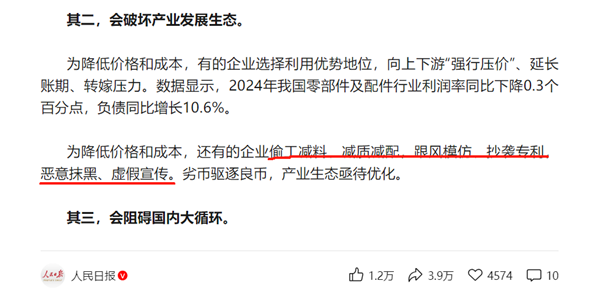

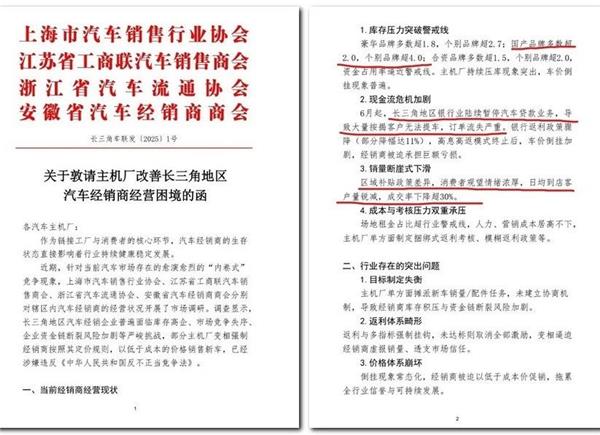

On June 29, the People's Daily published a commentary titled 'Why We Must Break Free from 'Involution' Competition?', criticizing some OEMs for forcefully cutting costs, compromising quality, and copying patents. The following day, automotive sales associations from Shanghai, Jiangsu, Zhejiang, and Anhui jointly issued a letter urging OEMs to improve the operational difficulties faced by auto dealers in the Yangtze River Delta region. This vicious cycle, which began with a price war, has spread from the sales terminals to the entire industry chain: when OEMs shift cost pressures onto dealers and suppliers, the entire industry ecology is gradually being consumed. The plight of dealers in the Yangtze River Delta is not just a business issue but a concentrated reflection of structural contradictions in the automotive industry chain. A harsh reality is that in the meat grinder of the price war, no segment can remain unaffected; the entire industry is paying the price for short-sighted malicious competition.

1. The Survival Crisis of Dealers in the Yangtze River Delta: Inventory Pressure at the Forefront. The letter from the four provinces' associations pointed out that the inventory coefficient for luxury brands has surpassed the 2.7 warning line, with some domestic brands reaching as high as 4.0, meaning dealers must pre-purchase four times their monthly sales in new cars. The sudden change in financial policies has become the last straw. Starting in June, banks in the Yangtze River Delta have gradually suspended auto loan services, resulting in many mortgage customers being unable to pick up their vehicles and a serious loss of orders. Coupled with tightened regional subsidy policies, consumer hesitation has become pronounced, leading to a sharp decline in sales. Additionally, high costs have further exacerbated operational difficulties. Rental costs in the Yangtze River Delta far exceed industry warning lines, and labor and marketing expenditures are hard to reduce. For instance, the withdrawal and adjustment of luxury car dealers in the Hangzhou market reflect the overall downturn in the industry. In May, Hangzhou's Yuntong and Sheng Automotive Sales Service Co., Ltd. faced a crisis involving three 4S dealerships for BMW, Audi, and Land Rover, affecting over 2,000 car owners, with more than 200 attending a rights protection event on the same night of the collapse. Guanghui Baoxin announced that ten BMW 4S stores in the Jiangsu-Zhejiang-Shanghai area had been deauthorized by the manufacturer, including two in Hangzhou. The Baolide Group also faced deauthorization of two Jaguar Land Rover stores in Hangzhou, leaving only two stores remaining for the brand. Furthermore, there are rumors of closure for Baolide's Mercedes-Benz 4S store in Hangzhou. Survivors are also seeking transformation for survival. Zhejiang Lihua Automotive Sales Co., Ltd., an established Audi 4S dealer, has shifted to Xiaomi Automotive; Zhongsheng Holdings' Zhejiang Zhongsheng Jinao Automotive Sales Service Co., Ltd. has transformed into a Wenkai dealership. Behind this brutal scene lies a deeper crisis characterized by a serious imbalance in network layout. Taking Shanghai as an example, FAW Audi, BMW, and Mercedes-Benz have 18, 25, and 27 stores, respectively. This outdated strategy of 'clustering stores' may have provided relief during the growth phase, but as the industry enters a deep area of stock competition, 'too many monks and too little porridge' becomes inevitable. More alarmingly, the penetration rate of new energy vehicles in Shanghai has already surpassed 48% in the first quarter, with new forces such as Tesla, Wenkai, NIO, and Xiaomi reshaping the battlefield with technology and experience. The dealer crisis, which originated in the Yangtze River Delta, is essentially a microcosm of the restructuring of channel models during the automotive industry's transformation period and also reflects the growing pains of the entire industry during its transition.

2. Under the Inventory Pressure Model, 4S Stores Are 'Living Dead'. OEMs and dealers should be mutually beneficial business partners. As long as profits exist, both sides can maintain a superficial balance. However, when the entire industry falls into a vicious cycle of 'exchanging price for volume', the fragile symbiotic relationship is riddled with cracks. The letter from the four provinces' associations exposes the glossy facade of the industry, directly pointing to two fatal operations by OEMs: first, imposing sales targets through administrative orders, completely disregarding market capacity limits, pushing dealers into the abyss of inventory accumulation and cash flow breakage; second, designing abnormal rebate rules that forcibly tie incentives to multiple targets, with total cancellation for any shortfall, effectively forcing dealers to falsify sales and overdraw market trust. The associations pointed out that such inventory pressure practices have crossed the legal red line of the Anti-Unfair Competition Law, calling for the establishment of a dynamic inventory adjustment mechanism (recommended coefficient ≤ 1.5) and the abolition of forced bundling and irrational assessments such as frequent changes of test drive vehicles. This is not the first industry complaint; last year, the State Administration for Market Regulation had already issued 'reminder letters' to major brands like Jaguar Land Rover, Audi, Volkswagen, BMW, and Mercedes-Benz, warning them of monopolistic risks in their operational behaviors. However, it is evident that these warnings have failed to prevent OEMs from continuing the inertia of shifting inventory pressure onto dealers. In the more intense price wars of 2025, the frenzied measures taken by OEMs to capture market share are pushing dealers to the brink of survival. Under the inventory pressure model, it has become common for dealers to be forced into breakeven and loss sales to meet targets. The cost of refusing to follow through on assignments is even more severe: first, rebates evaporate; then, marketing support ceases; and ultimately, even after-sales parts ordering and claims qualifications will be frozen—this is akin to receiving a 'commercial death sentence' within the brand system. The entire dealer system has already become a subordinate of a distorted assessment system. As automotive industry commentator Han Che has said, many 4S stores are already 'living dead with only a name'. Investors choosing to run away are not evading responsibility; rather, they are continuing operations, waiting for their fate, which is not just simple loss of capital, but a deep, bottomless abyss. This game exposes the most fatal structural contradictions in the automotive industry chain: when OEMs regard dealers as 'water reservoirs' to transfer operational risks, and when commercial cooperation morphs into a zero-sum game, the entire industry pays the price for such short-sightedness.

3. There Are No Winners in the Price War. In the fifth year of rampant price wars, China's automotive industry is trapped in a vicious cycle of 'increased production without increased revenue'. In the first quarter of 2025, passenger car sales grew by 8.4% year-on-year, yet the industry's profit margin fell from 4.3% to 3.9%. Behind these numbers is the collective bloodletting of the entire industry chain. As the average transaction price of new cars plummeted from 184,000 yuan in 2023 to 164,000 yuan, this double-edged sword of price wars is beginning to backfire on the industry's foundation. The upstream supply chain has already raised red flags. The China Iron and Steel Industry Association's statement revealed the harsh truth of OEMs' 'extreme cost reduction': when cold-rolled plate profits fall below the 100 yuan/ton threshold, automakers still insist on demanding an additional 300 yuan reduction per ton. Such pressure beyond cost limits is forcing the steel industry to resort to extreme measures like 'payment upon delivery'. More deadly is the ultra-long payment terms of 180 days or more, which are draining the cash flow of small and medium-sized parts manufacturers. The entire supply chain is like a tightrope that could snap at any moment. The survival scenario for downstream dealers is even more dire. Data from the China Automobile Circulation Association shows that the dealer inventory warning index soared in May 2025, with terminal price fluctuations leading to extended order cycles and obstructed cash recovery. Under the pressure of semi-annual assessments, only 35% of 4S stores barely met sales targets. The financial chain breakage of groups like Yuntong, Baoxin, and Qiancheng is merely an inevitable result of the combination of inventory pressure models and price wars. When dealers are forced to choose between 'selling at a loss' and 'losing authorization', the entire sales network is experiencing a systemic collapse. This price war initiated by OEMs is evolving into a chronic suicide for the entire industry. The joint letter from the four provinces' associations and the warning signals from regulatory departments are just the tip of the iceberg. When suppliers refuse to extend credit and dealers exit in batches, OEMs will eventually realize that the industry chain fortress they have built is starting to disintegrate from within. As dealers struggle in a quagmire of losses and suppliers resort to supply halts for self-preservation, the entire industry's healthy ecology has been strangled to death by the price war. History has repeatedly proven that when every segment of the industry chain is struggling for survival, it means no segment can remain unaffected. It is time to press the pause button on this price war.

Commentary on Why We Must Break Free from 'Involution' Competition in the Auto Industry

Images

Share this post on: