As a century-old unicorn enterprise embarks on a transformative journey, its energy is shaking the entire industry. Recently, the Hurun Research Institute unveiled the "2025 Hurun Global Unicorn List," with Jingxi Zhixing making a strong comeback with an estimated valuation of approximately 13 billion RMB, reaffirming its leading position in the smart automotive chassis supply chain. The fervent pursuit by the capital market is deeply rooted in Jingxi Zhixing's century-long technological foundation. Notably, Jingxi Zhixing has recently undergone a significant strategic transformation across three dimensions: product management, organizational restructuring, and supply chain strategy, achieving a leap from technical accumulation to market breakthroughs. This has infused the company with new vigor, showcasing a robust momentum in the fiercely competitive market that has stirred the industry’s imagination about its future prospects.

Technological Breakthroughs: The Analysis of MagneRide® Technology

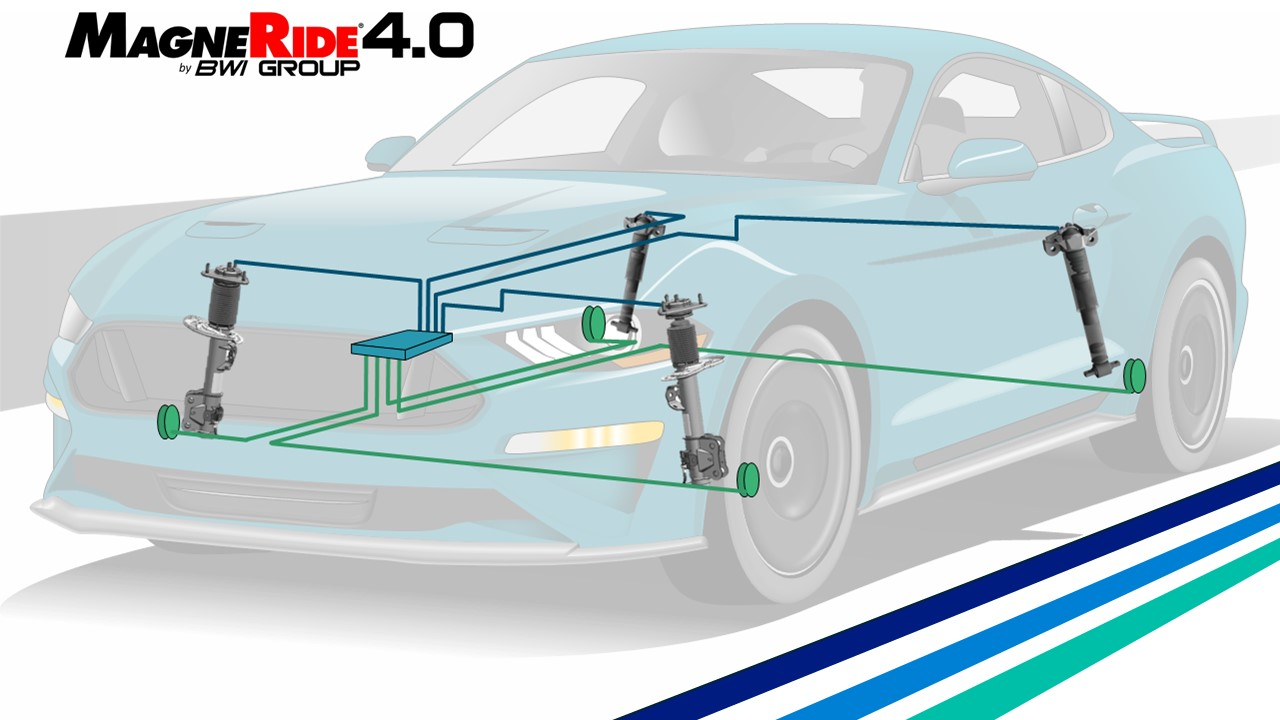

It is impossible to discuss Jingxi Zhixing without mentioning its core technology, the MagneRide® suspension system. This industrial application represents the future of suspension technology, having evolved from its inception during the Delphi era to its fourth generation today. Originally debuting with the Cadillac STS in 2002, it continuously reshapes the driving quality of luxury vehicles, creating an unshakeable technological moat for Jingxi Zhixing. Moreover, Jingxi Zhixing is constructing a matrix of intelligent chassis solutions that include the electronically controlled braking system (EMB) and the MagneRide® system. Jingxi Zhixing is currently the only company globally with complete R&D and production capabilities for MagneRide® suspension systems.

However, despite its strengths, Jingxi Zhixing finds itself in an awkward position where its technical prowess does not match its market share in China, with a mere sub-1% market share in the passenger vehicle line control braking system as per data from the Gai Shi Automotive Research Institute. To unlock the commercial value of its century-old technology in the Chinese market, Jingxi Zhixing aims to double its sales in the region within the next two to three years while maintaining steady growth in overseas markets. Achieving this goal is no easy task, as many of its clients in the Chinese market have annual sales below 30 million RMB, making it difficult for them to gain attention.

After an in-depth internal evaluation, Jingxi Zhixing's decision-makers implemented a strategic transformation plan, establishing a product planning committee to focus resources on the MagneRide® and EMB systems, reducing non-strategic product lines. This shift from a 'broad and weak' to a 'narrow and strong' approach aims to reshape its core value in the OEM ecosystem. The MagneRide® suspension system is set to be mass-produced in the first quarter of this year, and the EMB system's automated production line is expected to be completed within the year, laying the groundwork for mass production by 2026. Together, these innovations position Jingxi Zhixing at the center of smart chassis development.

As time progresses, the results of the strategic focus are becoming increasingly evident. Data from the Gai Shi Automotive Research Institute shows that the number of new models equipped with Jingxi Zhixing's line control braking solutions surged by 460% year-on-year in the first four months of 2025. More importantly, the company has reportedly secured over 10 billion RMB in new orders since its transformation, primarily from domestic automobile brands. By concentrating on core products with high technological barriers, Jingxi Zhixing is breaking through procurement barriers with leading local OEMs at an unprecedented speed.

Organizational Restructuring: Navigating a Chinese-style Transition

As the penetration rate of new energy passenger vehicles in China surpassed 50% in April this year, a revolution led by local automakers is entering deeper waters. With a focus on 'quarterly iteration' in R&D efficiency and cost optimization, Jingxi Zhixing's supply chain response time has shortened to a weekly level, rewriting the global automotive industry's rules of the game.

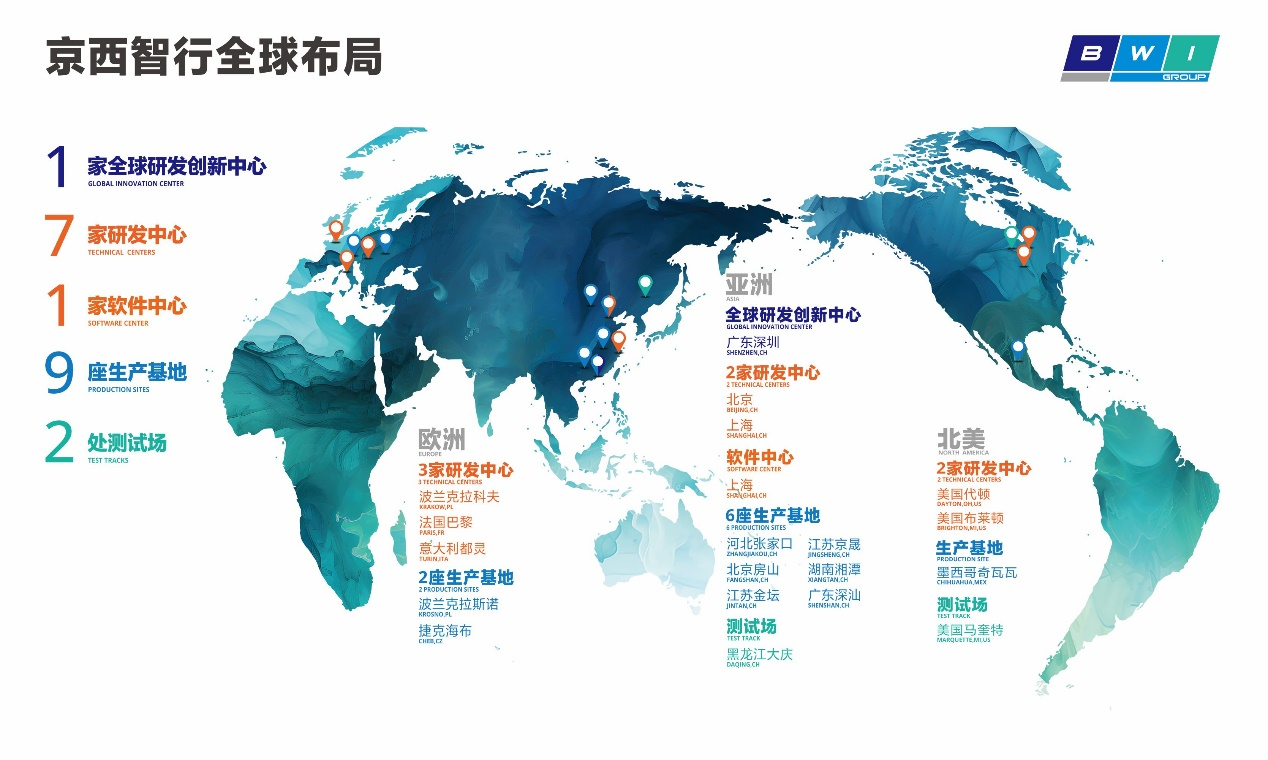

In light of this challenge, traditional multinational enterprises with lengthy decision-making processes need more than just project cuts; they require a fundamental organizational overhaul to regain competitiveness in this disruptive transformation. Jingxi Zhixing, with its nine production bases, seven technology centers, and one global R&D center, has particularly felt this challenge. The large network spread across North America and Europe often faces internal barriers and lengthy approval chains. Consequently, starting in the second half of 2024, Jingxi Zhixing initiated an unprecedented organizational 'blood replacement' campaign, eliminating over ten managerial positions and letting go of over 400 mid-to-senior level managers and R&D personnel, which were swiftly replaced by a new generation of talent well-versed in product logic and innovation.

This 'blood replacement' is merely the prologue; the core battle lies in restructuring the organizational DNA. Jingxi Zhixing has launched a cross-industry talent introduction plan, with a focus on recruiting individuals from Huawei to inject internet-driven objectives and results-oriented principles into its corporate culture. This strategy broke down decades-old pyramid processes, establishing a closed-loop task force that integrates R&D, sales, and delivery. Additionally, Jingxi Zhixing implemented the DingTalk global collaboration system, reducing traditional email approval times from weekly responses to within eight hours.

Supply Chain Transformation: Regional Collaboration to Leverage Cost Advantages

In the rapidly changing automotive industry, the speed of supply chain response and cost control capability are critical variables for success. This has highlighted the challenges faced by Jingxi Zhixing, which has traditionally utilized a unified global procurement model. The company has now shifted to a regional-driven procurement strategy, delegating procurement responsibilities to local teams in North America, Europe, and China to enhance responsiveness to regional market demands. This approach preserves critical scale bargaining power while avoiding decision-making inefficiencies caused by organizational redundancy.

For example, Jingxi Zhixing launched its 'MagneRide® Year' initiative in January, aiming to reduce prices below traditional electromagnetic valve suspension levels. This ambitious goal is supported by over 140 global patents and a production capacity of 2 million units per year from its Shenzhen and Zhangjiakou bases. In March, Jingxi Zhixing entered partnerships with key suppliers in Zhangjiakou to localize critical components for its MagneRide® system, significantly reducing costs and lead times.

In summary, Jingxi Zhixing's recent strategic transformations are setting the stage for its acceleration towards growth, positioning it as a formidable force in the global automotive landscape. With a renewed focus on core technologies and an agile organizational structure, Jingxi Zhixing is poised to redefine the competitive landscape in the intelligent chassis sector.

Jingxi Zhixing's Strategic Transformation and Global Ambitions

Images

Share this post on: