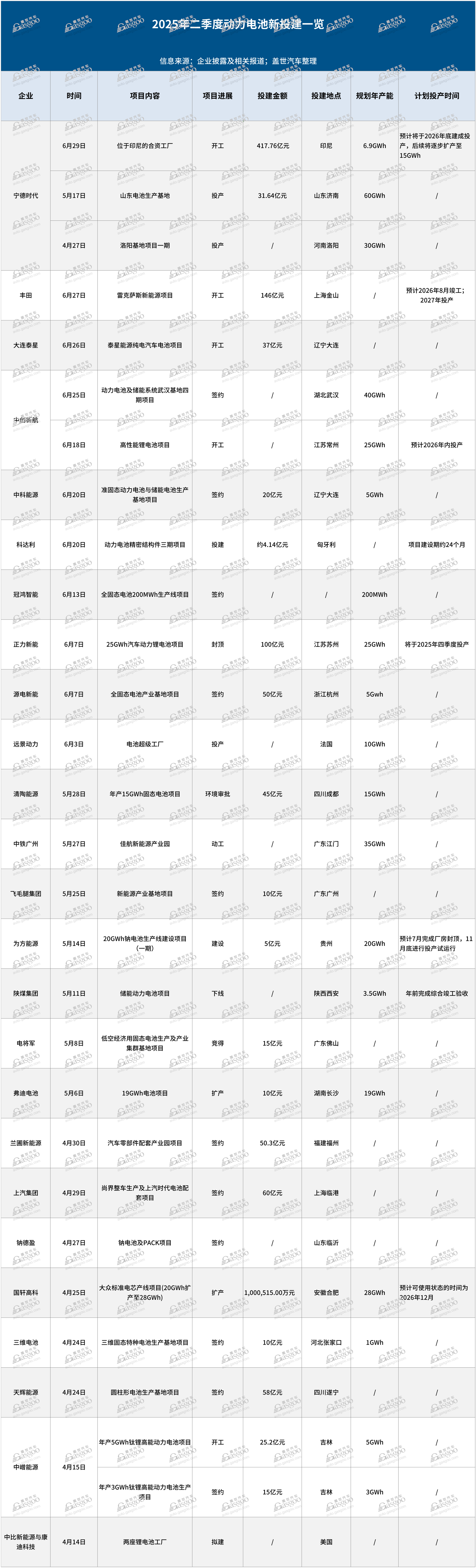

In the second quarter of 2025, the power battery industry maintained its growth momentum, driven by the ongoing expansion of the global new energy vehicle market. According to incomplete statistics from Gaishi Auto, 29 new projects were initiated by power battery companies both domestically and internationally, with total investments exceeding 111 billion yuan and planned production capacity surpassing 290 GWh. The competition for expansion intensified with 14 projects signed during this quarter, with announced investments nearing 30 billion yuan. Notably, companies such as CATL, Fudi Battery, and Guoxuan High-Tech made significant moves. On April 25, Guoxuan High-Tech announced that it would change the existing project for a "20 GWh production line for Volkswagen standard battery cells" to a "Volkswagen standard battery cell project," increasing the planned annual production to 28 GWh, with expected operational status adjusted from December 2024 to December 2026. Specifically, the project will shift from producing "20 GWh of lithium-ion batteries, including 10 GWh of ternary batteries and 10 GWh of lithium iron phosphate batteries" to "28 GWh of lithium-ion batteries, including 12 GWh of ternary batteries and 16 GWh of lithium iron phosphate batteries, along with supporting PACK production projects." Regarding Fudi Battery, on May 6, the expansion project for its PACK production line was approved. Located in Ningxiang City, this project covers an area of 86,792 square meters with a total investment of 100 million yuan, and after expansion, it will produce 19 GWh of battery packs annually. On June 25, CATL signed an agreement to start construction of its Wuhan base for power batteries and energy storage systems, planning to establish 6 new production lines with an estimated annual capacity of around 400,000 sets of battery packs, aiming for production in the first half of next year. Additionally, five related projects commenced in Q2, with major investments from Toyota and CATL, drawing significant industry attention. On June 27, the Lexus new energy project officially began construction, with an expected completion in August 2026 and an initial annual capacity of 100,000 vehicles. Two days later, CATL's joint battery factory project in Indonesia officially started, with an initial capacity of 6.9 GWh set to begin production by the end of 2026, with plans to expand to 15 GWh. The total investment for this project is part of a $6 billion power battery project signed by Indonesian companies in 2022. As per the planning, most projects aim for production in 2026, which means that by the end of 2026, these projects will gradually release capacity, providing over 80 GWh of new supply to the market. With these capacities gradually coming online, the supply capability of the power battery industry will be further enhanced. In the wave of rapid iteration and upgrading in the power battery industry, new battery technologies are undoubtedly the core engine driving industry transformation and a focal point for major battery companies in their expansion efforts. In Q2, there were 12 expansion projects related to new battery technologies, a significant increase from 7 in Q1, demonstrating vigorous industry development. Half of these projects were in the (semi-)solid-state battery sector, with total investments exceeding 14.7 billion yuan and expected total capacity surpassing 54 GWh. Companies engaged in this sector include Zhongke Energy, Guanhong Intelligent, Yuan Energy, Qingtang Energy, Electric General, and Sanwei Battery. Notably, Yuan Energy and Qingtang Energy are the main investment players. On May 28, the Chengdu Ecological Environment Bureau proposed approval for the environmental impact assessment of the Qingtang solid-state battery southwest industrial base project, which has an investment of 4.5 billion yuan and will include a manufacturing center and R&D for solid-state lithium battery energy storage technology. On June 6, a project construction promotion meeting was held in Hangzhou, which included a full solid-state battery industrial base project by Yuan Energy with a planned investment of about 2.5 billion yuan. This project aims to establish a high-end digital factory producing solid-state batteries, with an estimated annual output value of 5 billion yuan. In the sodium battery sector, only one new investment project was signed in Q2, while a cylindrical battery production base project was also noted. Overall, the second quarter saw diverse developments in (semi-)solid-state battery projects, expanding into more emerging application areas.

Power Battery Industry Continues Growth with New Investments in Q2 2025

Images

Share this post on: