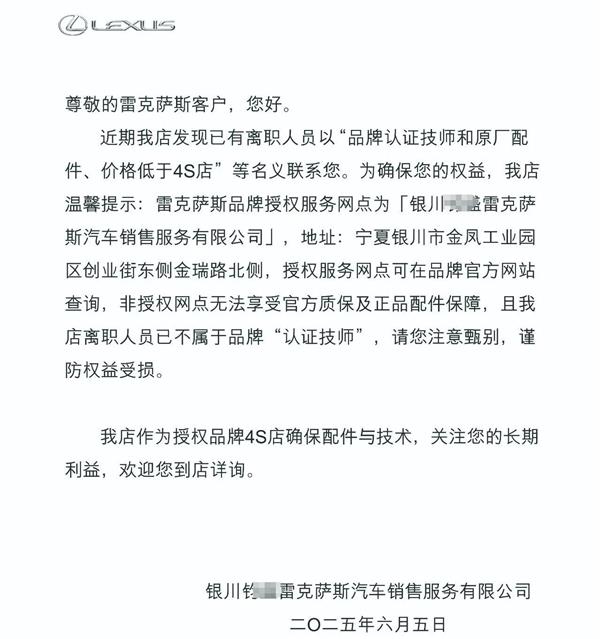

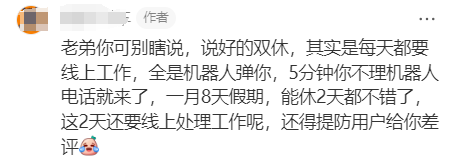

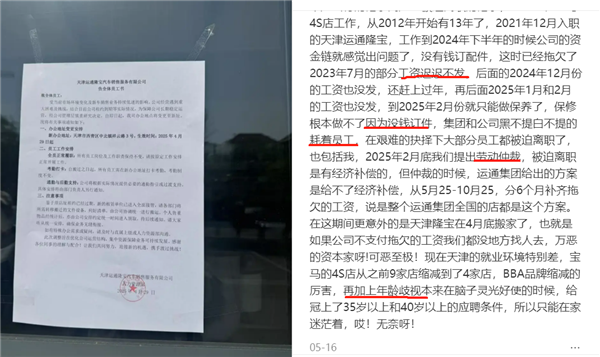

In 2024, a total of 4,419 4S dealerships have closed or transitioned, with nearly 10,000 dealerships having undergone reshuffling over the past five years, marking a significant turning point in the industry. If we estimate that each dealership employs about 50 people, approximately 500,000 employees in the 4S sector are facing severe challenges in entrepreneurship or job seeking. According to an automotive columnist, the widespread closure of dealerships has intensified employment difficulties for these '4S personnel', compounded by a general decline in efficiency across the 4S industry, leading to significant reductions in salaries and benefits. For many seasoned 4S employees, establishing a repair shop has almost become the ultimate goal, whether they choose to operate independently or in partnerships. However, this group of '4S personnel' is encountering new obstacles as they venture into the aftermarket. A recent notice from a Lexus 4S dealership in Yinchuan serves as a representative example: the dealership warned car owners that former employees are posing as 'brand-certified technicians' promising 'genuine parts' at 'lower prices than the 4S dealership.' The notice emphasized that to protect their rights, car owners should seek repairs at officially authorized outlets, as non-authorized shops cannot guarantee official warranties or genuine parts, and it clearly stated that the related former employees no longer belong to the brand's 'certified technicians.' Whether this practice will be emulated by other dealerships remains uncertain, but it is evident that after-sales countermeasures within the 4S system are strengthening. More critically, the entrepreneurial environment in the aftermarket has become increasingly complex, presenting a 'siege mentality' where 'those inside want to get out, while those outside want to get in', adding further uncertainty to the transformation path for '4S personnel'. The harsh reality for those who remain within the traditional 4S system is equally agonizing. A survey on career prospects for automotive store staff shows that 38% wish to continue developing as experts in their roles; 36% are considering switching careers; 29.9% plan to enter the new energy sector; and 24% lean towards entrepreneurship. On the surface, this data seems to provide diverse options, but it actually reflects the widespread confusion and lack of clear direction among industry professionals in the face of significant changes. For '4S personnel' who choose to stay, their daily experience can be summarized as 'little pay, too much work, and intense competition.' One service advisor's account on social media resonated widely: nominal weekends are consumed by online work, relentless reminders from robots, and bombarded phone calls demanding responses within five minutes, making it a luxury to take two days off from the eight days of holiday available each month. Even during breaks, they must still deal with work and live in constant fear of negative customer reviews. However, what’s more suffocating than high-pressure work is the helplessness of watching the 4S dealerships decline while being unable to intervene, ultimately facing the harsh reality of wage cuts, delays, or even being forced to claim their rights. The experience of an employee at Tianjin Yuntong BMW 4S dealership is highly representative: after joining in 2021, they encountered partial wage arrears by 2023, and by 2024, the company’s financial issues became apparent, leading to basic maintenance services only and halting accident repairs due to an inability to order parts. The company continued to owe wages, leading to employees leaving and seeking labor arbitration, but the group was unable to pay economic compensation and could only promise to pay the owed wages in installments. The employee lamented the deteriorating job market in Tianjin, where BMW 4S dealerships had shrunk from nine to four, severely contracting luxury brands and exacerbating the age barriers in recruitment, leaving middle-aged employees in a state of confusion post-unemployment. Similar tragedies occurred at the Beijing Xingde Baby BMW 4S dealership after its closure, where former employees revealed that many were owed wages for August to October 2024. When the company proposed signing a 'Labor Contract Termination Agreement,' some employees refused and sought labor arbitration instead. Although August wages were eventually settled, wages for September and October and owed compensation remain unresolved. The struggles of '4S personnel' who stay in the industry paint a vivid picture of their reality—they await the possibility of a rebound while paying the costs of their career golden years for transformation. The incident involving the Lexus 4S dealership's 'declaration' reflects the deep-seated anxiety of dealership systems amid the current upheaval in the automotive market. As profits from new car sales continue to dwindle, after-sales services should be the 'ballast' for 4S dealerships. However, the loss of after-sales customers is no longer an occasional fluctuation but a structural trend. First, customer behavior and consumption patterns have changed significantly. The F6 Big Data Research Institute predicts that by 2025, the average mileage driven by car owners will continue to decline, falling below 10,000 kilometers, directly leading to a reduced frequency of dealership visits. Additionally, economic pressures have made car owners more cautious with spending; even high-end vehicle users are tightening their maintenance budgets. Furthermore, with the average age of cars increasing, many warranty-expired owners are becoming more price-sensitive. The combination of 'genuine parts + high labor fees' at 4S dealerships is generally 30%-60% higher than independent after-sales services, and high-end car owners are increasingly valuing cost-effectiveness. Secondly, the rapid proliferation of new energy vehicles poses a dual impact on traditional after-sales models. On one hand, new energy vehicles have replaced some fuel vehicles in terms of mileage driven, directly reducing the maintenance requirements for the latter; on the other hand, many new energy vehicles still under warranty have smaller after-sales business volumes than fuel vehicles and are tightly locked within the manufacturer’s authorized system, making it difficult for traditional 4S dealerships to share in the profits. Finally, the continuous closures of luxury brand 4S dealerships have created negative chain reactions. This year, several luxury car dealers suddenly collapsed, leaving behind after-sales disputes that have been exposed by the media, severely undermining car owners' trust in the 4S system and making it increasingly difficult to retain existing customers. It is noteworthy that these five factors impact the entire automotive aftermarket ecosystem. Data shows that in the first half of the year, both the number of visits to repair shops and their output have declined, indicating an overall shrinkage in maintenance demand. This means that whether they choose to stay within the 4S system or venture into independent after-sales entrepreneurship, '4S personnel' face fundamentally similar predicaments—the entire pie is shrinking. Both sides will inevitably become more competitive in the battle for existing customers, falling into a zero-sum game. For those involved, regardless of the chosen path, the challenges are unprecedented.

Challenges Faced by 4S Dealership Employees Amidst Industry Restructuring

Images

Share this post on: