The pride of Japanese manufacturing has always been that Japanese cars hold a quarter of the global market share. However, with Chinese automotive brands now on the rise, the question arises: what level can they achieve? Recently, reports from statistical agencies and overseas media declare that by 2030, Chinese car production is expected to account for nearly one-third of the global total. This is commonly interpreted as a sign of the Chinese automotive industry's rise, but some also associate it with the 'China manufacturing threat' narrative. Additionally, insiders in the domestic automotive industry are feeling the pressures of price wars and intense competition, which are also recognized globally. In summary, while Chinese cars may achieve a one-third global market share, they still face two significant challenges. If they can address productivity and pricing issues, the prospect of a 'one-third global share' for Chinese brands will hold more weight.

China's annual car production and sales reach 30 million units, while the global total is 90 million units, which could imply reaching a one-third share. However, the figures cited by companies such as IHS Markit and Bloomberg refer to the share of Chinese automotive brands in the global market, currently not reaching the level of a 'three-way split.' This means that out of the 30 million cars produced in China each year, around 40% are from joint venture brands, while about 5-6 million units are exported from Chinese brands, leading to an approximate total of 20 million units for domestic brands. According to statistics from organizations like JATO and IHS Markit, by 2024, the total sales of Chinese automotive brands, both domestically and abroad, are expected to surpass American brands for the first time, reaching 20-21%, just behind Japanese brands at 24-25%. In 2023, China exported 4.91 million vehicles, surpassing Japan to become the top automotive exporter, marking a significant direction for Chinese cars toward overseas markets.

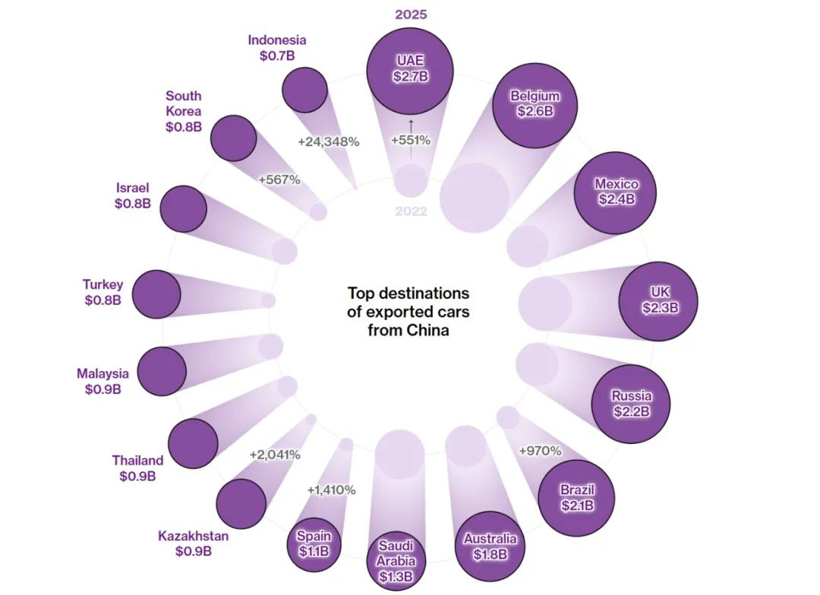

The soaring exports of Chinese automobiles are reshaping the global automotive market, with affordable vehicles flooding countries, sparking a price war that affects showrooms from Mexico to Malaysia. Chinese cars are increasingly dominating parts of South America, and affordable electric vehicles from manufacturers like BYD are gaining significant popularity in Europe. Despite geopolitical complexities, countries such as Mexico and Russia remain important markets for Chinese exports, with Mexico importing $2.4 billion worth of cars and Russia $2.2 billion. Analysts believe that Chinese manufacturers are looking to overseas markets for higher profit margins while acknowledging that the regional markets may not face competition as fierce as in China.

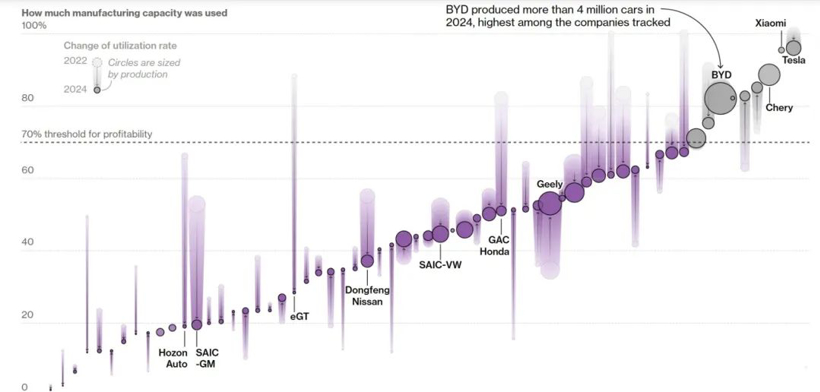

The rapid development of China's automotive industry has also given rise to some challenges, including overcapacity and price competition. The government is currently advocating for rational development of the industry to counteract these issues. Data shows that only about 15% of China's 70 active automotive manufacturers achieved the minimum viable capacity utilization rate of 70% needed for profitability by 2024. In contrast, leading companies like BYD maintain a utilization rate of 80-85%, while Tesla's utilization reaches 96% thanks to its strong domestic and export sales. Price competition remains a pressing concern, with the average price of passenger cars peaking at 183,000 yuan in 2023, but dropping to 177,000 yuan in 2024. Despite the pressures, analysts predict a slow recovery in prices, as the industry undergoes deep consolidation and has not yet reached a turning point.

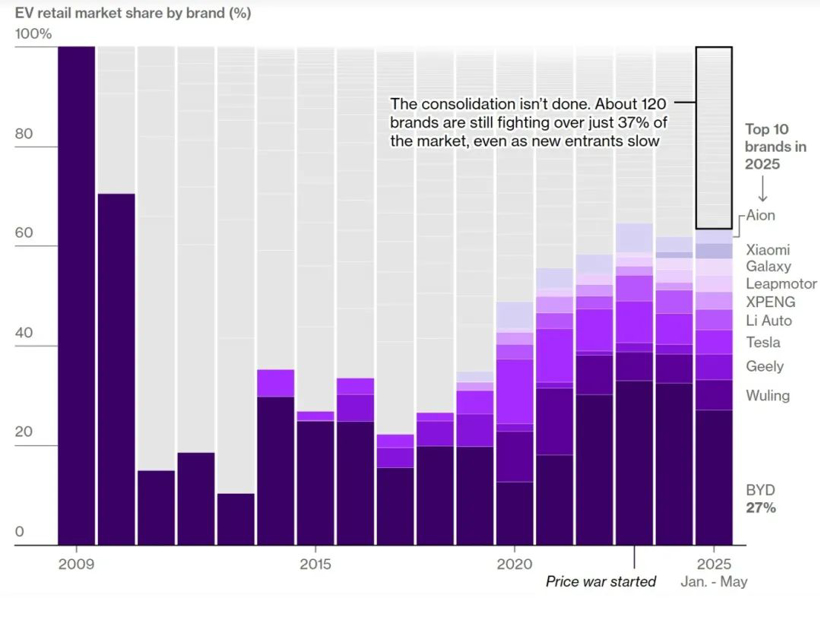

The acceleration of car exports is closely related to domestic overcapacity and intensifying competition. Many Chinese car exporters are shifting focus to overseas markets amidst an economic slowdown and fiercer competition at home. However, analysts caution that overseas markets may not always be reliable for weaker companies due to geopolitical factors and the initial costs of establishing foreign sales channels. The stronger players are more likely to succeed, as evidenced by companies like BYD that benefit from vertical integration, allowing them to maintain competitive pricing without compromising financial health. The market is still witnessing new entrants despite challenges, indicating that consolidation is far from complete. The performance of Chinese automotive companies is becoming increasingly polarized, with strong players gaining market share while weaker ones face elimination. As of May this year, BYD held about 27% of the domestic electric vehicle market, but over 120 other brands are vying for the remaining 37%. Ultimately, the future landscape of the automotive industry in China is uncertain, as local governments often extend the operational lifespan of manufacturers, even those with low efficiency, due to their impact on employment and automotive supply networks. The industry is expected to consolidate slowly, with only a handful of companies likely to survive in the long run.

Chinese Car Brands Expected to Capture One-Third of Global Market by 2030

Images

Share this post on: