On July 28, the national government released an implementation plan for the parenting subsidy system. Starting from January 1, 2025, families with one, two, or three children will receive an annual subsidy of 3,600 yuan until the child reaches three years old. This announcement sparked heated discussions, with many netizens arguing that 3,600 yuan is far below the actual costs of raising a child. For instance, in Shanghai, the average cost of raising a child from 0 to 17 years exceeds one million yuan, meaning the subsidy only covers 1% of total costs. Middle-class families have expressed that they would only consider having another child if the subsidies were raised to one million yuan, highlighting a significant gap between expectations and the subsidy amount.

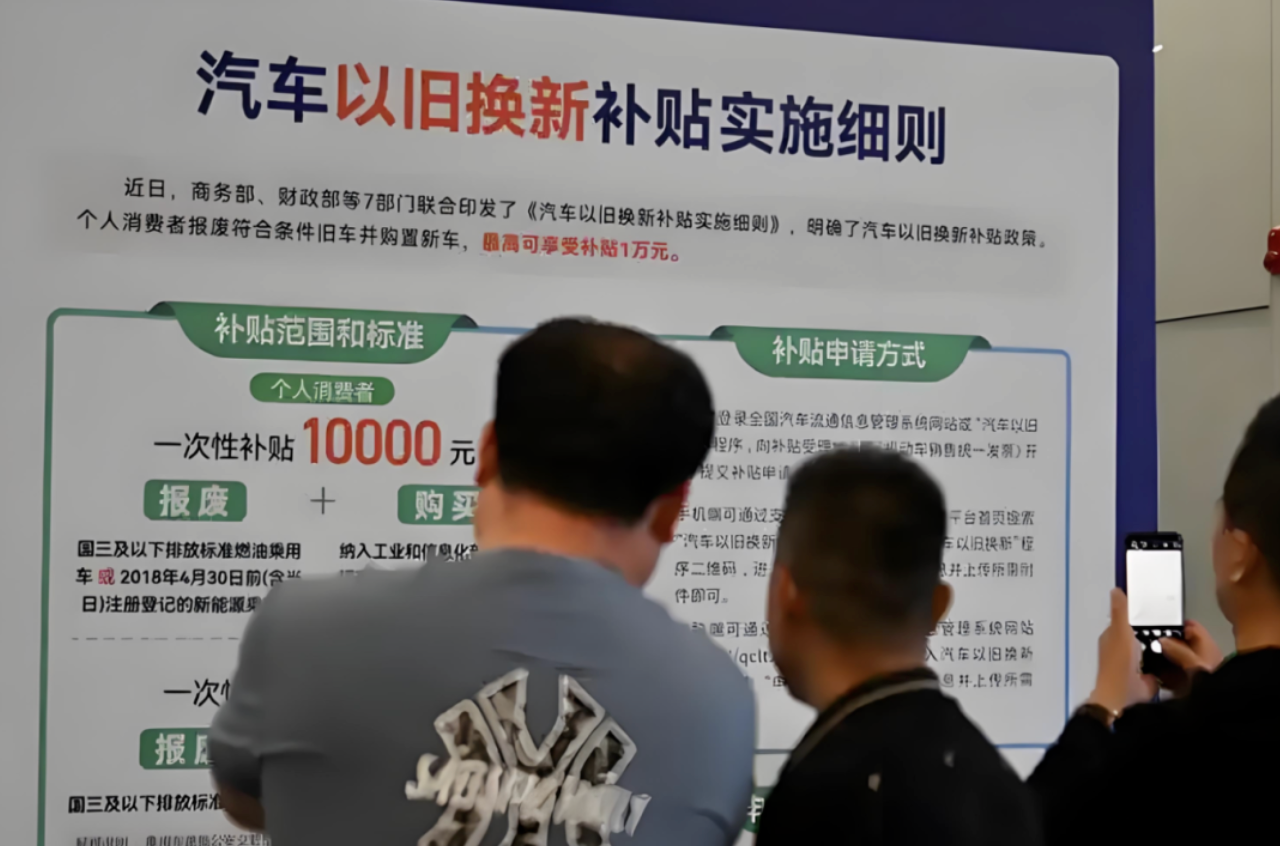

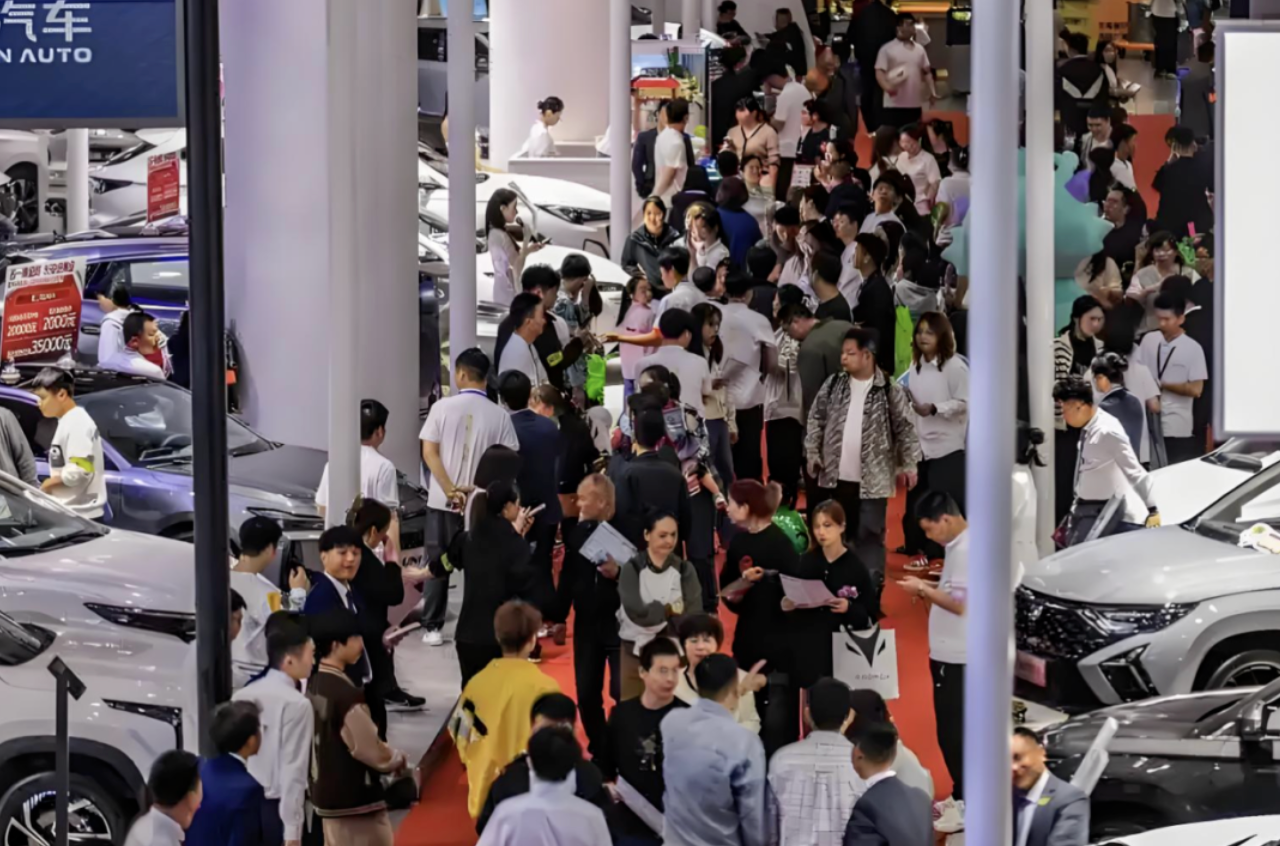

While debates about the effectiveness of parenting subsidies continue, the Chinese auto market has showcased the power of substantial policies through impressive data. By the end of May, the cumulative applications for the vehicle replacement subsidy had surpassed 4.12 million! Supported by national strategies, local initiatives, and proactive responses from car manufacturers, the auto market not only resisted downturns in the first half of 2025 but also experienced structural growth, with new energy vehicles (NEVs) retailing at 5.468 million units as a standout highlight. Since the start of the promotion in 2024, total applications have exceeded 10 million. With the third batch of vehicle replacement funds officially allocated in July, this 'promoting consumption' initiative is set to inject further momentum into the auto market for the second half of the year and provides a practical example for assessing the effectiveness of parenting subsidies.

The policy has significantly boosted the auto market. From the initial exploration of 'cars going to the countryside' in 2009 to the deepening of 'new energy vehicles going to the countryside' from 2019 to 2021, and up to the 300 billion yuan central financial consumption subsidy for 2025, the national support for automotive consumption has been unwavering and increasingly robust. Data from the Ministry of Commerce shows that in 2024, vehicle scrapping and renewal exceeded 2.9 million units, with over 3.7 million units replaced, directly driving sales of over 920 billion yuan. The proportion of NEVs among those replaced has exceeded 60%, effectively guiding green consumption and stimulating market vitality.

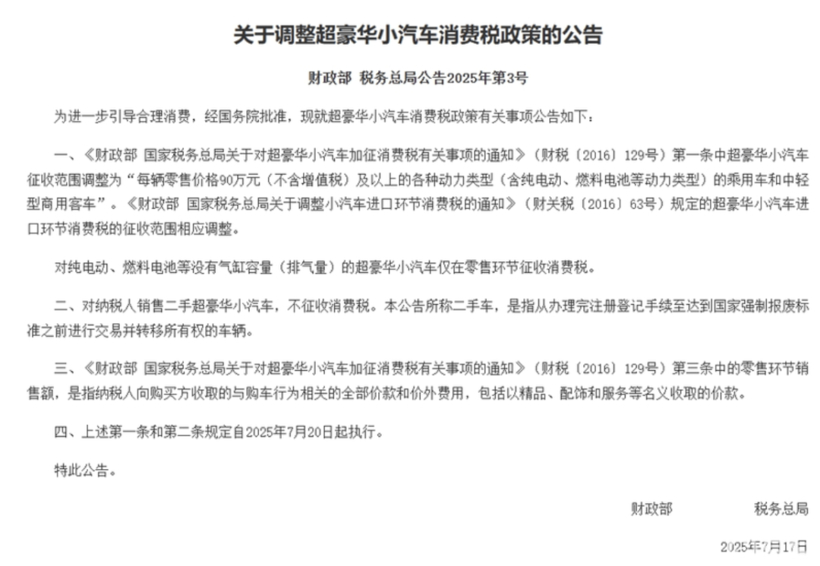

The latest notification from eight government departments regarding the 2025 vehicle replacement subsidy indicates that this year, in addition to expanding the range of eligible vehicles, specific standards for replacement subsidies have been clarified. For personal consumers who scrap gasoline vehicles registered before June 30, 2012, diesel and other fuel vehicles before June 30, 2014, or NEVs before December 31, 2018, and purchase new energy or small-displacement fuel vehicles, subsidies of 20,000 yuan and 15,000 yuan will be granted respectively.

As of May 31, 2025, the cumulative applications for the vehicle replacement subsidy reached 4.12 million, with June alone seeing 1.23 million applications, a 13% increase year-on-year. Nearly 70% of private car buyers have benefited from the vehicle replacement policy, with first-time buyers accounting for only about 30%. This indicates that under the influence of the policy, the demand for upgrading and replacing vehicles has become a driving force in the current auto market.

The second half of 2025 is anticipated to be even more promising, with the timely allocation of the third batch of funds eliminating concerns about policy gaps and sending positive signals to the market. This will help maintain the current momentum of vehicle replacement applications and ensure that policy support remains strong throughout the second half of the year.

In addition, local governments have implemented complementary measures, including local financial subsidies and streamlined application processes, enhancing consumer convenience. Mainstream automotive brands have also launched their own replacement subsidies, which can add up to substantial discounts when combined with national and local incentives. The NEV sector is leading in these initiatives, providing additional services such as exclusive financing options and extended warranties.

Overall, the 4.12 million applications for vehicle replacement subsidies are a direct testament to the policy's positive impact on market vitality. With a powerful synergy formed by national strategies, local support, and active participation from car manufacturers, the Chinese auto market is poised for resilience and growth, moving towards a new phase of higher quality and sustainable development.

China's Vehicle Replacement Subsidy Policy Boosts Auto Market Amid Parenting Subsidy Discussions

Images

Share this post on: