After a period of official restructuring in the first half of the year, the first month of the second half appears unusually calm. Contrary to expectations of a cooling overall sales in the automotive market due to the crackdown on over-competition, the July sales figures for new energy vehicles reveal a different story. Although some brands experienced fluctuations, the overall performance during the off-peak season remained strong. For instance, Hongmeng Zhixing sold 47,752 vehicles in July, with the Wenjie model alone accounting for 40,753 units, significantly contributing to its total sales. Before the launch of the Shangjie model, the average transaction price for Hongmeng Zhixing exceeded 350,000 yuan, leading to a total sales revenue of 18.6 billion yuan in July, marking it as a major profit driver in the luxury sector in China.

Conversely, Li Auto has faced challenges with recent controversies surrounding user profiling and collision tests. Their new vehicle deliveries in July reached 30,731 units, representing a decline of 39.74% year-on-year and 15.29% month-on-month; the cumulative sales from January to July amounted to 234,669 units, down by 2.21% year-on-year. All three metrics—year-on-year, month-on-month, and cumulative—show a decline, indicating a challenging period for Li Auto. The fluctuations relate significantly to recent organizational changes, as well as competition from new products launched by rivals.

Xiaomi delivered over 30,000 units in July, achieving a month-on-month growth of about 20%, with cumulative deliveries surpassing 300,000 units. Reviewing the previous months' deliveries—28,000 in May and 25,000 in June—suggests that capacity improvements are not yet significant. The second-phase factory is set to commence production soon, with Xiaomi aiming for a breakthrough in the busy months of September and October, though its growth is currently limited by production capacity.

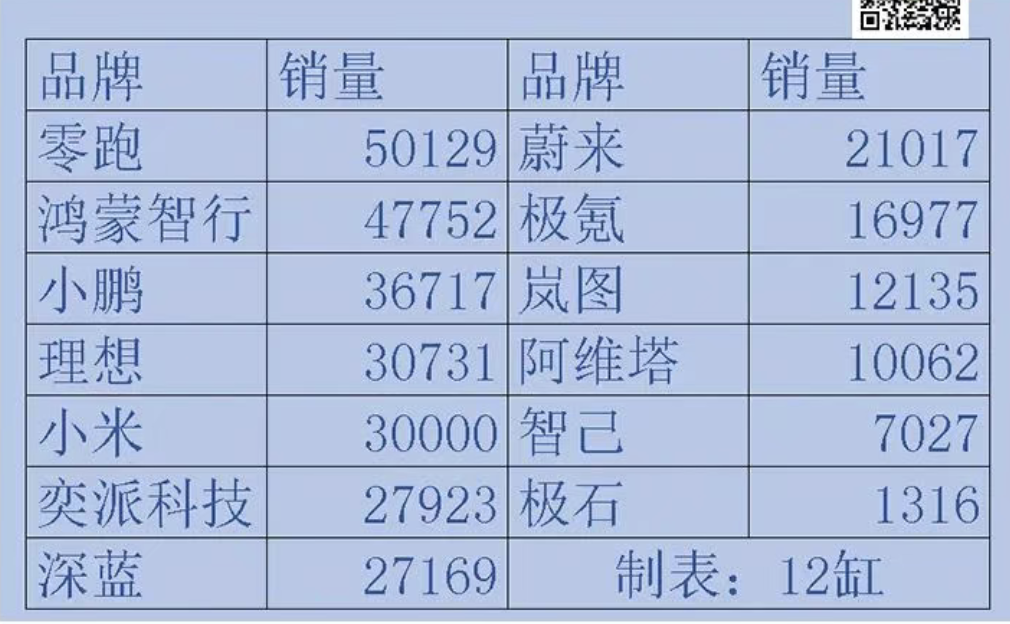

Meanwhile, Leap Motor has achieved a remarkable milestone, selling 50,129 units in July, with a year-on-year growth exceeding 126%, marking a new monthly high, and leading the new energy vehicle sector from January to July. Xpeng also reported strong figures with 36,717 deliveries in July, a 229% year-on-year increase, with new models like the P7 anticipated to drive further sales.

NIO delivered 21,017 new vehicles in July, with the main brand contributing 12,675 units, while the Ladao brand delivered 5,976 units and the Firefly brand added 2,366 units. The launch of the Ladao L90 at a competitive price could potentially boost next month’s sales.

Other brands like Zeekr, Lantu, and Avita reported deliveries of 16,977, 12,135, and 10,062 units respectively. IM Motors delivered 7,027 units, achieving top two positions in specific market segments but still struggling to break the 10,000 mark.

The situation is changing for joint ventures as well, with Nissan’s N7 and Toyota’s BZ3X selling 6,455 and 6,834 units respectively in July. The narrative of underestimating joint ventures is increasingly challenged, with many now led by local teams and utilizing domestic supply chains, thus abandoning high premiums. The success of these products is crucial, as it opens the door for joint ventures to reshape consumer perceptions in the latter half of the year. As of the publication date, some brands have yet to disclose their sales figures, but industry experts express a positive outlook for the second half based on the strong performance in July, suggesting that the off-peak season may not be as quiet as anticipated.

Electric Vehicle Market Shows Resilience in July Despite Challenges

Images

Share this post on: