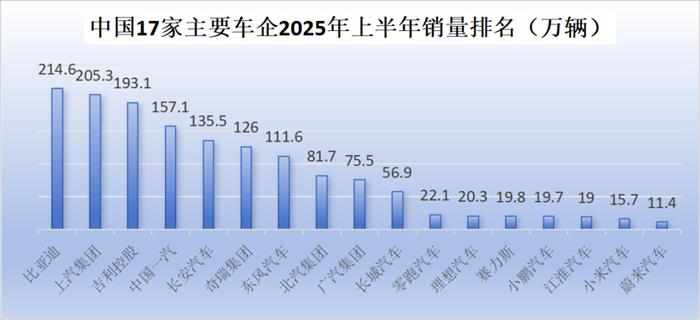

The mid-year examination of the Chinese automotive market has unveiled significant trends. According to data from the Passenger Car Association, retail sales of passenger vehicles in the first half of the year reached 10.901 million units, marking a 10.8% increase year-on-year, showcasing a remarkable growth rate. As production and sales data continue to be released, the competitive landscape among 17 major automotive enterprises is becoming clearer. BYD, SAIC Group, and Geely Holding Group have formed the top three in terms of sales, with only about a 10% difference between them, indicating a tightly contested market. Meanwhile, the divide between traditional car manufacturers and new entrants is widening. The former relies on scale advantages to maintain their market share but experiences slower growth, while the latter, represented by Leap Motor and XPeng, is making strong gains through high growth and flexible strategies. The competition in sales during the first half of the year suggests that the second half will see even more intense reshuffling.

In the battle for the top three positions, BYD leads with cumulative sales of 2.146 million units, representing a year-on-year growth of 33.04%. Approximately 1.0234 million of these are pure electric vehicles, showing a growth of 40.93%, while plug-in hybrid sales reached about 1.0899 million, growing by 23.71%. BYD's overseas sales surged to 470,000 units, a 132% increase, although domestic growth is slowing down. In June, domestic sales of passenger vehicles dropped by 8% year-on-year, while overseas markets became a new driving force, with exports skyrocketing 229.8%. BYD's Chairman Wang Chuanfu stated that overseas markets significantly contribute to profitability.

SAIC Group follows closely with sales of 2.053 million units, marking a 12.4% year-on-year increase, with monthly sales showing six consecutive months of growth. The group has met 45.62% of its annual target of 4.5 million units. Their self-owned brand sales reached 1.304 million units, up 21.1%, while new energy vehicle sales reached 646,000 units, a growth of 40.2%. Despite this, SAIC's overseas sales growth remains below the industry average. Geely Holding Group's overall sales reached 1.931 million units, up 30%, with new energy vehicle sales hitting 1.001 million units, a 73% increase, achieving a penetration rate of 52%. Geely has become the only company to raise its annual target mid-year, from 2.71 million to 3 million units, reflecting confidence in its strategy.

Among traditional manufacturers, Changan Automobile and Chery Group performed steadily. Changan recorded sales of 1.355 million units, a slight increase of 1.59%, reaching an eight-year high. Its self-owned brand sales accounted for 84.9%. Chery's sales of 1.26 million units marked a 14.5% increase, with exports leading among Chinese automakers. Conversely, GAC Group and Dongfeng Motor showed declines, with GAC's sales dropping by 12.48% and Dongfeng achieving only 37.2% of its annual target.

In the new energy vehicle sector, Leap Motor emerged as the sales champion among new players with 221,700 units sold, a 155.7% year-on-year increase. XPeng saw a remarkable growth of 279%, achieving 197,200 units sold. Xiaomi's automotive arm also made headlines with deliveries of 157,000 units, marking a 400% increase. However, traditional players like Li Auto and NIO struggled with minor growth or declining sales.

The second half of the year will likely witness intensified competition, especially as players strive to meet ambitious targets. The focus now shifts to who can leverage overseas markets and technological advancements to secure a competitive edge in the evolving landscape of the Chinese automotive industry.

Mid-Year Sales Data Reveals Intense Competition in China's Auto Market

Share this post on: