The Chinese automotive market in the first half of 2025 is witnessing accelerated changes in its structure. BYD has claimed the top spot among traditional manufacturers, while Geely is outpacing its competitors. The landscape for new energy vehicle manufacturers has dramatically shifted, with the 'Weilai, Xiaopeng, and Li Auto' trio becoming a thing of the past, as newer players like Leap Motor, Xpeng, and Xiaomi shake things up. Traditional giants, now referred to as 'second-generation manufacturers' are experiencing mixed fortunes. A multi-dimensional competition focusing on sales volume, penetration of new energy vehicles, and globalization capabilities has fully unfolded.

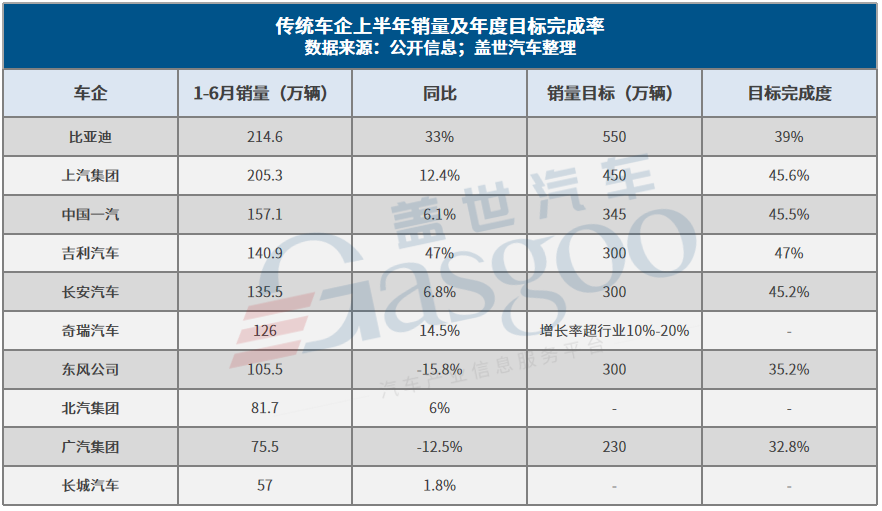

In the realm of traditional manufacturers, BYD leads with a remarkable sales figure of 2.146 million units in the first half, driven primarily by its Dynasty and Ocean series, which contributed 1.9717 million units. This performance surpasses the combined sales of Chery and Great Wall. Notably, BYD's models, the Qin and Seagull, have become stars, with sales of 274,300 and 284,400 units, respectively. The overseas market has emerged as a crucial engine for BYD, achieving a 59% completion rate of its ambitious annual target of 5.5 million vehicles.

SAIC Motor follows in second place with 2.053 million wholesale sales, and a retail delivery figure of 2.207 million, which when considered, surpasses BYD. This company is undergoing a transformation from reliance on joint ventures to driving its own brands, with a notable increase in its autonomous brand sales.

Geely stands out as the 'speed champion' with a 47% year-on-year growth, achieving 1.409 million sales and raising its annual target to 3 million. The growth is driven by its new energy vehicle sales, which soared by 126%.

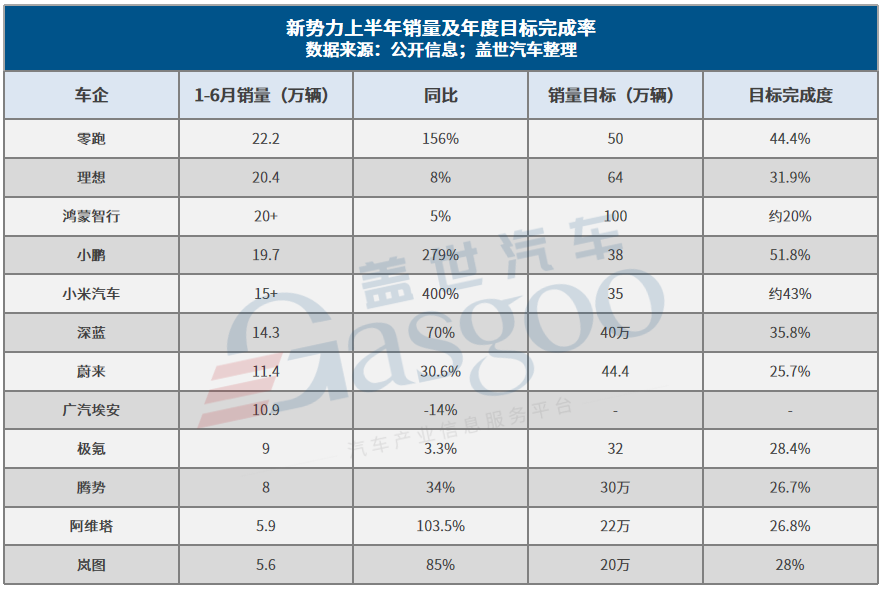

New energy vehicle manufacturers are also experiencing a reshuffling. Leap Motor has emerged as a significant player with cumulative sales of 222,000 units, making it the biggest surprise of the half-year. Meanwhile, Xpeng has managed to exceed last year's total sales with a strong performance, reaching 197,000 units. Xiaomi, as a latecomer, has shown phenomenal growth, with over 150,000 deliveries and a single model, the SU7, becoming the best-selling new energy vehicle.

However, the second-generation manufacturers face challenges, with many struggling to meet their annual sales targets. Zeekr and Deep Blue are exceptions, surpassing a 30% completion rate, while others like Avita and Lantu have yet to break through this barrier. The industry is now in a phase of intense competition, where the ability to adapt and execute effectively will be key to survival and success in the evolving market landscape.

Chinese Auto Market Dynamics in the First Half of 2025: Shifts and Challenges

Images

Share this post on: