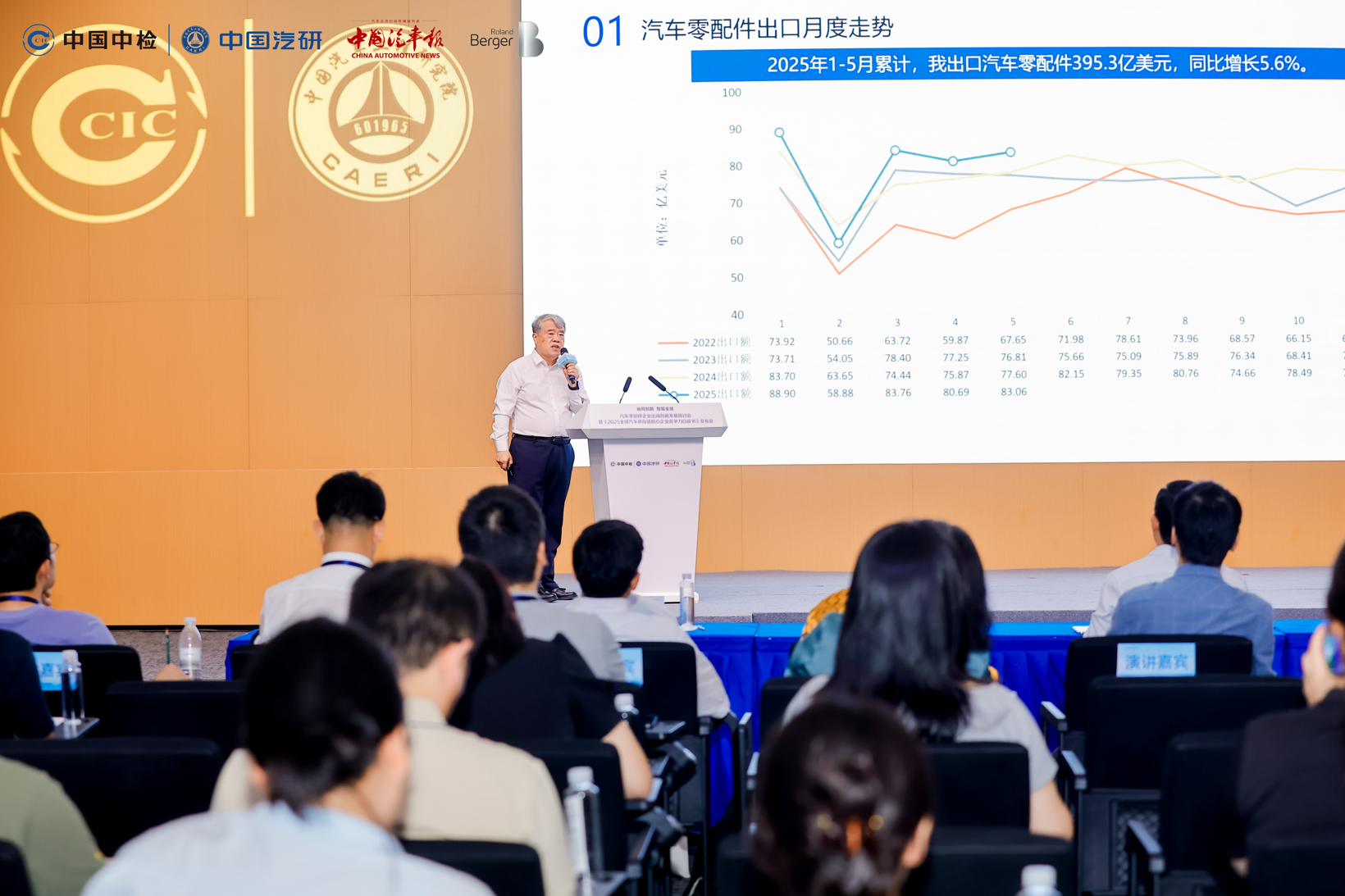

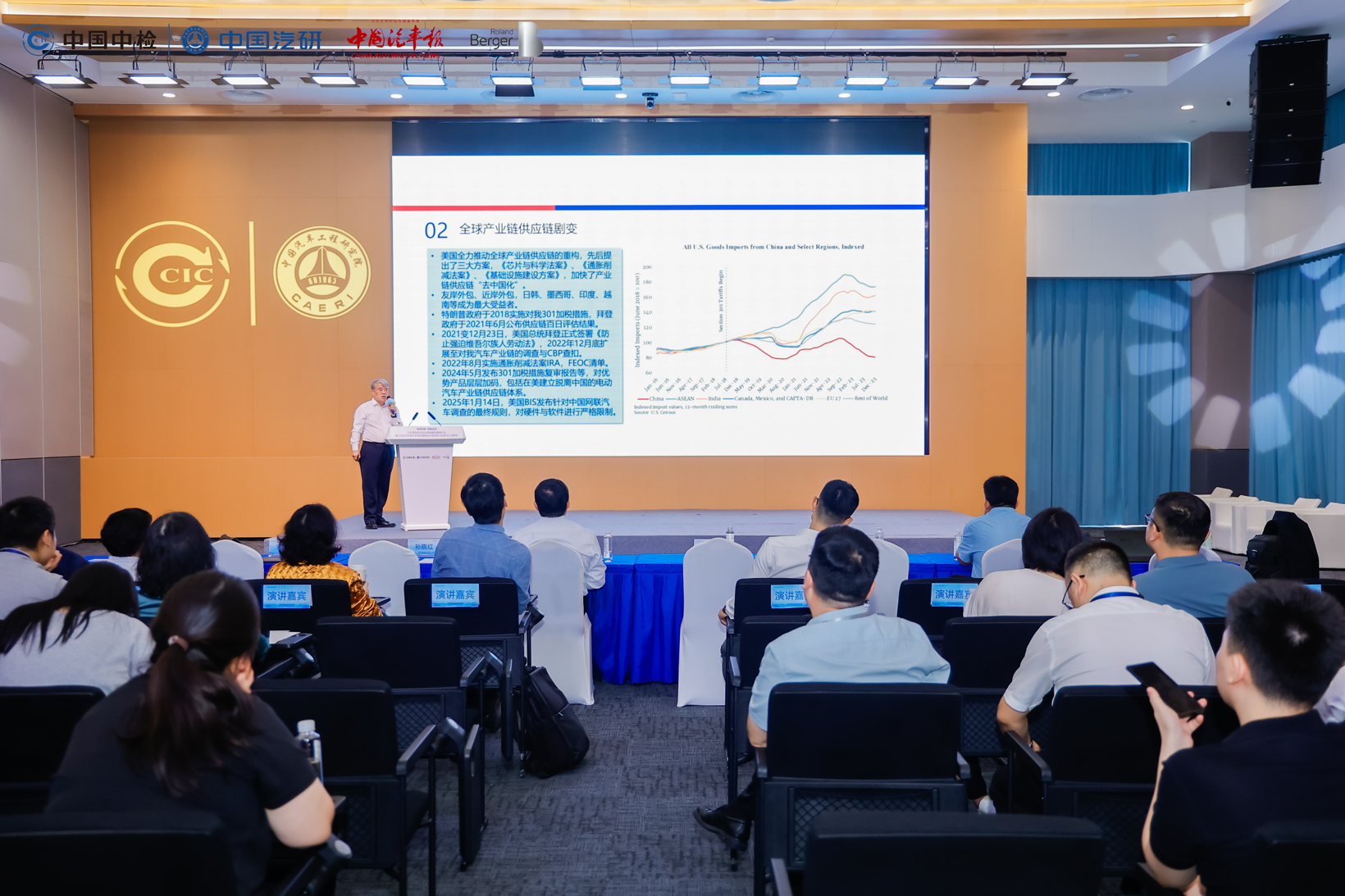

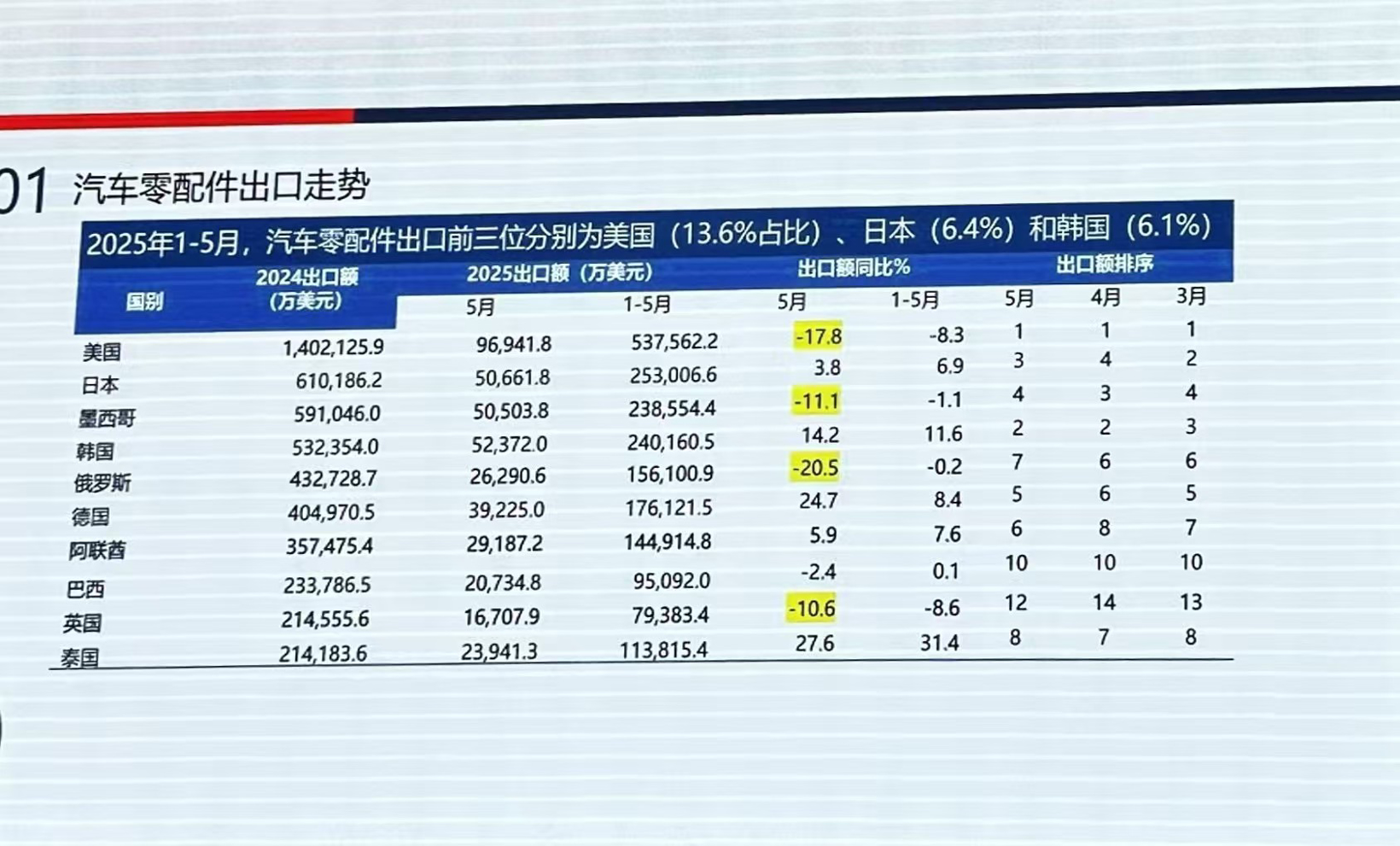

A recent report from a seminar on the innovative development of automotive parts companies revealed that China aims to achieve $120 billion in automotive parts exports by 2030, with an average annual growth rate of 5%. This ambitious target reflects both the confidence of Chinese parts manufacturers in their capabilities and the global market's demand for Chinese-made products. As the global automotive industry undergoes rapid development and transformation, the automotive parts market is poised for unprecedented opportunities and challenges. In response to increasing international competition and changing market demands, Chinese automotive parts companies are increasingly looking overseas to seek new growth points. While there are numerous uncertainties in the overseas market, data indicates that many foreign markets present significant opportunities compared to the domestic market. According to customs data, China is expected to export 6.4 million vehicles in 2024, with projections suggesting the figure could reach 10 million by 2030. Exports of parts (excluding power batteries) are anticipated to exceed $93 billion, aiming for $120 billion by 2030. As one of the world's largest automotive production and consumption countries, China's parts industry has developed substantial competitive strength, leading to an expanding export scale. The export structure is continuously optimized, influenced by the global electrification trend in the automotive sector. Furthermore, the export potential for components related to new energy vehicles (NEVs) remains promising, with China expected to hold 80% of the global NEV market share by 2024. The demand for associated components will continue to rise, supported by China's technological advantages and industrial foundation in this field. Despite the broad market potential, challenges persist in the overseas landscape, including geopolitical uncertainties, market competition, and localized pressures. Research indicates that 24% of companies view geopolitical uncertainties as the biggest challenge in overseas business, while 21% are concerned about market competition. Different markets require tailored strategies for Chinese parts manufacturers. Europe is seen as the primary destination for Chinese parts exports, followed by Asia, with the West European market viewed as particularly attractive. Despite the impact of previous tariffs imposed by the Trump administration, the U.S. remains a significant market for Chinese automotive parts, with substantial reliance on certain categories such as braking systems. The ongoing trade protection measures have seen exports to the U.S. reduce from 26% in 2018 to 15% by 2024. Experts suggest that businesses should weigh the risks of the North American market while recognizing its importance. In selecting overseas destinations, companies need to align their resources and capabilities with suitable business models. A majority of companies prefer to develop independently, while others explore joint ventures or mergers. The responsibilities vary across companies; large suppliers focus on establishing technical standards, while smaller firms emphasize innovation and agility. The journey for Chinese automotive parts companies in the global market is fraught with challenges but also abundant in opportunities. Companies must adopt clear strategic positions and flexible responses to navigate this evolving landscape.

China Aims for $120 Billion Automotive Parts Exports by 2030

Images

Share this post on: