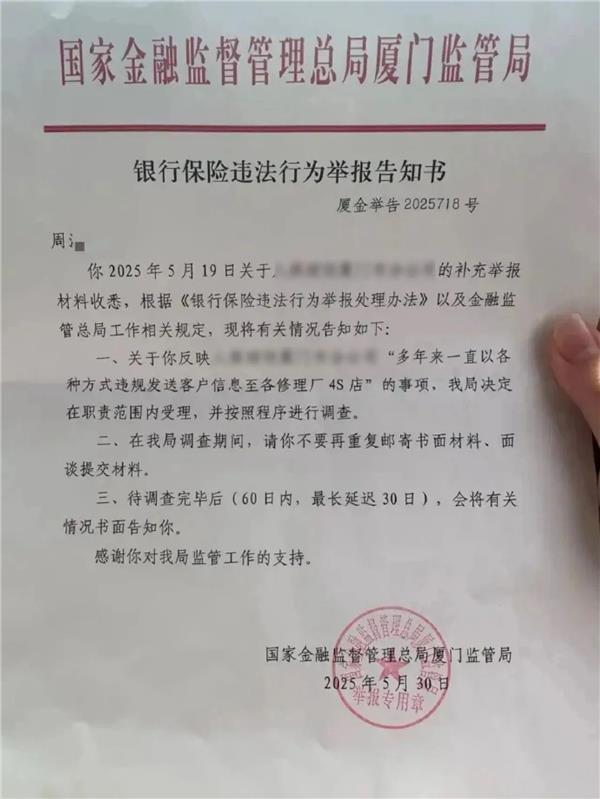

Recently, a former employee of a property insurance company in Xiamen reported that during their employment, they leaked over a thousand pieces of customer privacy information to partner 4S dealerships via social media under the direction of their supervisor. This information included details such as vehicle license plate numbers, owner phone numbers, and accident locations. In March 2025, the police fined the employee 1,500 yuan under relevant provisions of the Cybersecurity Law, while the supervisor faced criminal charges due to the severity of the situation. However, the incident did not end there; the employee was subsequently fired by the company. In May 2025, the former employee reported the company to the Xiamen regulatory bureau of the National Financial Regulatory Administration, accusing it of long-term illegal leakage of customer information to 4S dealerships. Regulatory authorities have since intervened, but no investigation results have been published yet. This case serves as a mirror reflecting the distorted ecosystem of the accident vehicle industry, where 'resources are exchanged for resources' seems to be the prevailing norm, treating vehicle owners as mere commodities. Industry insiders view the regulatory intervention as a positive signal, but they believe that mere case-by-case penalties are far from sufficient. The chaotic state of the accident vehicle repair industry remains an unachievable dream for reform.

1. Accident Vehicle Customer Information Has Become 'Hard Currency'

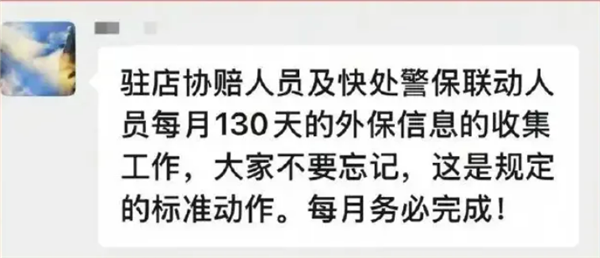

The practice of insurance companies pushing accident vehicle customer information to 4S dealerships is already an 'open secret' within the industry, born from the homogenized competition in the auto insurance market. In the fierce market competition to capture premium resources, insurance companies often engage in a 'resource exchange' model, making 'accident vehicle information' a critical bargaining chip. To secure information collection, insurance companies implement performance-linked assessments for relevant staff. As indicated in leaked internal chat records, company leaders required staff to collect 130 external insurance information entries monthly, rewarding those who meet the target and penalizing one yuan for each missing entry. Although the former employee's exposure is perceived as a desperate act, their ultimate role as a scapegoat was not unexpected. For 4S dealerships, accident vehicle business is crucial for survival, accounting for 40%-50% of after-sales value with profit margins as high as 35%-45%. Managing accident vehicle leads is a primary step; without customers, everything else is moot. Therefore, 4S dealerships place great importance on leads provided by insurance companies and have established strict internal management processes to maximize the value of each lead. Furthermore, 4S dealerships also explore the monetization potential of accident vehicle information. For instance, when accidents involve multiple brands, external personnel share vehicle accident information (only including brand and vague loss estimates) in industry WeChat groups, allowing interested repair enterprises to pay a fee to obtain detailed vehicle information and owner contact details for 'order taking'. This clearly indicates that accident vehicle customer information has become 'hard currency' in the exchange of interests within the industry. Some lawyers have pointed out that the awareness of the parties involved in the illegal behavior does not affect the determination of the act's illegality. Even if individuals are unaware of the laws or do not know their actions are illegal, any act that infringes on citizens' personal information constitutes an offense. The illegal flow of accident customer information reflects the systemic risks lurking within the industry's ecosystem.

2. Why Do Insurance Companies Continue to Violate Regulations?

The behavior of insurance companies pushing accident vehicle information to cooperative repair parties, though seen as a 'hidden rule' within the industry, clearly crosses compliance boundaries. According to standard insurance accident handling procedures (involving only the damages between the two parties), the vehicle owner should have the right to choose their repair provider after reporting the accident, determining responsibility, and assessing damages. While assessors can recommend repair enterprises, the final decision rests with the owner. The core of compliance lies in the necessity for insurance companies to explicitly seek the owner's consent and obtain authorization for information sharing and repair point selection. However, in practice, insurance companies often skip the crucial authorization step and directly push accident information to cooperative 4S dealerships or repair shops, sometimes even pressuring owners to go to designated repair locations through compensation conditions. The root of this practice lies in the profit-driven motives of insurance companies. As financial institutions, their core goal is profit. For example, with the comprehensive reform of auto insurance, regulators have raised the expected payout ratio to 75%, meaning insurance companies must achieve profitability within an operational cost framework that comprises only 25% of premiums. The immense cost pressure 'forces' insurance companies to compress expenditures on the claims side—binding specific repair channels (especially lower-cost partners) becomes an irresistible part of their 'cost reduction and efficiency enhancement' strategy. Pushing accident information to cooperative partners essentially aims to secure lower agreement repair prices and ensure repair volume in exchange for premium resources, thus seeking profit space within stringent cost frameworks. However, this 'shortcut' directly tramples legal and regulatory red lines. Skipping authorization to push customer information that includes license plates, phone numbers, and accident locations constitutes illegal provision of personal information. The China Banking and Insurance Regulatory Commission's 'Guidelines for Motor Vehicle Insurance Claims Management' clearly state: 'Insurance companies must ensure the right of customers to freely choose repair units and may not force or indirectly force designated repair units.' Insurance companies only have the right to suggest; consumers have the complete right to refuse their recommendations and independently choose repair institutions. Thus, the so-called industry logic of 'resource exchange' cannot obscure the essence of infringing on consumer choice and personal information rights.

3. When Will the Chaos of Resource Exchange in Accident Vehicles Be Resolved?

To resolve the issue, one must start with those who created it. CCTV News has revealed that insurance companies, as the financial controllers and main decision-makers in the claims chain, have a profound impact on repair quality and safety and should uphold integrity and compliance. However, the reality is that, leveraging their absolute advantage in assessment rights, insurance companies often find themselves in a conflict of interest as both 'referee and player.' A typical example is the public confrontation between Wuhan Hengxin Group and PICC in 2022: PICC unilaterally announced a suspension of cooperation, refusing to recognize Hengxin's assessment results, even notifying vehicle owners via text message. This sparked industry controversy—individual disputes causing consumers to bear the consequences exposed the dominance and arbitrariness of insurance companies within the chain. A deeper issue is that the entire accident vehicle ecosystem has fallen into a distorted state of 'collusion among all.' Insurance companies skillfully utilize 'resource exchange' hidden rules to bind repair shops, resulting in numerous unqualified 'family-run shops' obtaining accident vehicle resources through gray methods such as affiliation and subcontracting. Even more worryingly, some vehicle owners, tempted by high rebates, tacitly allow repair shops to use 'substitute parts' and 'high imitation parts' to pass off as original parts. When layers of exploitation become the norm, uninformed consumers become the ultimate victims, leading to frequent repair disputes. Consequently, accident vehicle business has devolved into a resource grab rather than market competition based on service quality. Every link in the chain strives to carve out profit. Industry insiders sharply point out: 'When vehicle owners can profit without spending money on insurance, the rules of competition have collapsed; enterprises without strong resources can only exit the market.' In contrast, the motivation behind the former employee's whistleblowing incident was their perception of unfair treatment rather than an awakening awareness of the violation of vehicle owner information rights. This precisely reflects the unresolved issues in the industry—core interests of vehicle owners are still not genuinely respected by insurance companies and repair enterprises. Many core issues facing the industry, such as the owner's autonomy in repairs, handling of damaged parts (repair or replacement?), and choice of parts source (original or remanufactured?), remain unclear. Returning the accident vehicle business to its essence of service rather than resource competition still requires a systematic breakthrough.

Insurance Company Employee Exposes Illegal Customer Information Leaks

Images

Share this post on: