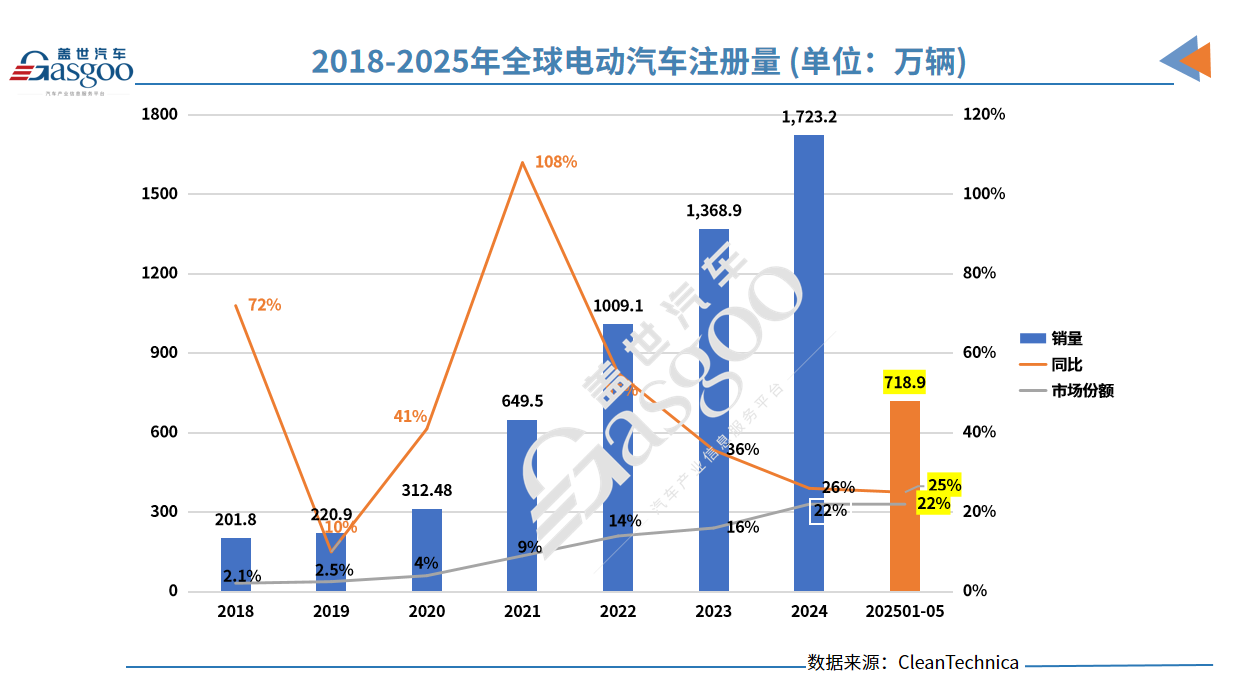

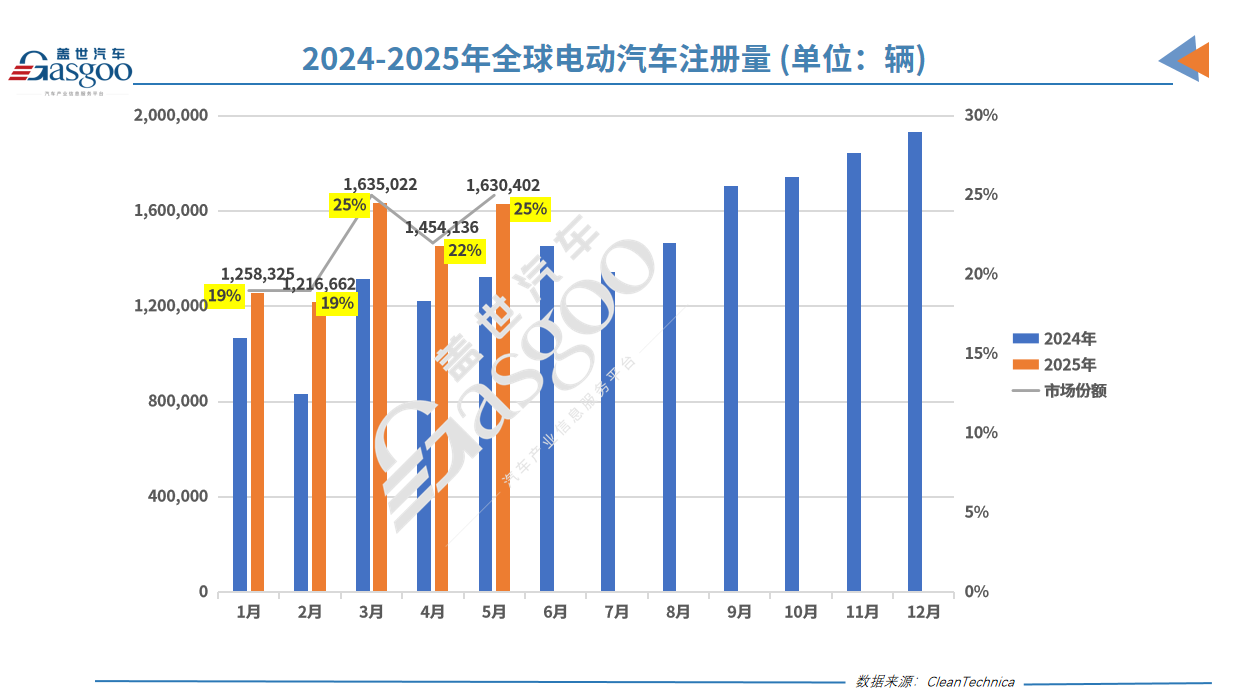

In 2025, the global electric vehicle market continues to warm up compared to 2024, but the growth rate has significantly slowed down compared to previous years. According to CleanTechnica, in the first five months of this year, a total of 7.189 million electric vehicles (including pure electric vehicles and plug-in hybrids) were registered globally, representing a year-on-year increase of 25%. In May alone, the new vehicle registrations in the global electric vehicle market reached 1,630,402, up 22% year-on-year. Among these, pure electric vehicles saw a 19% increase, with registrations exceeding 1 million and accounting for 65% of the total; plug-in hybrids grew even faster, with a 28% year-on-year increase, reaching over 500,000 registrations. Overall, electric vehicles captured 25% of the global automotive market share in May, an increase of 5 percentage points compared to the same period last year and 3 percentage points compared to April. As the traditional sales peak season arrives in June, the market share of global electric vehicles is expected to further improve.

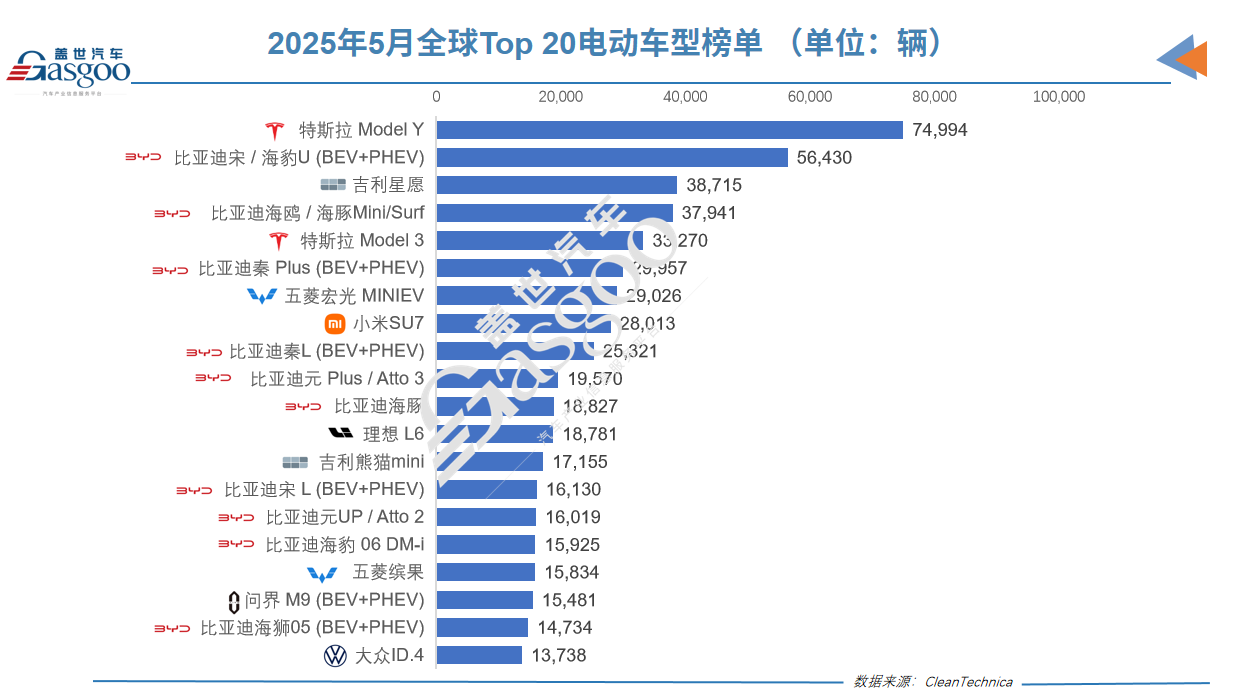

Tesla's Model Y regained the top spot, but sales are still declining. Despite a 19% year-on-year drop in registrations, Tesla Model Y achieved approximately 75,000 units in May, reclaiming its position as the world’s best-selling electric vehicle, replacing BYD Song (known as Seal U in overseas markets), which saw an 11% decline to about 56,000 units. Although these two models continue to maintain a strong presence in the electric vehicle market, they are facing significant growth pressures. Without the overseas sales support for BYD Song (in markets like Europe and Brazil), its ranking might have slipped further. Notably, the market response to the refreshed Tesla Model Y launched in March has been limited, with April registrations still plummeting by 29%. Although there was a slight recovery in May, it still represented a 19% decline. If June cannot reverse this trend, Tesla's dominance in the global electric vehicle market will be in jeopardy. More critically, the situation for Tesla Model 3 is dire, with global registrations dropping 29% year-on-year to around 33,000 units. Amid slow model updates and the emergence of new competitors, this model is facing increasingly fierce competition, with some consumers turning to the newer Model Y.

Geely's Xingyuan jumps to third place. In May, Geely Xingyuan achieved a record 38,715 registrations, making it the third best-selling electric vehicle. This marks the fifth consecutive month that this model has set a monthly sales record, successfully surpassing its direct competitor BYD Dolphin (also known as Dolphin Mini/Surf), which came in fourth with a slight margin of about 800 units. It's worth noting that Geely Xingyuan is still primarily focused on the domestic market and continues to increase delivery volumes; if it accelerates its export pace in the future, it could potentially challenge the top positions. Meanwhile, BYD Dolphin is not idle either, as it gradually enters the European market, its overseas sales are expected to increase. These two Chinese micro electric vehicles will compete for the top spots during Tesla's downturn.

Additionally, BYD's Sea Lion 05 saw its registrations rise to 15,000, entering the global top 20 for the first time, which led BYD to dominate the top 20 list with 10 models, claiming half of the market share. Outside the top 20, Leapmotor C10 registered 13,567 units, just one step away from making the list. The 20th position is held by Volkswagen ID.4, the only entry from international traditional automakers, while Volkswagen ID.3, the second best-selling electric model from traditional automakers, registered 10,976 units, lagging far behind new models from China, such as AITO M8 (12,116 units) and BYD Sea Lion 07 (11,866 units). It's noteworthy that, in the May global electric vehicle registration top 20 list, aside from the two Tesla models and Volkswagen ID.4, all other entries are Chinese models. Given that the second half of the year typically sees stronger performance in the Chinese automotive market, and Volkswagen's business in China remains sluggish, it is possible that even Volkswagen ID.4 could be pushed out of the rankings, resulting in the top twenty being completely occupied by Chinese models and Tesla.

From January to May, the top three remain unchanged, maintaining the 'iron triangle' pattern of Tesla Model Y, BYD Song, and Tesla Model 3 since 2022. Given that there is still a sales gap of 25,000 units between Tesla Model 3 and the fourth-place BYD Dolphin, it is anticipated that the top three will not change by the end of the year. However, with new Chinese forces continuing to exert pressure, changes are quietly occurring outside the top three. BYD Dolphin and Geely Xingyuan are both demonstrating strong growth momentum, posing potential threats to Tesla Model 3. Additionally, Li Auto L6 and Geely Panda Mini have climbed to 11th and 12th places respectively. Furthermore, many models in BYD's lineup are also rising in rankings, including Dolphin, which jumped 3 places to 15th, Yuan UP reaching 18th, and BYD Song L entering the rankings at 19th. The surge in small cars is also reflected in Wuling Bingo's rise, which has entered the global top 17, further confirming the global popularity of micro pure electric models.

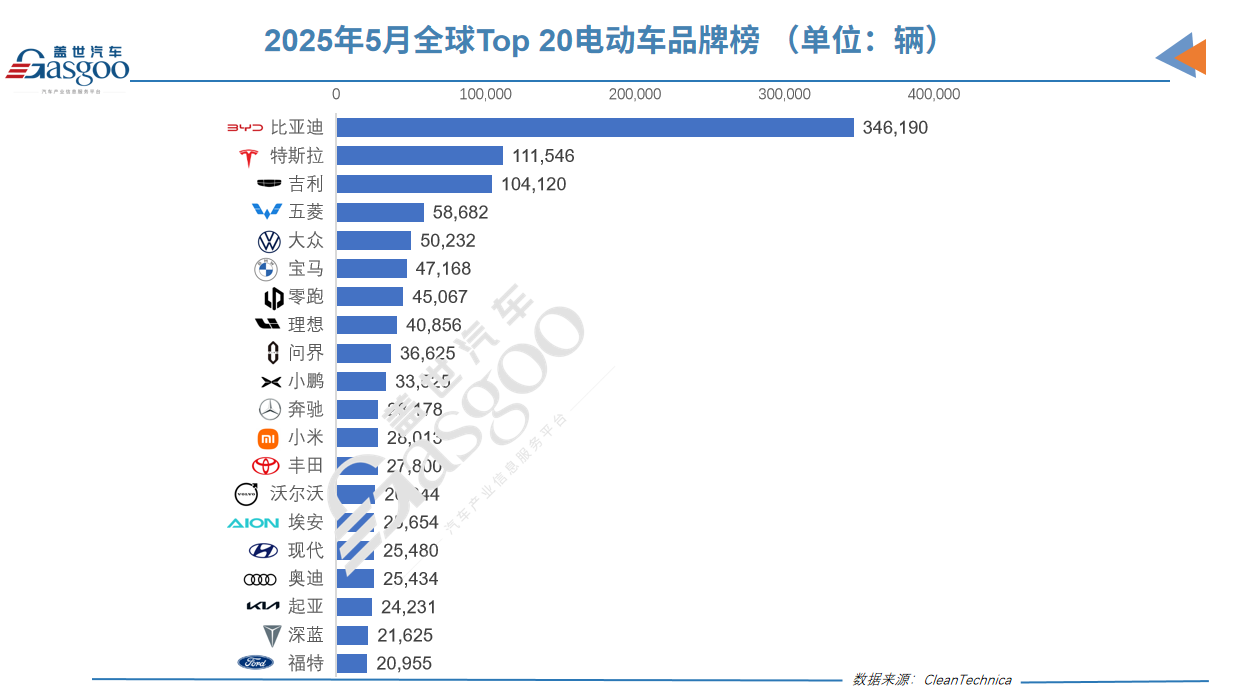

In terms of brand competition, the top three global sales in May were BYD, Tesla, and Geely. BYD maintained its lead with nearly 350,000 units, continuing to dominate the market, with sales about three times that of Tesla. However, despite leading in total volume, BYD's growth in the domestic market is slowing, and its ability to maintain rapid growth will depend on the expansion speed in overseas markets. Tesla's sales in May dropped 24% year-on-year to 111,500 units, but it narrowly regained second place over Geely. Nevertheless, Geely's performance is noteworthy, achieving a record registration of 104,120 units in May, as it continues to challenge BYD's dominance and strive to surpass Tesla. Geely's progress in market share is also significant. A year ago, Geely ranked third with a 7.9% market share; it has now increased by 3.4 percentage points to 11.3%, rising to second place. This stands in stark contrast to Tesla, which saw its market share decline by 3.6 percentage points during the same period. Beyond Geely, Leapmotor's registrations have also been setting new records, with May deliveries surging 148% year-on-year to over 45,000 units, making it the best-selling new electric vehicle brand in China. AITO, with strong performance from the M8 model, surged to ninth place among brands with over 36,000 units; Xiaomi is also expected to ramp up production to 50,000 units by the end of the year, putting pressure on Leapmotor.

In the latter half of the rankings, Deep Blue and Ford have re-entered the list, with Ford benefiting from sales growth in Europe and expected strong demand in the U.S. market as consumers rush to purchase electric vehicles before tariffs increase and subsidies are removed. In summary, the new energy landscape is being reshaped, with more domestic brands rising. From the data in May 2025, the global electric vehicle market is undergoing a profound transformation. Tesla is no longer an unattainable myth; domestic brands are rapidly rising, especially with the explosion of micro electric vehicles and new forces reshaping the global electric vehicle market structure. BYD continues to lead, Geely is hot on its heels, and emerging brands like Leapmotor and AITO are making strong debuts, while traditional giants like Tesla and Volkswagen are being forced into a defensive position.

Global Electric Vehicle Market Heats Up in 2025, But Growth Slows

Images

Share this post on: