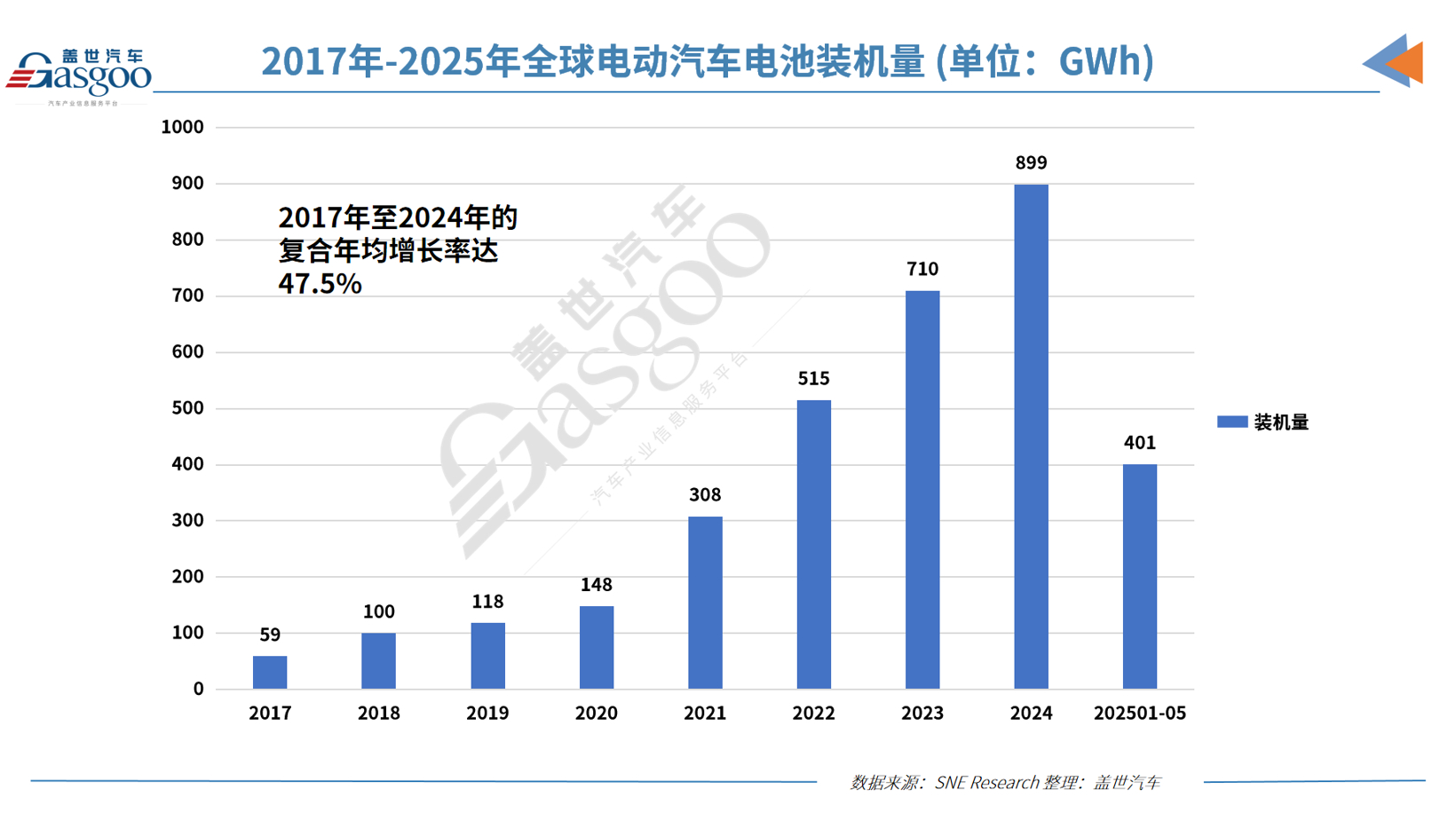

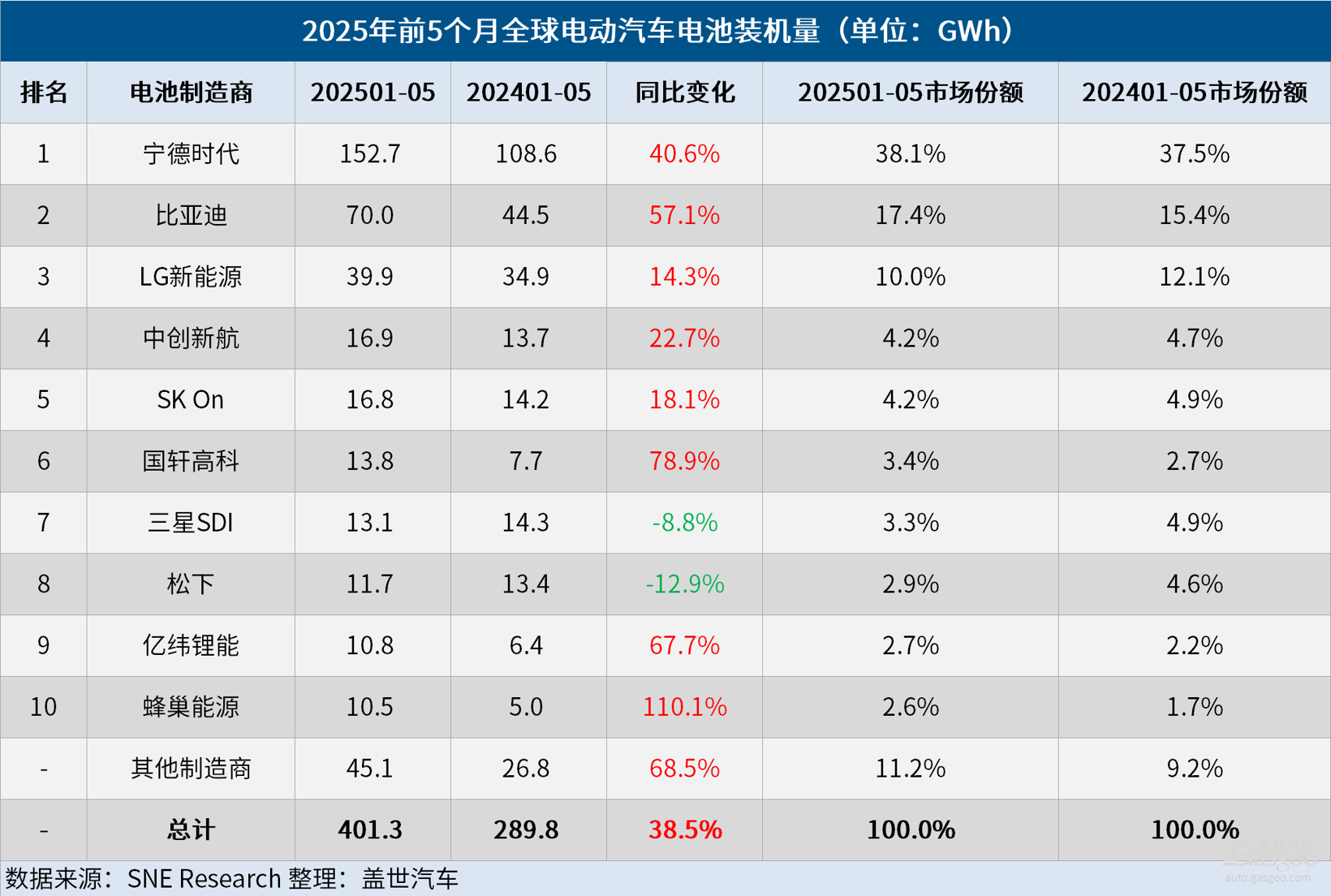

Recently, data released by South Korean market research firm SNE Research indicates that the global electric vehicle (EV) battery installed capacity (including pure electric, plug-in hybrid, and hybrid models) reached 401.3 GWh in the first five months of 2025, marking a 38.5% increase from 289.8 GWh during the same period last year. In the first five months of 2025, six Chinese EV battery manufacturers made it into the top ten global EV battery installed capacity rankings. CATL continues to dominate the market, with installed capacity increasing by 40.6% year-on-year to 152.7 GWh, though its growth rate has slightly slowed compared to the first four months of this year (42.4%). CATL's market share stands at 38.1%, up by 0.6 percentage points year-on-year. In addition to Chinese brands like Zeekr, Wuling, Li Auto, and Xiaomi, global automakers such as Tesla, BMW, Mercedes-Benz, and the Volkswagen Group also widely utilize CATL's batteries. As the world's largest EV manufacturer, BYD's battery installed capacity grew by 57.1% to 70.0 GWh, with its market share rising from 15.4% to 17.4%, maintaining its second-place position, although its growth rate has also slowed from 60.8% in the first four months of this year. BYD produces both batteries and electric vehicles (including pure electric and plug-in hybrid vehicles), leveraging its strong vertical integration and resulting price competitiveness to launch multiple market-recognized electric vehicles. In 2025, BYD's EV sales are projected to reach approximately 5.5 million units, and with its continued growth momentum, BYD is expected to expand its global market share further. Other four Chinese battery manufacturers also maintained strong growth, although their rankings have seen some changes. Notably, CALB's battery installed capacity grew by 22.7% to 16.9 GWh, moving up from fifth to fourth place; Gotion's battery installed capacity surged by 78.9% to 13.8 GWh, securing sixth place; EVE's battery installed capacity increased by 67.7% to 10.8 GWh, ranking ninth; and SVOLT followed closely with a battery installed capacity of 10.5 GWh, marking the fastest growth rate among battery manufacturers in the first five months of this year at 110.1%. The combined battery installed capacity of South Korea's battery giants (LG Energy Solution, SK On, and Samsung SDI) accounted for 17.4% of the global total in the first five months of this year, a decline of 4.5 percentage points year-on-year. Among them, LG Energy Solution's battery installed capacity still grew by 14.3% to 39.9 GWh, ranking third, but its market share dropped from 12.1% last year to 10.0%. Although SK On's battery installed capacity rose by 18.1% to 16.8 GWh, its ranking fell from fourth to fifth, and its market share decreased from 4.9% last year to 4.2%. Samsung SDI's battery installed capacity continued to decline, dropping by 8.8% to 13.1 GWh, with its market share falling from 4.9% last year to 3.3%, primarily due to a decline in battery demand from major automakers in Europe and North America. In terms of specific models, Samsung SDI batteries are mainly used in brands like BMW, Audi, and Rivian. Despite good sales of models like the BMW i4 and i5 equipped with Samsung SDI batteries, the decline in Audi Q8 e-Tron sales and Rivian's standard model using non-Samsung SDI produced lithium iron phosphate (LFP) batteries negatively impacted Samsung SDI's battery installed capacity performance. SK On mainly supplies batteries for Hyundai Motor Group, Ford, Mercedes-Benz, and the Volkswagen Group. The sales rebound of Hyundai's IONIQ 5 and EV6 models, combined with strong sales of the Ford F-150 Lightning in North America and Volkswagen's ID.7 and ID.4 in Europe, boosted SK On's battery installed capacity growth. LG Energy Solution batteries are primarily used in models from Tesla, Chevrolet, Kia, and Volkswagen. However, Tesla's weak sales this year led to a year-on-year decline of 13.3% in LG Energy Solution's battery installed capacity due to reduced demand, particularly in the European market where sales of Chinese OEM-produced electric vehicles are expanding while Tesla's demand has decreased. Despite this, LG Energy Solution's overall battery installed capacity still grew by 14.3% thanks to good sales of the Volkswagen ID series and Kia EV 3, alongside increased sales of Chevrolet electric vehicles based on GM's Ultium platform in North America. Additionally, Panasonic, the only Japanese company in the top ten global EV battery installed capacity rankings, is also one of the manufacturers experiencing a decline in installed capacity alongside Samsung SDI. In the first five months of this year, Panasonic's battery installed capacity fell by 12.9% to 11.7 GWh, ranking eighth. The decline in Tesla Model 3 and Model Y demand has impacted Tesla's sales this year, leading to a decrease in Panasonic's battery installed capacity due to its heavy reliance on Tesla. However, with upgrades to its 2170 and 4680 batteries, Panasonic's battery installed capacity in the North American market is expected to recover rapidly. In response to the recent U.S. tariffs on Chinese batteries and raw materials, Panasonic is adjusting its supply chain and increasing the proportion of localized production in North America. It is noteworthy that Panasonic is working to reduce its reliance on Chinese materials while ensuring new material supplies through expanded local sourcing and diversifying its raw material supply chain to create a stable battery supply chain. These initiatives are expected to drive a rebound in its battery installed capacity and enhance its operational stability in North America. In the competition between Chinese and foreign battery manufacturers, China continues to show strong momentum while South Korean and Japanese manufacturers are struggling. From 2017 to 2024, the compound annual growth rate (CAGR) of global electric vehicle battery installed capacity reached 47.5%, highlighting the sustained growth of the global electric vehicle market. This trend continues into 2025. According to CleanTechnica, the cumulative registration of global electric vehicles (including pure electric and plug-in hybrid vehicles) reached 7.189 million units in the first five months of this year, a year-on-year increase of 25%. Leveraging the world's largest electric vehicle market, China's two dominant EV battery giants, CATL and BYD, have seen their market share continue to rise in the first five months of this year, collectively holding 55.5% of the global electric vehicle battery market, an increase of 0.1 percentage points compared to the first four months of this year and up 2.9 percentage points year-on-year. Although CALB's market share slightly decreased from 4.7% last year to 4.2%, it still achieved a small ranking improvement. Gotion, EVE, and SVOLT's market shares increased year-on-year by 0.7, 0.5, and 0.9 percentage points, respectively, bringing the total market share of these three Chinese battery manufacturers to 8.7%. This means that in the first five months of this year, Chinese EV battery manufacturers accounted for a total market share of 68.5% globally, a further increase of 0.5 percentage points compared to the 68% in the first four months. In contrast, the market share of South Korea's three battery giants has shrunk from 21.9% last year and 17.9% in the first four months of this year to 17.4% in the first five months. SK On's ranking has also declined, widening the gap between Chinese and South Korean battery manufacturers. Meanwhile, Japanese battery manufacturer Panasonic's market share now stands at only 2.9%, down from 3.0% in the first four months of this year. Overall, in the face of increasingly strong competition from Chinese battery manufacturers, South Korean and Japanese battery manufacturers are becoming less resilient. Particularly in the U.S. market, where South Korean and Japanese battery manufacturers are heavily reliant, policy changes under the Trump administration have compounded their difficulties. Since President Trump took office, the U.S. has experienced numerous policy shifts, including the premature termination of the Inflation Reduction Act (IRA), the revocation of executive orders setting electric vehicle targets, and the tax credit cancellation scheduled for the end of September. These sudden policy changes have significantly impacted the global electric vehicle supply chain and market demand, leading to an overall decline in South Korea's battery cell and material exports. In light of this, South Korean and Japanese battery companies need to develop defensive measures to mitigate risks arising from potential U.S. policy changes. Additionally, from a medium- to long-term perspective, South Korean and Japanese battery companies must undertake structural adjustments and reorganizations to ensure they can meet future demands across different regions.

Global Electric Vehicle Battery Installed Capacity Reaches 401.3 GWh in First Five Months of 2025

Images

Share this post on: