. Global deliveries totaled 384,000 units, a 13.5% decrease year-over-year, with sales of the main Model 3/Y models plummeting over 70% in several European countries. From a business segment perspective, the core automotive revenue was $16.7 billion, down 16% year-over-year; energy storage revenue was $2.789 billion, down 7%; while service and other revenue increased by 17% to $3.05 billion. In terms of business progress, the launch of the budget Model 2.5 has been delayed; the Robotaxi business is expected to have a substantial financial impact by the end of next year; plans are underway to increase the scale of FSD model parameters by approximately 10 times, continuing to release the FSD supervision version more broadly in China, with plans to extend it to the European market. On the hardware front, the AI 5 chip is expected to begin production by the end of next year, showing tremendous potential; there are plans to integrate Dojo 3 with AI 6 inference chips, allowing for a single chip to be used in both vehicles and Optimus, or to be combined for applications in data centers. Regarding robots, Musk believes that Optimus 3 will be the greatest product ever. The company plans to unveil a prototype within three months and begin production early next year, with a goal of producing 100,000 Optimus robots per month within the next five years. Additionally, the Texas Gigafactory has deployed 16,000 NVIDIA H200 GPUs, expanding AI training computing capabilities, bringing the total number of H100 GPUs in the Texas supercomputing cluster Cortex to 67,000. During the earnings call, Musk expressed concern about his control over Tesla, stating that he could easily be ousted by aggressive shareholders, and hopes to address this issue at the upcoming shareholder meeting. Musk remarked, 'I believe my control over Tesla should be sufficient to ensure it develops in a positive direction, but not so much that I can’t be ousted if I go off the rails.'

Tesla Releases Q2 2025 Financial Report Amid Stock Decline

Images

Share this post on: