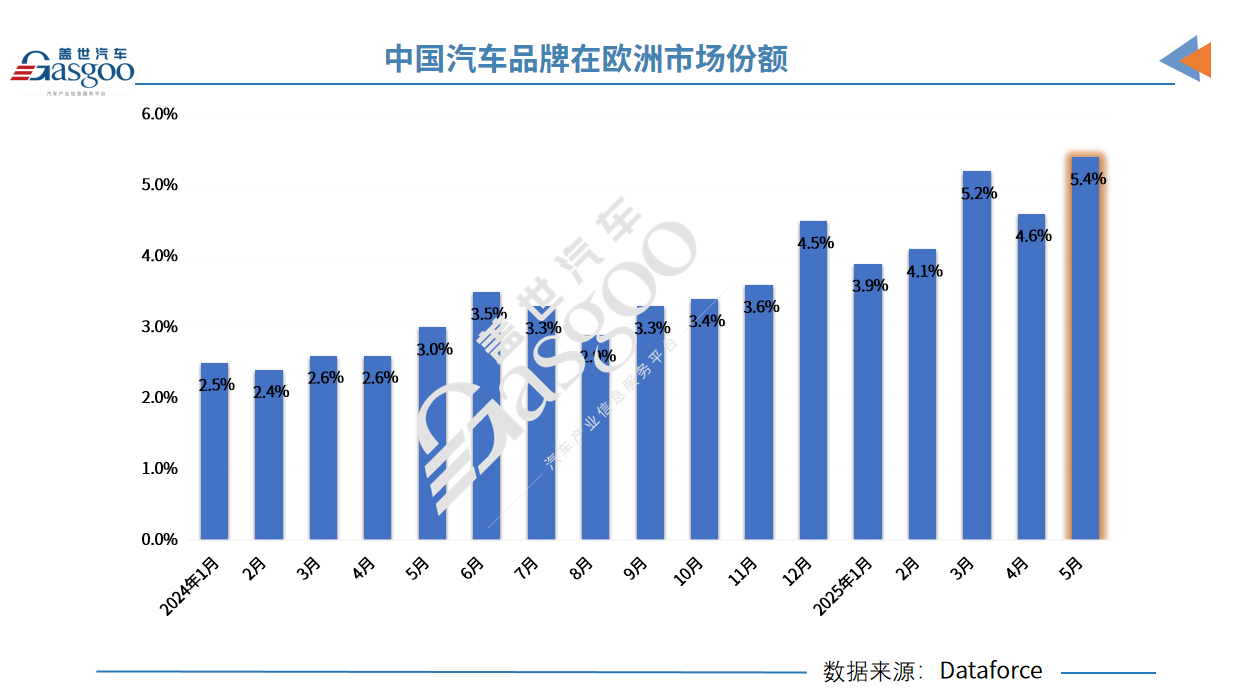

Chinese automotive brands have seen a significant surge in the European market, driven by a rise in sales of pure electric and plug-in hybrid vehicles. According to the latest data from Dataforce, the overall vehicle sales in Europe (including the EU, UK, and EFTA countries) experienced a slight increase of 1.3% in May compared to the same period last year, totaling 1,116,095 units. One of the standout highlights in the European automotive market is the performance of Chinese car brands, which saw a staggering increase of 85% in total sales year-on-year, reaching 60,215 vehicles, capturing a record market share of 5.4%. In contrast, the market share for Chinese brands was only 3% in the same month last year and 4.6% in April this year.

BYD has emerged as the Chinese brand with the highest sales increase, selling over 13,580 units in May, a staggering 388% increase compared to May 2024, largely driven by the mid-size SUV Sea Lion U, which saw an increase of over 7,000 units in sales, primarily from the plug-in hybrid version. Chery recorded the highest percentage sales growth among Chinese brands, with a year-on-year increase of 900%, selling 7,963 vehicles in May, thanks to the Jaecoo and Omoda brands launched in Europe last year.

SAIC Motor's MG brand remains the most recognized and best-selling Chinese brand in Europe, with sales increasing by 27% year-on-year to 26,855 units, driven by strong performance from the small car MG 3, which sold nearly 6,300 units in May, an increase of over 4,600 units compared to last year. In the first five months of this year, MG leads the Chinese brand rankings in Europe with sales of 126,493 units, ahead of BYD (54,986 units) and Chery (29,539 units). Another Chinese brand, Xpeng, also showed strong growth, selling 1,589 vehicles in May, a 350% increase from 353 units in the same month last year.

Despite the EU imposing tariffs on Chinese electric vehicles, analysts believe that Chinese brands will continue to grow in Europe, aided by their competitive cost advantages honed in China’s domestic market. Reports have indicated that BYD's compact SUV ATTO3 is priced 81% to 174% higher in overseas markets compared to domestic prices, providing a buffer against tariff impacts. Ongoing negotiations regarding electric vehicle tariffs between China and the EU may lead to a 'minimum export price' mechanism, potentially alleviating the impact of increased tariffs on EU imports.

In contrast, Japanese and Korean brands, along with some Western European brands, performed poorly in May. Tesla, in particular, saw a 28% drop in sales in Europe, attributed to an aging product lineup and intensified competition from Chinese manufacturers. Other brands, including Seat, Mazda, and Suzuki, also experienced declines in sales, with overall Japanese brand sales in Europe down 7.4% and Korean brands down 3.9%.

However, some traditional automakers managed to maintain their standings. Volkswagen Group saw a slight sales increase of 3.1%, with its Cupra brand seeing a 30% surge. BMW Group's sales rose by 5.9%, and Renault Group's rose by 4.8%. In response to competition from Chinese manufacturers, European giants like Volkswagen and Renault are accelerating the development of affordable electric models, aiming to counter the core advantages of Chinese brands.

The sales of electric models have seen a significant rise, with plug-in hybrid vehicles sales up 46% year-on-year, reaching 108,497 units. Notably, Chinese brands contributed 13,040 units to this growth, marking an astonishing 874% increase. As the trend continues, traditional internal combustion engine models in Europe saw an 8.8% drop in sales, although gasoline vehicles from Chinese brands still experienced a 20% increase, totaling 17,726 units, with MG accounting for about two-thirds of this figure.

Chinese Car Brands Surge in European Market Amid Electric Vehicle Growth

Images

Share this post on: